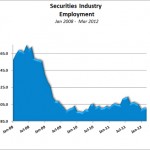

“The Securities Industry continues to meander around the 800,000 job level, where it has been stuck for nearly 3 years. March saw the loss of a few hundred jobs.”–BrokerHunter, April 10, 2012

If any investors wonder whether they are getting the best service possible from their brokerage firm or fund company, this employment chart may be enlightening.

It shows the number of layoffs in the securities industry over the past three years, which approximately coincides with the start of the recession. This should not be a surprise since the recession began with mortgage-backed securities, an investment banking and securities industry product that was allowed to proliferate without any management oversight. That brought down some major banks, investment banks and brokerage firms, and the rest is well-known history.

But this chart shows that the securities industry cut its employment numbers to the bone. Unfortunately, BrokerHunter does not have specific data on which departmental categories were cut, but most were probably in the non-sales and support categories, retail brokerage, and non-essential trading categories. Since the securities industry is all about sales, only the best (most profitable) salespeople remained, albeit with less support and lower payouts. That helps account for the switching between firms of large broker teams.

But the chart also shows an industry in trouble, especially the mutual funds. The last “new thing” in the fund industry was target-date funds, and they were not new, just re-packaging of mediocre funds from a single fund family. Today, the challenge continues from ETFs, but the fund companies cannot make that transition, even though those products are better for customers.

That leaves the fund industry in the doldrums. Their entire management structure and business model is predicated on large national sales organizations pushing commoditized, low return products. Unfortunately for investors, this is exactly the opposite of what they need to build a more financially secure retirement. But since it is good for the fund industry, nothing will change. That is why investors have to take the initiative and push for ETFs to be included in their 401(k)s, IRAs and other retirement products.

Securities industry: Afraid of Transparency

The other looming challenge will come this spring when the DOL’s new fee, expense and revenue sharing disclosure regulations go into effect. So far, this has escaped the financial media’s attention, but the securities industry does not cope well with full disclosure. Too many secret fees and hidden revenue streams to hide.

While that is bad news for the industry, it is good news for investors, who can finally see what they have been paying for all these years. In many cases, investors will discover they have been paying for steak, but getting old hamburger.

As for the lost security industry jobs, many will never come back, not because they are not needed, but because the remaining management wants to keep their salaries high, even if their customers suffer from lower-quality service.