Recent reports that younger people (aged 38 to 34) prefer to rent rather than buy homes are bad for the $10 trillion housing industry and retirement accounts.

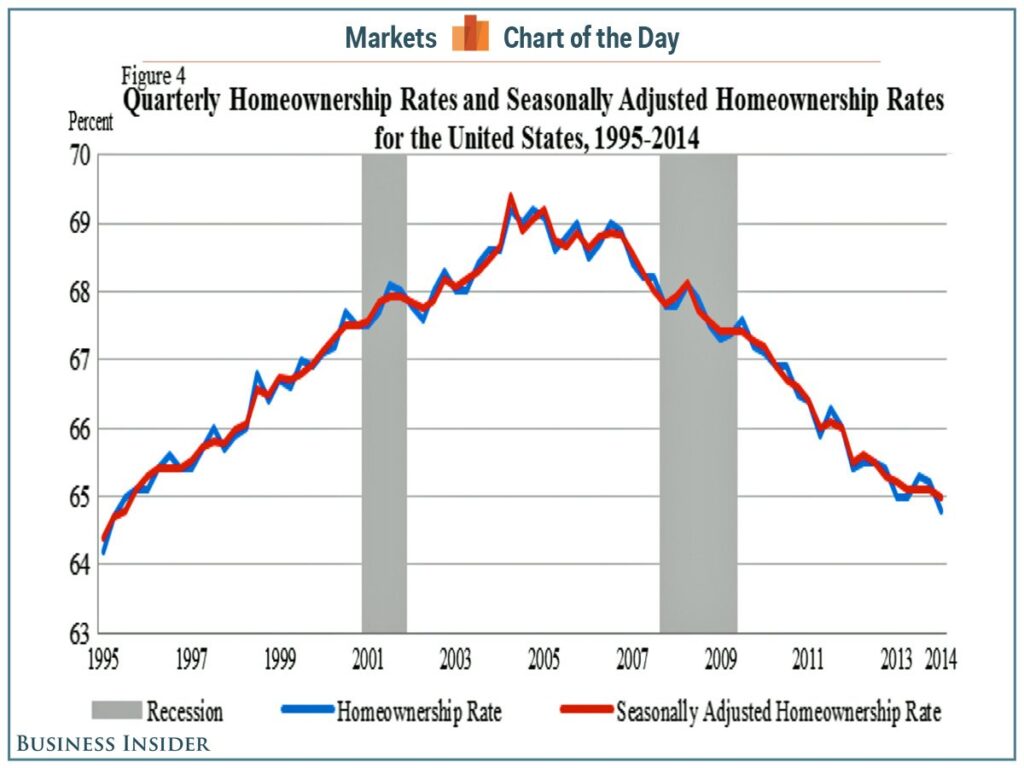

A new report by the Stanford Center on Longevity found that “the homeownership rate fell to 63% in 2016 – the lowest rate in half a century, and down from the all-time high of nearly 70% by the end of 2005, the peak in subprime lending,” according to a report on CNBC. The bad news is that the homeownership rate for Millennials (those born from 1980 to 1984) at age 30 was only 35%.

“Homeownership is especially down among millennials. Compared to those born around 1960, people born in the early 1980s are less likely to own a home by age 30,” the Stanford researchers said. Delaying this critical purchasing decision means less home equity, a primary driver of retirement wealth.

That rate was 48% among Baby Boomers. There are many good reasons not to buy a house, ranging from student loan debt to postponing marriage and starting a family, but the delay will also be a big hit financially.

This is because housing accounts for about 70% of the non-financial assets of middle-income Americans aged 55-64, and this excludes the value of Social Security and defined benefit plan pensions (401ks). If you remove this chunk of wealth-building potential from the equation for younger people, it will be hard to replace the outperformance of financial assets, such as stocks and bonds.

If the past is any indication, the decision to rent rather than own a house involves many factors, such as the ability to pay real estate taxes, maintain the house, make needed home improvements over time, and balance all that against the time constraints of having a family and managing leisure time.

Yet, for anyone of any age group planning for retirement, it’s time to assess your financial future and what financial engines are working on your behalf. This is a finely balanced equation, and any disruptions in only a few of these drivers will seriously alter your financial well-being.

Critical Drivers of Wealth

First, here are the critical wealth drivers that most Americans have to work with: Social Security, Medicare, pension plans, 401(k) plans, and, increasingly, house prices. Retirement experts and academics also factor other financial and nonfinancial wealth components into this calculation, including human capital (expected future labor earnings after retirement), personal savings, life insurance, annuities, gifts, and inheritances. As you can see, this is a short list. No lottery will fill your financial retirement gap.

Of these components, the most important are Social Security and home equity. Social Security benefits range from replacing approximately 45% of wages for the least wealthy individuals to replacing approximately 10% of salary for the most affluent. Home equity (a purchase price less the mortgage balance) accounted for 9% to 14% of total wealth.

This is why the Republicans’ current political attempt to reduce or replace Social Security with private investment accounts offered by high-fee and expense investment firms will reduce the net returns of any investments for millions of Americans. In short, this could produce one of the largest wealth transfers from the average American to private investment firms.

Still, the powerful cultural draw of owning a house is hard to overcome. Homeownership is part of the American Dream. Abandoning that goal means their dream won’t be attainable for many people. What will replace it? What will drive future goals?

These are tough questions, but looking at the recent past shows the upside and downside of home ownership.

The Impact of the 2008 Housing Crash

As a result of almost a decade of steadily improving house prices that ended in the 2008 housing crash and subsequent recession, housing had become the largest single financial asset among American families, especially among homeowners headed by the age group approaching retirement (usually age 55-64).

However, the dramatic and historic decrease in housing values of approximately $400 billion between 2007 and mid-2008 significantly altered the retirement plans of many Americans.

For Baby Boomers planning to retire, housing wealth accounts for most of their net worth. While this figure is skewed according to demographics (education, race, age within the Baby Boomer segment, marital status, sex), home equity accounts for one-third of net worth at the mean and 50% at the median. This makes Baby Boomers especially susceptible to housing price shocks, both positive and negative, which can significantly affect retirement planning and consumption patterns.

This decrease in home prices had a compounding effect on diminishing individual wealth, producing a cascading effect that impacted entire families, primarily single or divorced women and widows. This decreased wealth effect is especially acute among people approaching retirement age, who now must consider extending their retirement dates.

The decrease in housing values is especially significant since homeownership among the Baby Boomers has traditionally increased with age. As a result, older people rely more on their home equity as a source of wealth and as insurance against unforeseen adverse life events, such as a severe illness or the death of a spouse. Decreased home values also have reduced confidence in future retirement planning for people of all ages.

The Revised American Vision

Millennials choose not to buy homes for various reasons, from delaying marriage to staggering student loan debt to making the most of stagnant real wage growth. However, the bottom line is that fewer Millennials are signing mortgage documents. To the Stanford researchers, who often have to put a non-political face on their research, these results are summed up as “Refining strategies to address the declining homeownership rates among young people remains an important policy issue.”

That is undoubtedly an understatement, but it will not gain political traction. No federal or state officials have developed even the most basic retirement wealth policies since introducing 401(k)s in 1978.

Today, the financial services industry continues to spend millions with lobbyists to oppose the fiduciary standard, a standard that, in simple terms, can be stated as “Never give a sucker an even break.” The suckers are individual investors, and they won’t be getting a break from non-RIA advisors and national investment firms who want to sell overpriced products without disclosing their conflicts of interest.

Suppose you combine this with the decline in housing wealth and continued Republican attempts to privatize Social Security to any degree. In that case, it is a recipe for a lower standard of living for older Americans for years to come.