This article was updated on Oct. 7, 2025

If you’re considering moving to Florida and planning to live in a high-rise, especially one on the water, think twice.

The ocean, wind, rain, salt air, rising sea levels, a full moon, and warmer summers are the obvious caveats. But there is much more.

High-rise buildings, especially those over five stories that are near the ocean or the intercoastal, have expenses that most realtors will never disclose. The reason is that potential high-rise condos on the water require constant maintenance and frequent repairs due to natural events and man-made factors, such as insurance costs and HOA fees.

Since most realtors will never disclose these potential fees and the threat of rising sea levels, which can increase your HOA and potentially result in eye-popping special assessments.

Here is a list of repairs and other factors that can significantly raise expenses for a typical building in South Florida, near the ocean.

Being near the ocean, even a mile away, exposes the structure to constant erosion. So, if you plan on spending at least $500,000 to get your dream home in Florida near the Atlantic Ocean, remember the Atlantic is churning 24 hours a day, every day of the year, as it has for millions of years. It does not care about your building.

Here are the factors to consider that can add to your overall home expenses in Florida:

Homeowners Condo Insurance

Florida’s home insurance industry has been severely impacted by hurricanes, fraudulent claims, and insurance companies that have stopped issuing policies due to the high risks.

That’s why condo insurance jumped at double the inflation rate in South Florida.

A Realtor.com study examined home insurance costs for the top 100 metropolitan areas in the U.S. and found that homeowners in the Miami, Fort Lauderdale, and West Palm Beach markets paid the most, followed by four other Florida metros in the top 10, according to a story in Miami New Times.

The study also found that the primary factors contributing to the high insurance rates were flooding and strong winds. These pose the most significant risks in Miami, which was at the top of Realtor.com’s ranking with the most home value exposed to severe flooding. The Miami metroplex has a total home value of $307 billion, facing severe flood risks. Miami was followed by the New York, Newark, and Jersey City markets that ranked No. 2, with $295 billion worth of homes at severe risk of flooding. Miami also ranked first for the total value of homes at severe risk of wind damage, with about $1.3 trillion worth of homes in danger, according to the Realtor.com study.

Flooding also occurs during King Tides, when the gravitational pull of a full moon raises water levels in local rivers. These are flooding streets in inland developments, such as in Jupiter.

Other Florida towns that made the list of the most expensive insurance premiums nationally were Cape Coral-Fort Myers, Miami-Fort Lauderdale-West Palm Beach, Palm Bay-Melbourne-Titusville, North Port-Bradenton-Sarasota, and Tampa-St. Petersburg. Petersburg-Clearwater.

Florida condominium owners have seen their average home insurance rates increase by more than 50% over the past four years, reaching nearly $2,000 per year. That far outpaced overall consumer inflation in South Florida, at a time the region had the highest inflation rate in the country.

Water leaks originating from within individual units, such as a broken refrigerator, toilet, or leaky dishwasher, are common problems that cause costly damage in multiple units of high-rise buildings. These breaks happen in new and old buildings. Snowbirds who leave their condos for months at a time return to find their dishwashers leaking because the gaskets have dried out, as they were not being used. The water in the dishwasher keeps the seals and gaskets from drying out.

While insurance premiums are high, they are far less than tens of thousands of dollars in remediation and repair costs. According to Florida Statute §718.111(11), unit owners must have an HO6 insurance policy that insures:

- Personal property

- Floor, wall, and ceiling coverings

- Built-in cabinets and countertops

- Water heaters

- Electrical fixtures

- Appliances

- Water filters

- Window treatments

- If you are uninsured, owners will be responsible for repairs to these items in your unit.

Administrative Costs, including building staff and lawyers. The state heavily regulates condos and is often the focal point for slip-and-fall lawsuits, conflicts between owners, and disputes over payments. Condo lawyers are not cheap, and liability settlements can cost thousands; all of this impacts on the condo association’s finances.

Golf Courses

Maintaining a golf course in Florida goes against Mother Nature, but the game is why many people move here. Maintaining a course can cost as much as $20,000 a month, including chemicals, mowing, grass replacement, insecticides, weed control, fertilizer, and watering.

Dining Operations

High rises can have multiple restaurants for all meals and alcohol. The restaurants are expensive to maintain and require continuous staffing.

Owners Are Responsible for the Costs of Fixing the Condo Community Property

Elevators

Elevator repairs and maintenance are costly due to the complexity of the systems and their critical role in evacuation during a fire. Since the elevators are in constant use, maintenance is always required. Even standard practices, such as residents holding elevator doors open, strain the safety systems in the elevators. Elevator parts are also costly. Elevator replacement panels cost $750 each, plus $350 to order.

Electrical Surges

Equipment shutdowns from electrical outages and surges continue to cause issues in Florida. Lightning strikes, peak electric use during the summer, and wind cause lines to go down. Lightning is a common problem. Tampa, Florida, has more lightning strikes than anywhere else in the nation. When equipment fails due to power surges, buildings lose elevators, air conditioning, and other critical systems. Installing surge protectors can mitigate the situation.

Electrical Systems

Keeping electrical generator capacity and connections to maintain power during an outage, including elevators and power to common areas.

Air Conditioning Systems

Air conditioning systems are essential in Florida. Large systems are expensive, since they involve condensers, water cooling towers, ventilation maintenance, air handlers, and risers. These system parts can all rust or need repairs.

Condos have many amenities, and owners are responsible for all the costs. Here is a list of items commonly overlooked: Pool maintenance, landscaping, dock repairs, fire pump maintenance, insurance, domestic water pumps for irrigation, and security: (uniformed guards and surveillance).

Be Aware of Florida’s Rising Sea Levels

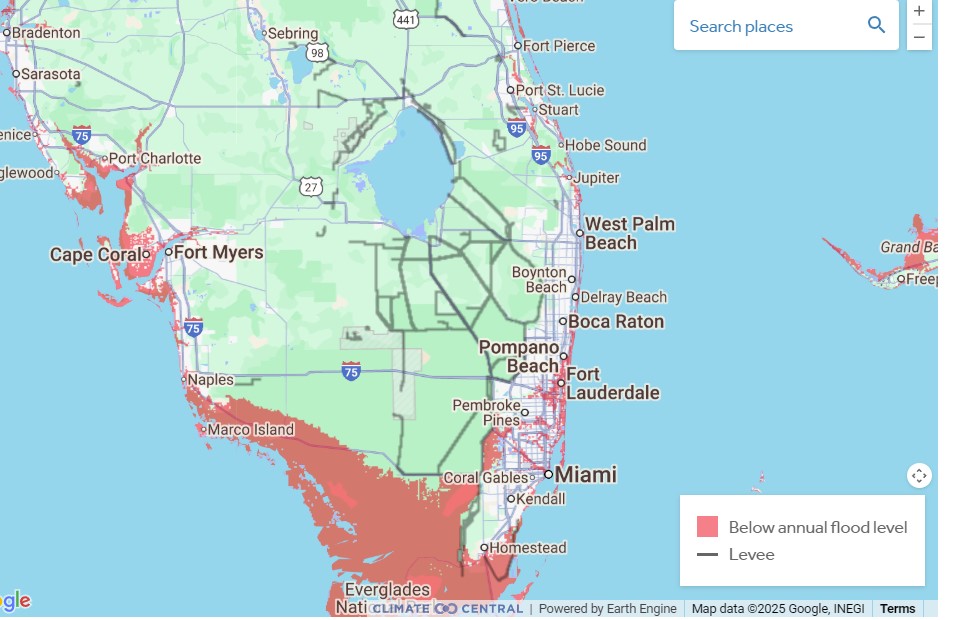

Although the Florida governor and legislature deny it, global warming and rising water levels in Florida are scientific facts. This video shows the areas that could be underwater in about 100 years.

This may not affect immediate purchase, but 100 years is not too long in the insurance world, where they are writing and liable for policies that can extend well into the future. Insurance companies are mighty in the mortgage market. If they decide not to insure a zip code, the real estate sales process stops.

This is more critical because Florida is one big hurricane away from a financial disaster. The last few hurricanes have prompted many property insurers to leave the state, leaving homeowners with limited insurance options. Plus, under the Trump administration’s new policies, FEMA will have a reduced role in any recovery efforts.

The danger areas, according to this video, are not just along the Florida coastline, but inland as well, especially areas close to lakes. “Much of Florida’s coastal areas — particularly around the Everglades National Park and Florida Keys — could be largely submerged within the next 100 years,” according to Tom Sorrells of Channel 6 News in Orlando.

“A 1-meter rise in sea level inundates about 10% of Florida, and that’s mostly in the South and Southwest,” he explained.

These projections have already begun to impact people living in the state.

“Even the insurance companies are starting to realize that. It’s going to be harder and harder to get a mortgage and insurance on a coastal property,” Donoghue continued.

“Of course, Central Florida wouldn’t be spared either in that case. According to the estimates, many low-lying areas bordering bodies of water like Lake Jesup and Lake Monroe would also be below flood levels.

“Coastal parts of the region like Volusia County and Brevard County would be heavily impacted, with the map suggesting large portions of the land surrounding the Kennedy Space Center could be flooded by 2120.”

Republicans deny global warming, so the state legislature is not doing anything to address the problem. It is a scientific issue, not a political one, so DeSantis is not concerned about the situation since it does not align with his cultural and political views.

Florida Ignores Pollution Standards

Florida also shows little concern for pollution. A October 2025 report found that Lake Okeechobee, the largest freshwater lake in Florida, ranks as the dirtiest lake in the country,” according to WPBF-TV. This pathetic ranking comes from the Environmental Protection Agency’s National Water Quality Monitoring Council, covering the period from January 2020 to July 2025, of the 100 largest lakes nationally. Much of this pollution is attributed to the sugar-growing and refining operations that require large amounts of fertilizer. These companies are also large donors to Desantis.

Do You Want to Buy in Florida?

If you are considering buying a home in Florida, take a closer look and research your town and development. Local real estate agents are often uninformed about the properties they sell and fail to investigate key details, including pending assessments, the HOA’s financial status, and past complaints. Therefore, it’s advisable not to rely on them.

Future condo buyers in South Florida should be informed. There are many issues your real estate agent will discuss. Their focus is solely on the sale, not on the details of the purchase. And since Florida is the fraud capital of the U.S., buyers should be informed. And as always, especially in Florida, caveat emptor.

.