Economic factors are expected to buffet financial wellness programs, but how do they work in an age of misinformation, distrust, and political gridlock?

Recent reports show they don’t. These deficiencies are not new. Financial literacy among Americans has remained poor for decades, and there are no signs this is reversing.

Financial literacy programs have been part of many corporate employee benefits programs since the 1990s. However, most American worker-investors still cannot save for retirement, decrease debt, pay for healthcare, and meet other living expenses in the world’s largest consumer society.

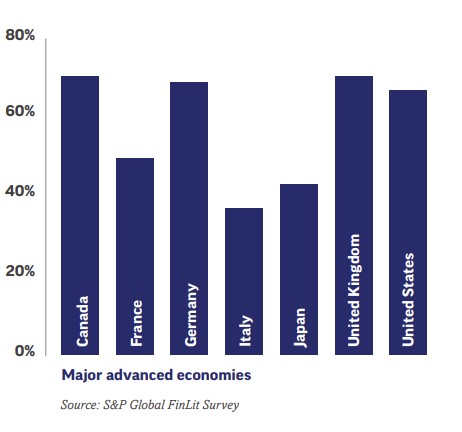

Improving financial literacy is an international corporate concern. In the 2015 Global FinLit Survey conducted by Standard & Poor’s, the seven most financially literate nations were Denmark, Sweden, Norway, Canada, Israel, the United Kingdom, and the Netherlands. The chart below shows the percentage of adults in each nation that are financially literate.

More recently, a study from Bank of America found that only 42% of employees rated their financial health as “good.” This was an all-time low for B of A’s data,” according to the November/December issue of Employee Benefit News. The main reason was inflation, which stressed salaries and forced some to forego their retirement contributions.

Financial wellness programs are not designed to cope with macroeconomic events like inflation. These shortcomings are built into most corporate financial wellness programs because many programs are unfocused or try to do too much unneeded investment-financial education. These programs also ignore the real-world reality that political and economic misinformation permeates American society outside the workplace.

QAnon conspiracies, partisan political and media attacks on the state of the economy, a financial media that focuses on trading versus investing, and constant advertising beckoning consumers to consume more are more powerful distractions that overpower educational literacy programs.

Despite the enormous budgets for all types of financial literacy programs, too many workers preparing for retirement said they are uncomfortable designing and managing long-term portfolios. To change this, benefits administrators have expanded the concept of financial literacy to “financial wellness programs” that combine total workplace employee benefits offerings that now include physical, psychological, and work-life balance programs.

In some workplaces, financial wellness programs address HSAs, employee discount programs, tuition reimbursement, financial planning sessions, credit management, mortgages, and personalized financial counseling. According to Sue Walton, Senior Retirement Strategist at the Capital Group, “health and wellness benefits are converging” into a new “benefits ecosystem.”

Adopting a More Holistic Approach

Benefits departments offer different financial wellness programs based on their employee population, budgets, and benefits. While some of these programs are more focused on the existing retirement plans offered by the employer, other benefits departments are taking a more expansive interpretation of what it means to support employees in the home, workplace, and community.

By doing this, some corporations offer more support for a work-life-community balance. This includes benefits offered at work and in retirement. Some of these work-life benefits programs can make a difference in employee retention, leadership development, improved productivity, and community political involvement.

For example, at Best Buy, financial wellness programs address the “total well-being of employees,” which includes the economic, physical, social, and mental states of its 112,000 employees. Debra Dennin, senior manager of retirement and wealth benefits at Best Buy, said the company has developed a program of “six pillars of financial wellness” that addresses debt management, retirement, emergency savings, managing cash flows, having insurance, and prioritizing savings.

Financial literacy programs must include political, as well as investment, considerations

This approach is also being used by local governments. In one ambitious program, Palm Beach County, Florida, launched its financial wellness program in 2014 for its deferred compensation 456-7(b) plan participants. It also hired a third-party administrator to streamline its investment offerings. This resulted in decreased funds from 41 to 19 and a reduction in fund investment management fees of 67%, from 83 bps to 27 bps on average. The streamlined offerings increased participation by 20% and average deferral rates by 10%.

In Palm Beach County, the benefits department moved from a program stressing financial wellness to emphasizing “employee well-being.” A benefits administrator said this created a “holistic employee well-being initiative” that bridged the gap between financial stress and its impact on physical and emotional health. The county worked with health care, banking, and retirement plan experts to do this.

The Evolution of Financial Literacy

Financial literacy has evolved. A few decades ago, when the 401(k) industry became more popular as defined benefit pension plans declined, financial literacy was considered basic investing knowledge. Financial Education 101 emerged when it became apparent to many employers and benefits administrators that too many employees were having trouble making the fundamental investing decisions needed to choose investments over a 20- or 30-year time horizon to meet income expectations during retirement.

The new definition of financial wellness is more expansive. It includes an emphasis on the financial management of everyday activities for employees and their families. This includes managing the stress of college tuition debt to higher wages, securing affordable health care, and providing a Social Security-type mechanism for retirees. While it may not be evident, this takes financial wellness into the political realm, where economic and political policies are decided outside of the direct sphere of the corporate employee benefits department.

So, how should 401(k) benefits administrators design financial literacy programs? They can take a cue from some companies and municipal governments addressing the causes of employee financial stress. For too long, benefits administrators, like social workers, have only addressed the symptoms of personal financial problems that affect workplace productivity. This needs to change.

New inclusive thinking is long overdue. Employees bring their financial problems to work and take them home. For better or worse, most of the American population is preoccupied with work. It concerns job insecurity, health expenses, wage stagnation, or external political concerns threatening social safety net benefits for themselves and their families.

At one employee benefits industry conference a few years ago, I asked one speaker why the threats to reduce Social Security were never mentioned when discussing benefits. She looked surprised. Then, she said the panelists assumed Social Security would always be there. This is a political assumption, not a financial one.

It is also an example of how myopic some financial wellness programs have become.

To be truly effective, financial wellness programs must become more politically aware, holistic, and community-oriented, and they must advocate for expanded public health and financial consumer protection programs.

This new approach to financial wellness must identify non-workplace sources of financial and emotional stress that hurt productivity, morale, and executive development.

This means addressing predatory financial practices that drive employees into debt, student loan repayment programs, and increasing transparency in financial transactions. It is also the approach that will create significant, pro-employee results in the next generation of financial wellness programs.