When it comes to taking sides publicly on major social issues, corporations have not led the way. Corporations do not like to state a public political position. This is not to say that corporations are not political—it is just the opposite. However, their vast political influence is hidden from the public via lobbying and contributions to opaque political groups.

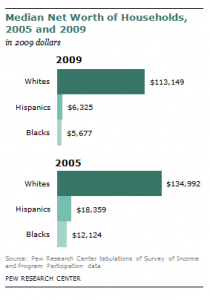

So, it is unsurprising that no financial institution (banks, investment firms, hedge funds, private equity, insurance companies, etc.) has taken a public stand on the numerous recent studies showing that income disparity in the U.S. is at historic levels.

But since fund companies are focused on protecting their positions through extensive federal and state lobbying and regulatory and political pressure, their collective silence is worth noting because the widening income gap will negatively affect their ability to raise future assets.

It’s a severe problem with more serious long-term consequences for the fund industry than regulatory reform. After all, who will buy mutual funds when any household’s extra money is used to pay for life’s essentials?

Confronting the Problem

So it’s surprising, even for this exceptionally conservative industry, that no fund has even raised the issue. Instead, investment company ads continue to address the pursuit of wealth management, even though we live in an era of wealth destruction.

While there are a number of good reasons why the fund industry is silent, including the one that there is no easy, quick remedy to closing the gap, this disparity should be at the top of any good fund marketing director’s planning sessions. The reason is that the dominant political and social mood is prepped to turn against financial institutions that do not acknowledge the ascent of customer rights or operate transparently.

This could pivot on single issues, such as the incendiary issue of bank fees (a multi-billion dollar business), and by extension, 12b-1 fees (in 2010 investors paid about $9.5 billion in these fees.) This may explain why Charles Schwab is now advertising that it does not charge any fees; a wise move that should attract new investors.

This non-existent response can also be explained by the fund industry’s attempt to remain separate from the rough-and-tumble trading side of the investment business. However, this may be a subtle distinction for many investors, especially as public discussions start again on Dodd-Frank and other regulatory reforms.

This puts the fund industry in a corner. Even though it is certainly not monolithic, the industry now has to consciously choose not to take a public position on this political-economic severe issue, which directly affects the industry’s future. But at the same time, it provides an opportunity for some fund companies to break away, a la Schwab, and adopt any pro-shareholder action that can be converted into a marketing advantage.

In this environment, even a tiny pro-shareholder change will look big, as evidenced by the increase in new accounts opening at the nation’s credit unions in response to anti-big bank sentiment. So, if you run a fund company that wants to break from the pack, this is the time to be different and visibly pro-shareholder.