By Neil Plein

From: Invest N’Retire, July 22, 2011

For the complete article, visit Invest n’Retire

Having a retirement calculator should be a good thing. It helps to perform computations and projections that would otherwise be out of reach to the common 401k participant.

The intent of calculators are primarily twofold; to help a participant understand what their retirement savings goal is and to present the necessary contribution rate needed to reach that goal. Calculators are not designed to compute investment performance history, but rather, to use such information along with contribution rate to give the participant an idea of whether or not they’re on track to reaching their savings goal.

Consider your savings goal for a moment. Most calculators, without much input other than simple variables, like age, salary and retirement age; can determine what your savings goal should be; how much money you’ll need to save to live on some percentage of your current income for some number of years until death based on standard actuarial tables.

This is common, most people know their age, salary and usually that they want to retire at 65; so figuring out a retirement savings goal, at least through the use of a retirement calculator(s), is something which can be done with relatively little resistance or confusion (I’m omitting mentioning inflation, salary increase, etc.).

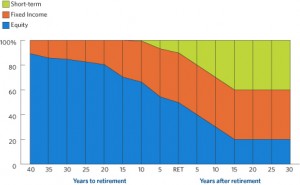

But with a goal established, now what? Logic would follow that you would look at where you are currently (point A) and determine how you will get to your goal (point B). Between these two points is your path and following that path depends on growth; which comes from investment returns and contribution rate working together. Needless to say, managing these two variables is exceptionally important.

Unfortunately, for the average participant, this is the point at which their comfort with plan tools (their retirement calculator) begins to slip away. This can be observed very easily by thinking of how your own retirement calculator works.

The odds, which are overwhelming in this case; are that you log in somewhere, go to your retirement calculator and are then presented with a series of questions that require you to enter personal information manually.

Examples are questions like: how old are you? What age would you like to retire at? What is your salary? How much are you contributing? What is your current retirement balance? What is your target rate of return? Now stop. Can you feel the ease with which answers entered your mind fade away on that last question? The first few questions were fairly obvious, came to your mind quickly; but do you have any idea what your target rate of return even is?

According to Warren Cormier, of the Boston Research Group, most participants don’t even know what their portfolio returns are, so by lacking this fundamental understanding, how would they even have a chance at grasping what their returns would need to be in the future?

For the complete article go to Invest’Retire