“The Arabic-language network Al-Jazeera released a full transcript Monday of the most recent videotape from Osama bin Laden in which the head of al Qaeda said his group’s goal is to force America into bankruptcy.

“Al-Jazeera aired portions of the videotape Friday but released the full transcript of the entire tape on its Web site Monday.

“We are continuing this policy in bleeding America to the point of bankruptcy. Allah willing, and nothing is too great for Allah,” bin Laden said in the transcript.” — CNN, Nov. 1, 2004

On the 12-year anniversary of the Sept. 11, 2001 attacks, re-reading bin Laden’s stated goal remains chilling, but it is incorrect.

While the U.S. is still suffering the after-effects of the 2008 recession, credit for disrupting the U.S. economy to the precipice of collapse must be attributed to Americans. In short, it was Americans who brought the U.S. economy to its knees, not bin Laden.

While bin Laden probably expected a U.S. invasion of Afghanistan in the immediate days after the 2011 attacks, he never envisioned the invasion of Iraq, nor the creation of a third front in the form of a Homeland Security institution aimed at screening people inside the U.S. Combined, all these events now meant the U.S. was financially and politically engaged on three expensive war-related fronts.

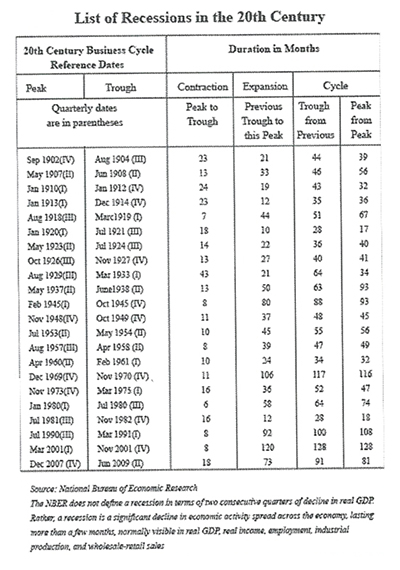

Only seven years later, the 2008 recession (which officially lasted from December 2007 to June 2009) started the process which destroyed trillions in wealth and whose full force is still unfolding. While the 2008 recession had many causes–corrupt mortgage lenders, over-extended borrowers, aggressive sub-prime mortgages sold to unwitting or mismanaged government agencies, inert regulators, complicit rating firms, all fanned by aggressive Wall Street salespeople—it was also facilitated by enabling politicians and some in the Fed, who effectively allowed the fraud to expand worldwide.

Another cause for the 2008 recession was due to the ill-effects of industry lobbying and regulatory mis-management. “Regulatory authority was stripped away or blocked, the congressionally appointed panel wrote, with much of what remained undermined by infighting, loopholes and influence that the financial industry bought with $2.7 billion of lobbying and $1 billion of campaign contributions in the decade before the crash,” according to Bloomberg (“Banks Seen At Risk Five Years After Lehman Collapse,” Yalman Onaran, Michael J. Moore and Max Abelson, Bloomberg radio, Sept. 9, 2013.)

The Remains of the 2008 Recession

Today, here are the dismal financial results of the, as yet unfinished 2008 recession:

•“By the low point of the recession, Americans’ retirement savings had shrunk by about $2.5 trillion. More than 8.8 million jobs were lost, and roughly 3 million homes had gone into foreclosure,” according to Frontline, the PBS documentary program, “The Financial Crisis Five Years Later — How It Changed Us,” Frontline, September 10, 2013.

•Over $18.9 trillion in household wealth was eliminated, accompanied by the loss of over eight million jobs.

•The $2.5 trillion sub-prime fraud affected every racial, geographic and income group in the U.S. It was an equal opportunity financial disaster.

•Between 2007 and 2010, the median value of the average American’s housing equity fell 42%. By May 2012, 31% of homeowners owned homes that were worth less than their mortgages. Home equity is one of the largest wealth engines available to the vast majority of Americans and that evaporated wealth can take up to a decade to be replaced.

•The percentage of working-age adults in the labor force, aka, the participation rate, fell to 63% in August 2013, the lowest such figure since May 1979. This happened as people stopped looking for work in a stagnant hiring environment, or as they were offered part-time or jobs which would not cover expenses.

•In 2012, incomes of the top 1% rose almost 20% compared to a 1 percent increase for the remaining 99% of he U.S. population, according to this story. Also, 95% of the income gains reported since 2009 have gone to the top 1%, the AP reported based on an analysis of the data. The authors of this same study separately found that the U.S. had the greatest income inequality of any other developed nation on earth, which is dangerous for any democracy.

Another Meltdown Is Likely

Recessions are part of the economic cycle, but the 2008 recession opened a new chapter on financial meltdowns.

Future recessions are likely to occur faster and be more unpredictable and volatile. That’s because the nation’s largest banks have only gotten larger since the last recession (thanks to bailouts and loose credit), while they have successfully beaten back any regulatory reforms, such as Dodd-Frank and the Volker Rule, designed to prevent or limit bank proprietary trading. Worse, leverage continues to be readily available to banks, which will only accentuate losses and their ripple effects.

Bloomberg news reports that “while the amount of capital at the six largest U.S. lenders has almost doubled since 2008, policy makers and some Wall Street veterans say that’s not a panic, and regulators ill-equipped to head one off – the same conditions that led to the enough. They see a system still too leveraged, complicated and interconnected to withstand last crisis.” (“Banks Seen at Risk Five Years After Lehman Collapse,” Yalman Onaran, Michael J. Moore & Max Abelson, Sept. 10, 2013.)

J.P. Morgan lost $6.2 billion in 2012 by taking the wrong side in its credit default swaps tied to corporate debt “and then lied about it,” according to Robert Reich. In an article, he said “evidence shows the bank paid bribes to get certain counties to buy the swaps.” he also said the Justice Department is investigating JP Morgan over its improper energy trading, plus the Security and Exchange Commission is looking into whether the bank committed fraud in collecting credit card debt, foreclosing on mortgages, and misleading customers when selling them identity-theft products.

So while the Sept. 11, 2001 attacks will rightfully be commemorated for many years into the future, Americans should also re-examine the causes of the 2008 recession and how respected U.S. financial institutions unwittingly accomplished what bin Laden was never capable of doing.