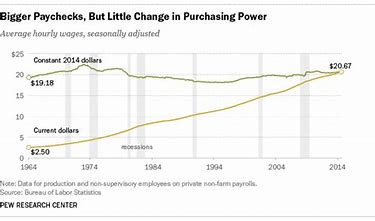

A new report from the Organisation for Economic Co-operation and Development (OECD) finds “unprecedented wage stagnation.” Despite a more robust economy with record low unemployment rates and a far-reaching and controversial tax cut, the average wages of American workers have not budged since the late 1970s when “the average American has been stuck since the Reagan era in a predawn darkness of stagnation and inequality, and we still haven’t shaken it off,” according to Nicholas Kristof.

In a nutshell, the OECD report found:

“In June 2018, the OECD released a report titled “Inequalities in household wealth across OECD countries,” which examined the distribution of household wealth across 28 countries and it discovered that America is the number one in the world for financial inequality. About 10 percent of American households own 79% of all the wealth in the country. Meanwhile, the poor and middle class, about 60% of American households, only own 2.4% of the country’s wealth,” according to ProTrading Research.

How the wage stagnation happened is no mystery. Numerous financial policy think tanks and academics have produced scores of studies, but financial planners have ignored most of them. One typical explanation from the Economic Policy Institute (EPI) found that “abstract economic trends did not create wage stagnation for the vast majority.

Instead, wages were suppressed by policy choices made for those with the most income, wealth, and power. In the past few decades, the American economy generated lots of income and wealth that would have allowed substantial living standards gains for every family.”

How bad is income inequality in the U.S.? According to the EPI, “the unequal income growth since the late 1970s has brought the top 1 percent income share in the United States to near its 1928 peak.”

However, wage inequality also contributes to the retirement crisis worldwide. According to “The Changing Face of Retirement: the Aegon Retirement Readiness Survey 2013,” conducted by Aegon, the Transamerica Center for Retirement Studies, and Cicero Consulting, the Aegon Retirement Readiness Index of 12,000 individuals polled in 12 countries shows that only 12% “are optimistic that they will have sufficient financial resources in retirement. Only 20% claim to understand financial matters about effective retirement planning.”

Other statistics also paint a bleak picture:

- Nearly half of families “have no retirement account savings at all,” the EPI reported.

- A Bankrate Security Index survey found that 39% of survey respondents only have $1,000 in savings as an emergency fund.

- While the average American family has $95,776 in retirement savings, that number is inflated when you consider the median savings, or those at the 50th percentile, for all families in the U.S. is just $5,000. The median for families with some savings is $60,000, according to the Economic Policy Institute.

As someone who has been covering the retirement industry since the 1970s, I have never seen a flurry of positive news stories saying the financial picture for retirees has greatly improved, especially since the decline of pensions, bad decisions made in 401(k) plans, accompanied by rising living expenses that erode the ability to save for retirement.

Wage Stagnation Is the Best Explanation for the Retirement Crisis

In addition to wage stagnation and income inequality in the U.S., pension experts continue to reiterate that there is a retirement crisis. To understand the depth of their predicament, more people approaching retirement have smaller accumulated savings, accompanied by poor knowledge of essential finances. While these warnings have been repeated to policymakers, employers, the retirement industry, and elected officials for decades, little has changed for the better.

It is time to consider this crisis a permanent fixture in American life. Worse, the financial services industry continues to offer the same tired advice as timid advisors, and their investment firms encourage people to start saving for retirement earlier, save more, or reduce expenditures even as many acknowledge that incomes have stagnated.

Many of these tired financial services industry recommendations confuse an expanding economy with the assumption that wages are rising. They also confuse a rising stock market with greater prosperity. Both are patently false. Financial advisors who ignore these facts as they continue to recommend products, even low-cost funds and ETFs, should seriously revamp their sales and recommendation approaches to include this new reality.

Advisors who are bothered by these issues should also push their firms to make a fundamental political shift towards a more equitable wage growth policy to reduce the world’s largest level of income inequality in the developed world. However, this is not part of the corporate and economic worldview that considers the “unprecedented wage stagnation” a “structural problem” in economic jargon, not a political or social one. It is part of the rise in corporatism and neoliberalism worldwide.

The financial services industry is one of Washington’s most significant lobbying forces. As such, it uses its money to lobby against the interests of its clients. Something fundamentally wrong with that has been going on for decades even as the industry continues to oppose the DOL’s fiduciary standard. In contrast, some global firms continue victimizing their clients by selling look-alike, high-fee products or blatantly falsifying new account applications.

If the industry continues to promote income inequality and the subsequent retirement crisis through its inaction, other political forces can come into play. As Brendan Greeley, editor of Financial Time Alphaville, said in a CNBC interview (July 17, 2018), “It is hard to talk about wage stagnation without sounding like Karl Marx.” Now, that is something the financial industry should seriously ponder.