Two news items this week indicate that the financial services industry may be inherently unethical, yet the SEC has chosen to do little about it.

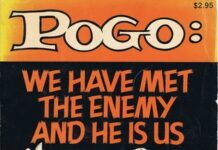

That’s the conclusion anyone who has followed the twisted, convoluted and agonizingly slow pace of the adoption of a fiduciary standard by the financial services industry.

Due to inherent conflicts of interests between brokers and clients and even entire investment banks and trading firms against their own customers, adopting the fiduciary standard would re-distribute the balance of power in favor of the uninformed, naïve and unassuming investors, by simply giving them the facts. And as everyone knows, an informed customer can challenge the status quo.

The basic assumption that an informed investor is good for business is not the rule in the financial services industry. As a result, a new survey conducted by the Economist Intelligence Unit found the following about the prevalence or desirability of ethical conduct in the financial business.

- 53% of financial services executives say adhering to ethical standards inhibits career progression at their firm.

- 53% also say strict codes of conduct would harm their firm’s competitiveness.

- 43% have had to introduce incentives to encourage ethical conduct.

- 96% nonetheless prefer to work for a firm with a good reputation on ethical conduct.

“The very fact that 53 percent of them think that being inflexible on ethical standards would hamper their career progression, that shows that ethical conduct is just not an actual fit with financial services as of yet,” Sara Mosavi, Research Editor at The Economist Intelligence Unit, told StreetID.

The Old Testament dictum that a person “should not put a stumbling block before the blind” was recognized a few thousand years ago to correct this exact problem about taking advantage of the uninformed.

Business As Usual

Professionals who have promoted and pushed for the adoption of the fiduciary standard have waited years for the issue to percolate to the surface.

One reason why this change has been is difficult to implement is that it is not only a regulatory issue, but it seeks to correct a flaw in human nature. Giving a sucker an even break is not a natural business practice. The Old Testament dictum that a person “should not put a stumbling block before the blind” was recognized a few thousand years ago to correct this exact problem. Yet the most recent criminal and unethical behavior of real estate, appraisal, mortgage bankers and traders did not create any sense of urgency among regulators to advance the fiduciary standard even though these criminal practices destroyed trillions in wealth that has affection millions of people worldwide. Yet the SEC does not recognize an immediate need to act.

And that is exactly what happened. A report by Investment News said the SEC, certainly no friend of individual investors, will consider this critical issue in 2014.

Another more investor-friendly regulator, the U.S. Department of Labor, also re-listed the fiduciary standard on its 2014 priority list calendar for investment advice applying to retirement plans, including 401(k)s and pensions. But according to the publication, “the measure was first floated in 2010 but withdrawn after fierce financial industry protest that its requirements would drive brokers out of the market for individual retirement accounts.”

Now this delay happens after years of testimony and an increasing cascade of abuses by top investment firms and professionals against their unsuspecting clients. Worse, this is occurring on a global scale, as evidenced by the record fine paid by JP Morgan Chase–$13 billion—which essentially went unnoticed by the financial media. This fine was paid to settle allegations surrounding the bank’s role in selling corrupted mortgage-backed securities in the prelude to the 2008 financial crisis. The fine is the largest single settlement ever paid by a bank.

Separately, UBS and Barclays, two of Europe’s largest banks, co-operated with regulators inorder to avoid fines which could have totaled $4.3 billion in European Union anti-trust penalties. The fines were threatened over charges that the banks conspired to rig LIBOR interest rates, a global benchmark which affects trillions in consumer and commercial loans. And in another investigation, regulators in the U.K., Switzerland, the U.S. and Asia were investigating attempts to rig the $5.3 trillion-a-day foreign exchange market, the most liquid market in the world.

Instead, these record fines and continued global bid-rigging investigations should mark the Black Day in the history of financial services. These deeds should have totally revamped entire practices ion the industry, including the way financial service public relations are handled on a day-to-day basis. Yet as expected, these PR professionals, client managers and anyone interfacing with unsuspecting investors ignored these sad events and continued as if nothing ever happened. Too big to fail means you do not have to acknowledge the obvious.

So the financial services industry juggernaut continues unobstructed, while the SEC whistles past the graveyard. And again, the victims are unsuspecting investors, as well as millions of average citizens who suffered from the trillions in lost wealth spawned by the 2007 financial crisis..