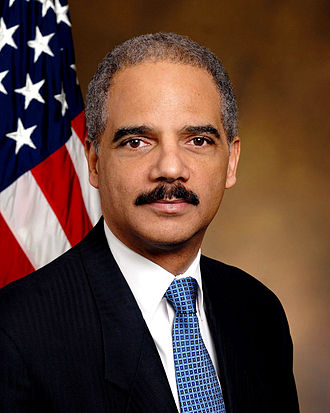

Maybe it was just bad timing, bad politics, bad people or a bad system, but for anyone concerned about law enforcement and the delivery of justice to the afflicted, the administration of U.S. Attorney General Eric

Holder from 2009 to 2015 was a mockery of the law and a great victory for white collar criminals.

In a quiet move, Holder moved back to his former law firm, Covington & Burling, a corporate law firm known for serving Wall Street clients, where he worked from 2001 to 2009, immediately before he became U.S. Attorney General. The law firm was so confident that he was returning that it kept his corner office vacant for his inevitable return, as reported in The Intercept.

In the process, Holder most likely took a pay cut from the $1 million he was probably making at his law firm (my estimate) to the $200,000 salary he received from taxpayers as U.S. Attorney General.

But while Holder took a temporary pay cut, millions of Americans took permanent pay cuts in the form of lost jobs and trillions in lost home equity, job insecurity, and personal stress that happened as a result of the systemic mortgage fraud conducted by some of his law firm’s clients: Bank of America, Citigroup, JPMorgan Chase and Wells Fargo, Wells Fargo. Holder certainly knew his law firm’s client roster by heart and the dangers they faced all at the same time taxpayers were being victimized and too few elected officials in Congress pushed him to prosecute the bank and insurance company perpetrators.

But Holder had another more self-serving, business-friendly policy. “In a 1999 memo entitled ‘Bringing Criminal Charges Against Corporations,’ written when he was deputy U.S. attorney general, Eric Holder argued that government officials could take into account “collateral consequences” when prosecuting corporate crimes.”

We all know there are “collateral consequences” when any individual is prosecuted for their crimes. But when a major bank gets prosecuted, it seems Holder proposed that regulation (aka, enforcing the law) would cause some cascading ill-effects that were too difficult and painful to calculate for the Justice Department and for the American public.

This is certainly a weak-kneed argument coming from the nation’s senior law enforcement official, especially when widespread mortgage fraud was definitely cited as being the primary cause for the greatest financial failure since the Great Depression. But Holder ran for the moral, ethical and intellectual sidelines. This resulted in Holder’s sad policy of “too-big-to prosecute,” which dovetailed with the U.S. Treasury Department’s “too-big-to-fail” bank bailout policy. This was the long-awaited “get-out-of jail-free card,” which is expected among white-collar criminals, especially those with exceptional political connections.

And just to keep up appearances, Holder told the Senate Judiciary Committee on March 6, 2013 that “some of these [financial] institutions have become too large. It has an inhibiting impact on our ability to bring resolutions that I think would be more appropriate.”

The “too-big-to-do-anything-about” arguments all combined to ensure the continued victimization of the American public by financial institutions and their wealth destruction as Holder and former U.S. Treasury Department Secretary Tim Geithner were slumming in their highly-compensated positions (as least as far as middle-class wage standards are concerned), while being confident they both had even more lucrative jobs waiting for them as they emerged from their self-serving jobs in the Obama Administration.

In essence, both men were serving as inside agents advancing the interests of their former employers under the cover of working as public officials. These are well-known occurrences and academics call this development “regulatory capture.” This process happens when corporations take over the regulatory agency which supervises their industry and it is a common element of contemporary American political-economics. Unfortunately, regulatory capture is so ingrained into the political system that nothing changed under the Obama administration.

So it was no surprise that to keep up appearances over the public clamor for criminal prosecutions of mortgage fraud perpetrators, Holder produced some numbers about prosecutions of white-collar financial criminals. The problem was that these numbers were grossly overstated.

“The inspector general also reviewed a highly publicized October 2012 incident in which the department and Attorney General Eric Holder vastly overstated the success of an enforcement effort involving total losses first estimated at $1 billion. The actual loss involved in the fraud scheme was about $95 million and the number of criminal defendants charged as part of the initiative was 107, not 530 as originally reported by Justice officials.”

NO FREE GOVERNMENT CAN SURVIVE THAT IS NOT BASED ON THE SUPREMACY OF THE LAW WHERE LAW ENDS TYRANNY BEGINS. LAW ALONE CAN GIVE US FREEDOM.

– T. Hartley Alexander, Inscription, Pennsylvania Avenue, above Second Story located in the Robert F. Kennedy Department of Justice Building

So while Holder is back in his corner office earning at least $1 million, millions of Americans have seen the failure of the U.S. justice system and the U.S. banking system. Since no top-level bank executives were prosecuted, it just proved to the public that white-collar crimes pay handsomely. That is why Holder’s law firm is currently defending Citigroup over a civil lawsuit relating to the bank’s role in the trillion-dollar London Inter-Bank Offering Rate (Libor) price manipulation, as reported in the The Intercept.

So just to get the picture straight, Holder takes a temporary leave of absence from a powerhouse law and lobbying firm to become U.S. Attorney General, at the same time he continues to unofficially represent his law firm’s clients, after he swore an oath to represent the American people as the nation’s most senior law enforcement official.

So does anyone wonder why the American public is cynical about Washington and Wall Street?

POSTSCRIPT: The French have a saying that “The more it changes, the more it’s the same thing,” (plus ça change, plus c’est la même chose), so Holder’s successor as U.S. Attorney General is Loretta Lynch, the first Afro-American woman to hold the post. Lynch’s resume shows she has a lesser corporate career path than Holder, but a Salon story found that Lynch had “a strange detour in her legal career – serving as a director of the New York Federal Reserve Board from 2003 to 2005. Here she worked with people like former Citigroup chairman Sandy Weill, ex-Lehman Brothers CEO Richard Fuld and ex-Blackstone chairman Pete Peterson.”

All of that makes for a small world.