Social responsible investing (SRI) is defined as the investment process in which “investors weigh the social and financial returns they expect from an investment in different ways. They will often accept lower financial returns in order to generate greater social impact.”

Another more upbeat definition is: “SRI is an alternative investment philosophy and strategy seeks to encourage responsible behaviors, including those supporting positive environmental practices, human rights, religious views or what is perceived to be moral activities (or to avoid what is perceived to be amoral by the SRI society, such as alcohol, tobacco, gambling, firearms, military relations, or pornography).”

Another more upbeat definition is: “SRI is an alternative investment philosophy and strategy seeks to encourage responsible behaviors, including those supporting positive environmental practices, human rights, religious views or what is perceived to be moral activities (or to avoid what is perceived to be amoral by the SRI society, such as alcohol, tobacco, gambling, firearms, military relations, or pornography).”

The first fund to adopt a socially responsible investment policy was the Jane Addams Hull House in Chicago, in the early-1980s. This alternative investment philosophy gained traction during the anti-apartheid movement in the late-1970s. At about that time, a set of guidelines was created in 1977 by Leon Sullivan, a Baptist minister, civil rights activist, and board member of General Motors, who became a leading proponent against the apartheid policies in PW Bothas’s South Africa.

Sullivan reasoned that GM’s pension money, then ranked as one of the nation’s largest pension funds in the U.S., would have political and economic clout if it took a social stand on racial policies, which were then attracting worldwide attention.

In 1999, his Sullivan Principles were formalized to include racial non-segregation on the factory floor and in company eating and washing facilities; fair employment practices; equal pay for equal work; training for blacks and other nonwhites so they could advance to better jobs; promotion of more blacks and other nonwhites to supervisory positions, and improved housing, schooling, recreation and health facilities for workers, according to the New York Times.

To Sullivan’s credit, his timing was excellent. He capitalized on the combination of assigning a new form of public political activism with investing that became a combustible combination. This set the stage for a much wider social investing movement that over the past approximately 33 years has embraced such social issues as equal wages for women, environmentalism, anti-slave working environments, workplace safety, anti-child labor policies, anti-smoking, anti-defense weapons and the humane treatment of animals.

Take This Sector Seriously

Currently, the number of companies in the marijuana industry space is small, but to its credit, it already has established a price-weighted index, the MJX Marijuana Index.

comprised of about 44 companies, most of them very small. Realistically, these companies cannot be included in any institutional portfolio until they have about five years of financials. However, it is not too early to start positioning some of these firms as being companies which can be included in an SRI portfolio due to their beneficial impact on society. It would be up to each firm to position itself as a transformational force.

So, now it is time to advance social investing into the marijuana industry as a social justice issue for a few reasons:

–It will work to reform the harsh sentencing of people who trafficked and sold marijuana and now face exceptionally-long incarcerations;

–It will focus attention on other forms of long-accepted social practices—drinking and smoking—which have clear health-related diseases associated with their long-term use which cost society billions in health care and could be easily eradicated by not using them in excess.

It is estimated that and smoking- and drinking-related diseases cost the U.S. government $434 billion annually. By category, this breaks down as the annual smoking-attributable economic costs in the United States estimated for the years 2009–2012 were more than $289 billion. This included at least $133 billion for direct medical care of adults and more than $156 billion in lost productivity, and $5.6 billion (2006 data) for lost productivity due to exposure to secondhand smoke, according to the Centers for Disease Control and Prevention. (CDC)

Excessive alcohol and alcohol-related medical expenses use cost states a median of $2.9 billion in 2006, ranging from $420 million in North Dakota to $32 billion in California, according to a CDC study.

Despite years of anti-smoking public education, millions of Americans remain addicted to nicotine and alcohol and cannot break the habit. Marijuana does not cause not addicted, according to the most reliable and repeatable studies.

The Plus Side of Marijuana

On the positive side, marijuana has the following benefits;

–Marijuana has the ability to be socially transformational. Without becoming exuberant, the marijuana industry is now emerging with a very new set of independent, young entrepreneurs who come from a variety of backgrounds and have been well-exposed to America’s counter-culture for years. While it may be an exaggeration, it is safe to say the marijuana industry today is not Brooks Brothers, wing-tip corporate America. While I have not seen any formal studies, I would guess it is decidedly democratic, or leaning towards libertarian, multi-racial and multi-gender.

Like the fracking industry which took the Five Sisters oil monarchs by surprise, the marijuana industry is largely comprised of the office equivalent of wildcatters who worked in the shadow of the big oil companies devising revolutionary oil drilling techniques, such as horizontal drilling and experimenting with compounds to break apart shale thousands of feet under the surface to extract oil and natural gas. In the process, the wild caters of the fracking industry revolutionized oil exploration and did a complete end around the major global oil companies.

Without extending this analogy too much, the marijuana industry has the ability to propel pharmaceutical research; the entertainment, music, and food industries; as well as environmentalism. In the process, they will rely on grass roots social participation to reshape the nation’s antiquated anti-marijuana laws at all jurisdictional levels. This alone represents a major political coup, which has more potential impact on the nation than all the smoke the Tea Party has made thus far.

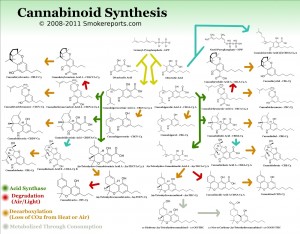

–Pharmaceutical research. Cannabinoids, an active chemical compound found in marijuana, has been used in medical treatments for thousands of years. However, since federal law states that the possession of marijuana is illegal in the United States; most states have enacted laws to prevent its medical use. Taking its cue from the Justice Department and federal law, the U.S. Food and Drug Administration has not approved Cannabis as a treatment for cancer or any other medical condition.

According to the National Cancer Institute (NCI), cannabinoids have beneficial properties which can aid cancer patients. Specifically, the NCI said: “the potential benefits of medicinal Cannabis for people living with cancer include antiemetic effects, appetite stimulation, pain relief, and improved sleep. Although few relevant surveys of practice patterns exist, it appears that physicians caring for cancer patients in the United States who recommend medicinal Cannabis predominantly do so for symptom management. The active ingredient for medicinal use is Cannabinoids, a group of terpenophenolic compounds found in Cannabis species (e.g., Cannabis sativa L.). Research into this new family of pharmaceuticals is going on in other parts of the world, particularly Israel, but research is being stymied in the US due to political and legal reasons.

Get Socially Responsible Fast

So what should the new, publicly-listed marijuana industry companies do next? I suggest they make a concerted pitch to the nation’s socially responsible mutual funds (Domini, Calvert, Parnasus) and fund companies which have stand-alone socially responsible funds (Vanguard, Fidelity, Appleseed Fund, Walden Social Equity Fund, for example) to develop a pitch which resonates inside this genre of investment firms. While the companies are new and have no longer-term track record to be included in a portfolio, the time to make the socially responsible case is now, so the companies can be included in research reports, performance summaries and news updates.

Socially responsible investing took years to even appear in the investment industry. Economists used to dismiss any non-financial activities as externalities, or not fundamentally important to the ongoing data gathering and investment research process.

But now that shareholder activism and transparency have become more accepted, after being resisted by the investment and financial services industry for decades (like the industry is current fighting the ethically correct adoption of a universal fiduciary standard), including the marijuana industry into the asset mix is a grand possibility and one which can be done by individual investors tomorrow if these companies put together the right package of financials, industry innovation and social transformational possibilities.

After all, what is investing all about if it cannot make people and their society more positive, conscious, upbeat, just and profitable? And it is all organic and natural, too.