[sgmb id=”2″]

The long arm of revenge has finally been felt by the Democrat Party.

This is because the ongoing autopsy of the 2016 presidential election will find many real culprits, including the Democratic National Committee’s efforts to derail Bernie Sanders and bad campaign decisions by Clinton, but the festering one is that the 2007 housing fraud and subsequent recession showed the American public that white collar criminals can get away unpunished.

And the common people do not like that.

This double standard of justice is what partially propelled Trump, along with xenophobia, racism, lies, hyperbole and theater, but everyone suffered from the housing crisis and subsequent recession and the Obama Administration did nothing to put any of these criminals in jail.

And the common people do not like that.

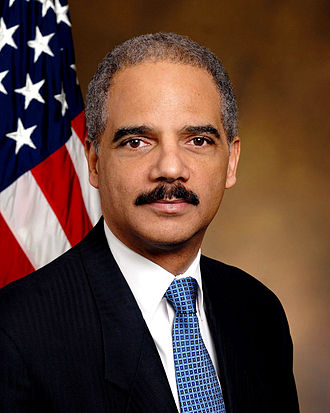

This means former Attorney General Eric Holder and his Justice Department intentionally decided not to prosecute the criminals. Who gave him that order and why he made it is something historians will discover, but his failure along with U.S. Treasury Secretary Timothy Geithner’s input, made Obama look toothless when it came to prosecuting fraud.

And the common people do not like that.

The housing fraud shockwaves that broke the U.S. banking system and had a ripple effect worldwide is going unchecked because it is part of the unofficial policy of U.S. regulators.

What’s Behind the Lack of Prosecution?

According to Professor William Black, associate professor of economics and law at the University of Missouri, in Kansas City, U.S. legal and financial market regulators have adopted an “immunity doctrine” that allowed senior mortgage and banking officials to go unpunished, despite the thousands of cases of mortgage fraud identified by the FBI.

Black noted that there has not been a single senior official of the major non-prime financial lending and mortgage players that has been prosecuted or convicted, despite the massive illegalities.

According to the FBI, there was an “epidemic of fraud” in the mortgage industry. This fraud started as “liar’s loans” made by lenders and borrows, according to Black and they had nothing to do with the Community Re-Investment Act of 1977, which has been cited as being a main contributor to lax bank and mortgage lending habits. The “liar’s loans” were initiated solely by the lenders themselves, he stressed.

In describing the process, Black said “when you have no underwriting, you will have massive adverse selection and then negative expected values of lending, or in plain English, lost money.” This process is rewarded because it creates huge profits and due to the excessive executive compensation structure that allows executives to extract bonuses on these false profits, the mortgage fraud process feeds upon itself.

While mortgage fraud was not well-known by average citizens, it was well-known inside the banking and mortgage industries, Black said. When the amount of mortgage fraud and record profits increased, Bank of America went to Countrywide mortgage and asked them to service their fraudulent loans. 6 years.

This was the same arrangement done by Washington Mutual (WAMU), the nation’s largest savings and loan, and CitiCorp, which both purchased Ameriquest. This purchase was made even though Ameriquest was being sued by 49 states’ attorney’s generals and the FTC for fraud and predatory lending practices.

The Mortgage Fraud Virus

The nature of mortgage fraud is that it leads to the accompanying servicing fraud because the underlying mortgage and home ownership-related documents do not exist. These fraudulent activities happened 10,000 times per month, which are felonies that have been committed without any prosecutions, according to Black.

At the time, Black said the lack of prosecution of those engaged in mortgage fraud is part of “the unofficial policy of the U.S. government.” In 2011, regulators, including the U.S. Comptroller of the Currency, said they were “rushing” to prevent any prosecutions by the states’ attorneys generals, who probably were not be able to pursue any criminal actions against these executives because they surprisingly lacked the resources. Yet these same attorneys generals had no problem prosecuting thousands of victimless crimes within their own states.

This “unofficial policy” exists because it will be “extremely embarrassing” to U.S. regulators to bring pursue the fraud. This policy lets the elite criminals go free because the entire banking sector is so fragile, Black said. This policy is “significantly insane” and it will only make the next banking and financial crisis come quicker and deeper than before.

Why? Because mortgage fraud is profitable and migrates from one sector of the financial marketplace to another (mortgage origination, to servicing to collections.)

As bad as the situation is today, Black said any change will have to come from the people themselves, not federal officials.

And this helps explain why Trump won: Because when huge crimes and criminals went unpunished.

And the common people do not like it.

And the nation has the Obama Administration to blame for its toothless position on white-collar law enforcement.

Now, we are all going to pay a terrible price.

While this is an important issue and it is true the Obama administration did nothing to prosecute Wall St after the most massive financial fraud in history, Mr, Epstein demeans his piece with this line: “This double standard of justice is what partially propelled Trump, along with xenophobia, racism, lies, hyperbole and theater …”. Chuck Epstein proves he is nothing but a lapdog of the mainstream media that gave the Obama administration a free pass on letting the financial criminals go (Hillary Clinton herself completely in bed with Wall St. actually said there were too many people involved with causing the Credit Crisis, the government should just forget about prosecuting ANYONE).

Epstein can’t have it both ways. Half of America voted for Trump. The other side lost. Chuck Epstein and his elitist friends need to get through their thick skulls that most of America is not buying their BS anymore, so they should give it a rest. If we examine the roots of these claims against Trump for “racism”, it is his opposition to “ILLEGAL” immigrants. Illegal refers to the commission of a crime. Chuck Epstein is opposed to mass criminal activity on Wall St, but apparently mass criminal activity among immigrants is OK. This is pretty hypocritical and inconsistent.

The popular vote goes to Clinton, so it is not half the population who voted for Trump. If you took the time to read this blog, you would see that there are no elitists here. This is probably one of the only blogs that has consistently been pro-investor and publicized bad practices by fund and investment companies. I was one of the first to endorse the fiduciary standard and even wrote a book endorsing it and pointing out show excessive fees and revenue sharing reduce returns. Finally, Trump has publicly used racist statements against along list of people, plus the disabled, veterans, and people who don’t agree with him. There also is no evidence that illegals are responsible for a majority of crimes in any state in the union. If you have this data, let’s see it.