Bear markets are an inherent part of market cycles, just as expansions and contractions are a normal part of business cycles. While investors should be concerned about bear markets, especially their duration, there is also an established link between market and business cycles. Understanding both will help investors better understand the cause and duration of bear markets. Under these circumstances, dollar-cost averaging (DCA) can provide a disciplined investing strategy to re-invest during volatile markets.

Making Sense of Business Cycles

Economists recognize that the economic cycle undergoes periods of expansion and contraction. While these periods are relatively easy to identify, determining the cause of an economic ascent or descent is more complicated. Some explanations have tried to link these cycles to over- and under-consumption, monetary policy, consumer psychology, political situations, technological innovation, and inventory supplies.

In today’s complex economy, business and stock market cycles have become more linked, and their periods overlap. This is because stock market cycles generally happen before a business cycle develops, as investors anticipate economic events while the economy usually moves through the stages from recession to recovery. In each phase, consumer expectations, industrial production, interest rates, and the yield curve have different characteristics.

Each market cycle presents different characteristics as it unfolds over time.

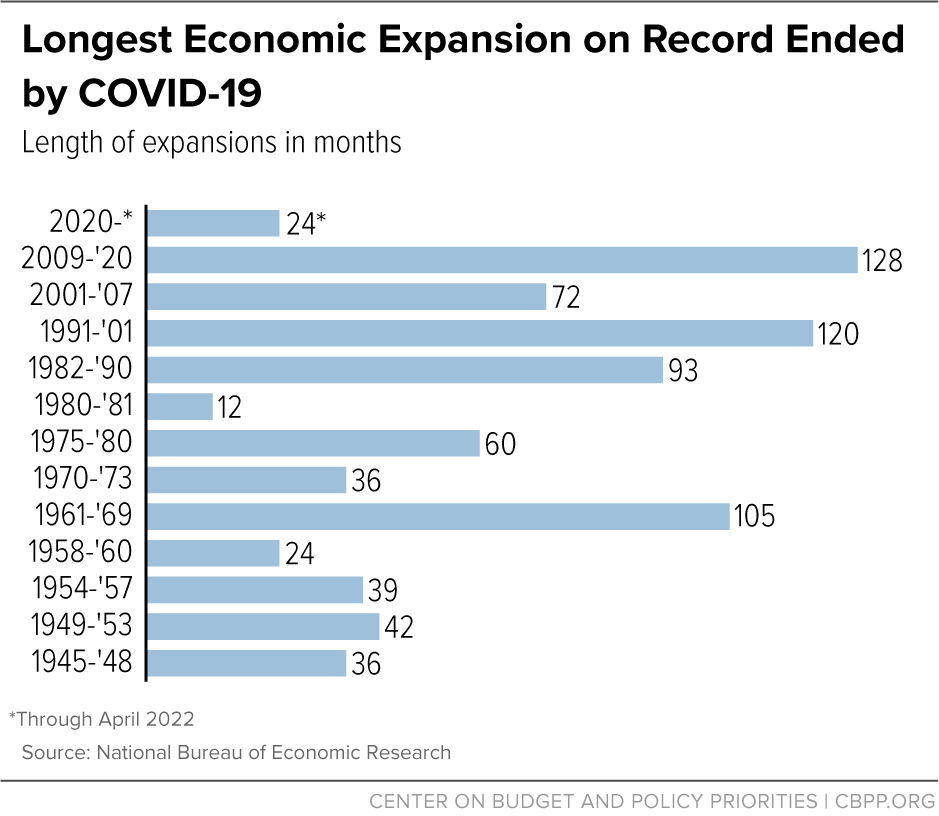

Chart of Business Cycles

The chart below shows business expansions from 1945 to 2020, when the COVID-19 epidemic cut the longest expansion on record to an abrupt close in March 2020. As the economy shut down, it caused a decline in real GDP of 5% at an annual rate in the year’s first quarter and 31% percent in the second quarter of 2020.