“There’s this avalanche of dollars that’s falling out of the sky,” says Peter Laatz, global managing director of sponsorship researcher IEG,” Bloomberg news reported.

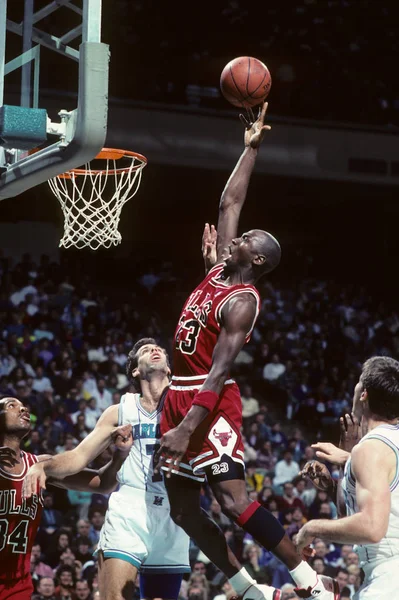

Laatz is talking about the hundreds of millions in new sports ad spending coming from crypto firms into the laps of professional teams worldwide, ranging from basketball, and car racing, to soccer, and baseball.

But the bigger question is why are the crypto ad dollars targeting this audience?

Like most of the $225 billion spent in media advertising in the U.S. in 2020, the answer is that corporations are seeking a few seconds to gain the attention of cable, Facebook, or anyone else with access to some spendable money to buy their product or services.

The results of these billions spent on advertising clicks, views, or peripheral notices are not really measurable, aside from some double-talk in ad presentations, but after about 300 years of advertising in the U.S., businesses of all sizes and billion-dollar corporations still don’t know whether their ads work.

Nothing has changed since John Wanamaker, a marketing pioneer and the owner of department stores in Philadelphia, once quipped, “Half the money I spend on advertising is wasted, the trouble is I don’t know which half.”

So, what’s the link between crypto, the largest Ponzi scheme ever to infect people who want to get rich quick, and sports fans?

The answer: Macho and greed on behalf of the sports fans and the team owners. At least that is something both can agree on.

The only other base human emotional driver to add to the equation is sex, and that’s probably just around the corner.

As the Bloomberg article notes, “a boom in cigarette advertising funded the sport’s golden age in the 1970s and ’80s, with Grand Prix races covered in Marlboro red and Rothmans blue.” But that was for the more upscale Formula One crowd.

Today, crypto firms and their ad partners are pitching the Ponzi get-rich-quick pitch to fans of basketball, soccer, and basketball.

A Dangerous Development: Sports Crypto Betting and Money Laundering

So what’s the end game of the marriage between crypto and sports?

Betting.

Think of Las Vegas from the bleachers, without the neon lights, free drinks, and sexy barmaids. Think of going to a competition and betting on the gladiators.

But that day is already here. The NFL approved seven sportsbook betting partners in 2021, so fans with some disposable income can get sucked into the data dump of sports statistics that equity analysts use from corporations to predict future earnings surprises. Sports betting alone is expected to reach $2.1 billion in 2022, according to Front Office Sports.

Today, every American can aspire to be a trader. They may know nothing about trading or fundamental analysis of the underlying asset, but they can now use data (aka “sports analytics,” a $2 billion industry expected to hit $16.5 billion in 2030) to make some harebrained guess that sounds rationale in an effort to beat the bell-shaped curve of success.

But that is a rare mathematical event. There are few Black Swans in sports, just like there are in investing.

So, back in the USA, the political reality remains that the ever-widening wealth gap shows no signs of decreasing. This was made worse due to Covid-inspired changes in the employment world, neoliberalism, and the growing awareness that mind-numbing minimum wage jobs at corporations have little social purpose, and are not emotionally fulfilling. To reach the American Dream, people have to win the lottery or bet on something which they don’t understand: crypto. But most people cannot admit they are betters, so they lie to themselves and call it “investing.”

The reality is that we know buying crypto or a non-fungible token (whatever that is) of your favorite team instead of a souvenir T-shirt, is not investing.

The Sad Reality of Crypto: It Sucks

This brings us to the reality of crypto.

Despite the worldwide hype, crypto is not a replacement for any currency worldwide, it has been tried in a few small nations in South America with dismal results that make poor people poorer. It has also been the subject of some major global criminal scams, and more can certainly be expected.

People are not buying houses and paying for them directly in crypto, at least not in cases where they want to talk about it publicly.

…no educated investor knows what drives crypto prices or who invented it.

The reality is that since it seeped into the open via social media, and not from any major central bank of a legitimate financial institution, is that crypto was never going to be the new global currency or an asset class.

Just like Esperanto, which was developed to be a global new language spoken by the world’s population, crypto never met its naïve promise.

We still don’t even know who invented crypto, just like we don’t know who is behind QAnon. If that sounds suspicious, it should. Maybe they are being pushed by the same bad guys located in the Urals or under the Great Wall.

Why Crypto Exists

But whatever the reason, crypto today only has a few purposes:

- As a money laundering scheme;

- To be used for tax evasion;

- To destabilize central banks around the world and create financial havoc;

- To give working-class people the chance to make a profit even if they have no idea why the price went up;

- To give people hope that the crypto they own, less hidden fees and expenses, can be worth something more in the future than when they bought it.

- To give owners bragging rights, so they can join in the crypto conversation.

- To fuel the Ponzi scheme that benefits people who run crypto brokerage firms, sell NFTs, and advertising firms.

- To give some financial journalists and news outlets something new to write about, even if they know it is possibly fraudulent.

- To sell crypto ads that generate huge sums of money for online social media, including financial websites, and sports teams, that profit from the Ponzi scheme.

In short, crypto’s real message to most Americans, especially those who distrust elections, and by inference the American capitalist and democratic systems, is that you can watch a sporting event, buy crypto, and maybe in a few months, afford to buy a new couch to watch the game.

But that is just hope because no educated investor knows what drives crypto prices.

This simple omission is the epitome of intellectual honesty. Worse, federal and state regulators, Central Bankers, global investment firms, pension fund sponsors, and unethical financial media know crypto trading is just a revival of unregulated pink sheet, penny stock trading, yet they have not banned it. Instead, they go through the charade that it could be an “asset class,” or has some fake investment fundamentals, or that crypto is part of blockchain software that has a legitimate application.

Today, crypto is banned in Bolivia, Cuba, China, Colombia, Egypt, Indonesia, Iran, and India, so what do these central bankers know that those in the US do not? People in these nations go to soccer games, buy consumer goods and houses, and watch advertisements. But the US is the epitome of a consumer society. Anything is continuously bought and sold, and the economy is 70% driven by consumer spending. But there are problems here.

Most Americans under the age of 50 can’t afford to buy a house or have the comfort of ever having a financially secure retirement due to getting a pension, and even a Social Security check in 20 years because the Republicans want to privatize Social Security. That’s why sports fans may as well own a few NFTs, Bitcoins, or Doctor Spock cryptos, which they can nail to the wall of their rental unit and pretend they are in Beverly Hills or Deep Space.

Let the crypto sports ads flourish. Let the games continue.