A new study examining the income sources for Americans over age 65 shows more people are relying on Social Security for their retirement income, while income from jobs has remained consistent since 1962, according to a new study by the Social Security Administration.

The study found that 38% of Americans over age 65 in 2009 claimed Social Security as their largest income source. This was an increase from 30% in 1962.

The report said Social Security comprised at least 50% of retirement income of 66% of Americans age 65 and older in 2009, an increase from 64% in 2008. Over a third of retirees (35%) receive 90% or more of their income as a monthly payment from the Social Security Administration.

Paying Modest Amounts

How much income are Social Security recipients receiving?

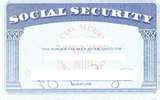

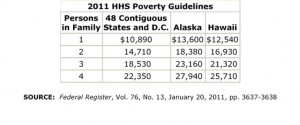

The report found that the average monthly payout to retired workers was $1,176 in 2010, or $14,112 per year. This amount puts a family of two in the category of meeting federal poverty level guidelines for 2011, if Social Security is their only income source. If so, this puts the majority of Americans over age 65 who rely on Social Security alone as meeting poverty level standards.

Over 54 million Americans received Social Security benefits last year. Of this group, retired workers comprise the bulk of people receiving Social Security payments (64 %.) The program also makes payments to disabled workers (15%), spouses of deceased workers (12%), and the spouses and children of retired or disabled workers (9%).

Among the report’s other findings:

- The proportion of women receiving retired-worker benefits has quadrupled since the program was founded, from 12% in 1940 to 49% in 2010.

- About a quarter (26%) of women age 62 or older received benefits on the basis of only their husband’s earning record in 2010, down from 57% in 1960.

- An increasing number of women (28%) have a dual entitlement to Social Security because they are eligible for both individual and spousal earnings, up from 5% in 1960.