If people believe the fallacy that Trump is a successful businessman, than his negative impact on the stock market is no surprise.

Turmoil in the White House begets turmoil in the confidence of the American electorate, as well as in the financial markets. Whether it is paranoia about invaders from the south or corruption in the FBI or Justice Department, psychological destabilization has the same negative impact as financial and political destabilization.

The Trump-inspired turmoil is hurting investor risk and financial advisor confidence, according to the last two month’s of surveys conducted by SourceMedia Research. Based on two indexes, confidence levels are in “negative territory” as a result of the uncertainty surrounding tariffs, high corporate debt, the rising deficit, and the end of a short-term tax stimulus.

An article in the January 2019 issue of Financial Planning said the uncertainty is also spilling over into decreased retirement savings to the lowest level in the index’s history. This means retiree savings plans are being derailed now that will cause people to have less money after they stop working. In short, there is bad news for both investors and advisors. And because the U.S. market is so dominant, this market turmoil is spreading worldwide.

The big question is who benefits from this destabilization and why is it being enabled and caused by an American president?

Consider the following events:

- The S&P 500 Index posted its largest price retraction since 2010, according to Bloomberg news, on Dec. 28, 2018, a day after the gauge capped its largest advance since 2009. Despite the two-day gain, the measure is still down almost 10 percent in December alone.

- Since 1945, December has produced the highest average gains of any month, he says, but this month is set to be the worst of the year, according to MSN.

- Since the 1970s, the S&P 500 has never slumped when earnings growth was more than 10%, according to Mark Matthews, head of Asia research at Bank Julius Baer & Co. in Singapore, as reported on MSM.

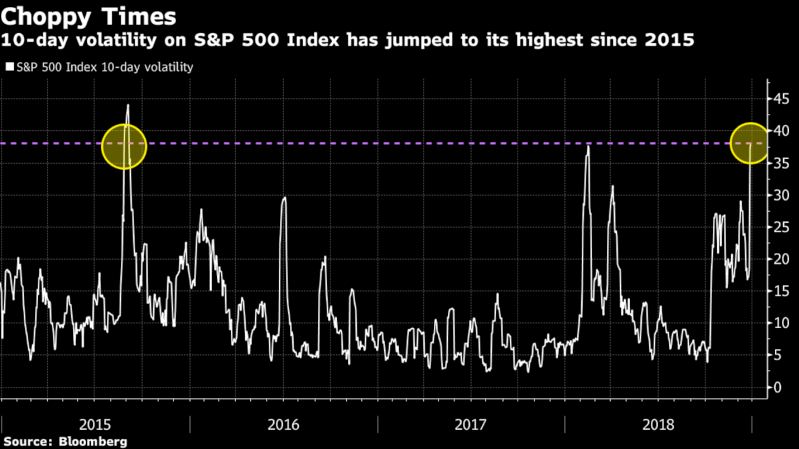

As this chart shows, the volatility has reached an extreme point. It is so extreme that market professionals don’t know if this is the start of a recovery or the beginning of a bear market.

Trump has sought to derail the financial markets by criticizing the Federal Reserve, saying the shout down could last “for years,” imposing tariffs, antagonizing long-term allies, gutting the White House staff, and using his public office for personal gain. All of this is imbedded in irrational behavior. It’s now time for federal elected officials to question Trump’s intent and sanity.

Remember, the goal of Osama Bin Laden was never to overthrow the U.S. government and establish a Muslim caliphate here. His goal was to destabilize the American economy.

According to this site, Bin Laden said: “We are continuing this policy in bleeding America to the point of  bankruptcy, Allah willing. And nothing is too great for Allah.” He went on to say that “his goal was to do to the US what had previously been done to the Soviet Union; slowly bleed it to death in a long, intractable military conflict in Afghanistan.”

bankruptcy, Allah willing. And nothing is too great for Allah.” He went on to say that “his goal was to do to the US what had previously been done to the Soviet Union; slowly bleed it to death in a long, intractable military conflict in Afghanistan.”

He failed, but Trump can succeed. Who knows? That may even be his goal since he could forfeit or re-negotiate his personal business loans or help the Russian government.

So What Should Average Investors Do?

Market volatility only benefits active, professional traders. It is not friendly to average investors. The volatility traders at large banks and trading firms, such as Goldman Sachs, benefit from volatile markets and leverage, so look for them to make large profits. The volatility can also be exaggerated since there is less liquidity now than in the past decade, according to Bloomberg.

This instability has two components: it is a byproduct of a mature market expansion that reflects trade tensions, recessions in Europe, the end of loose central bank policies worldwide and other market noise that is always present.

But the high volatility also should concern average investors. The volatility benefits Trump since it instills fear into the public and detracts from the deep-seated corruption in the Trump administration. It is also a diversion from the Muller investigation and his failed administration. Trump benefits from the instability and volatility; no one else.

If you are a long-term investor, stay the course. Investors who follow this site know we are proponents of investing in passive funds via low-cost mutual funds and ETFs sold through RIAs. The markets will recover to near-normal behavior when Trump is removed from office. The sooner that happens, the faster the markets will recover. And that is something you will never hear on FOX or CNBC news.