If you are one of the 116 million individual investors in the U.S. who own a mutual fund, you might want to re-evaluate your buy-and-hold strategy. The reason is that it may have a significant downside.

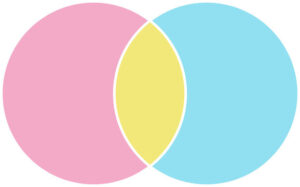

This downside is called “overlap” or “drift,” and it works against you when your fund gets too big and unsuccessful. While that may not sound like bad news, it can be expensive and risky as your fund drifts away from its stated investment objectives and overlaps with other funds or ETF holdings.

So how can you prevent this problem?

Drift happens when mutual funds deviate from their names and prospectuses and stray from their stated investing mandate over time. For instance, growth funds start buying value stocks, or large-cap funds start holding cash or investing in NASDAQ companies. So when a portfolio manager starts to go their way, it can take your well-planned diversification strategy into a new direction you never intended to go.

How Overlap Happens

There are three ways overlap can happen:

- Style drift. If you invest in a growth stock with a capital-gains orientation and an equity income fund to achieve capital gains, both funds could easily own many of the same stocks.

- Capitalization changes. Over time, a company’s capitalization can increase from small to mid-cap. This growth alters your desired small-cap exposure.

- Investment product overlap. By definition, ETFs are indexes comprised of different weightings in underlying stocks. When ETFs are combined with mutual funds, investors may find they hold many of the same stocks despite the other products.

While these changes occur slowly, they create problems. First, you have no control over the process. Plus, if you are paying a financial professional to make asset allocation decisions, their results will be hindered by undetected portfolio overlap.

So, with all this downside potential, how can you prevent your portfolio’s diversification plans from going astray?

Why Overlap Happens

Since investing is a social activity, fund managers often follow the same thought processes, share the same research, and get caught in national moods, which can focus their attention on a limited number of stocks. This is human.

Another complicating factor is that huge multinational conglomerates often defy simple descriptions since they are involved in many different businesses and appeal to managers for various reasons. That helps explain why a company like Microsoft (MSFT) would be a top holding in a technology, Internet, large-cap, wireless, or global mutual fund.

Small-cap managers often face a simple problem as companies grow over time. By definition, some small-cap managers should sell those stocks as they push past the fund’s stated capitalization limits, but many managers violate their own rules. Instead, they will rationalize their holding since it is something they have held for years.

The problem with owning too few stocks is that you are not diversified. This problem cuts both ways: In the event of a market decline, you do not have enough stocks, which may cushion your landing. On the upside, holding too few stocks reduces your chance of making a broad-based gain.

Style drift can be problematic for investors concerned about having specific fund investment-style percentages within certain asset classes. For instance, if your target diversification for small-cap funds is 10% and your small-cap fund grows into the mid-cap category, your fund diversification will fall below 10%.

So, how should investors check whether their portfolios are diversified?

Checking for Mutual Fund Overlap

The best way to check for overlap is to find the top 10 holdings in your mutual funds and compare them against each other. You can find those holdings in the mutual fund’s quarterly reports. However, that is a time-consuming process.

Then, there is the less detectable process of drift. For an individual, “this is next to impossible to detect,” according to Lawrence Balter, president of Oracle Investment Research. That’s because an individual may not often know what constitutes a small- versus a mid- or large-cap stock. Individuals also cannot differentiate between the price-earnings and price-to-book ratios, which determine the valuation characteristics of a value or growth stock.

However, for more intrepid investors, some web alternatives can easily make quarterly comparisons of specific holdings. The first comes from the SEC’s own EDGAR database http://www.sec.gov/edgar/searchedgar/webusers.htm

While navigating this database may take practice, investors can view or download a specific fund by entering the fund name, trading symbol, or special Central Index Key (CIK) number unique to the EDGAR system. With this CIK, you can isolate a specific fund and see its most recent filings, including its most recent individual holdings. These holdings (listed by sector, number of shares, and most recent market value) are in SEC Form N-Q.

Morningstar.com also offers premium premium members an overlap detection program in its Portfolio X-Ray feature.