The recent announcement that a New York federal judge has approved T Mobile US Inc.’s takeover of Sprint Corp. means there will be a fundamental change in the U.S. wireless market. It also can mean an end to competitive pricing that benefits average consumers.

The Wall Street Journal said the new merger will “test whether three giants (Sprint, T-Mobile, ATT) will compete as aggressively for cellphone users as four unequal players once did.”

The judge’s 173-page decision essentially ignored expert testimony from economists, engineers, consumer advocates, and academics from both sides. He ruled in favor of the merger in the hope that the new combined company would benefit consumers.

But others were not so confident. “While the court may think it unlikely for a newly entrenched trio of enormous wireless carriers to collude rather than compete,” Matt Wood, general counsel at the media reform group Free Press, said in a statement, “the history of broken and abandoned merger promises from these companies — to say nothing of the mountains of evidence and expert analysis in this trial — say otherwise.”

More Problems for Capitalism

Wood referred to corporations that merge and then falsely claim they will compete. This is a fallacy. Antitrust is effectively dead thanks to neoliberal, conservative policies that say there is no such thing as a monopoly and that market forces would correct any pricing and anti-competitive practices. Both of these are wrong. Both fail to recognize the problems with capitalism.

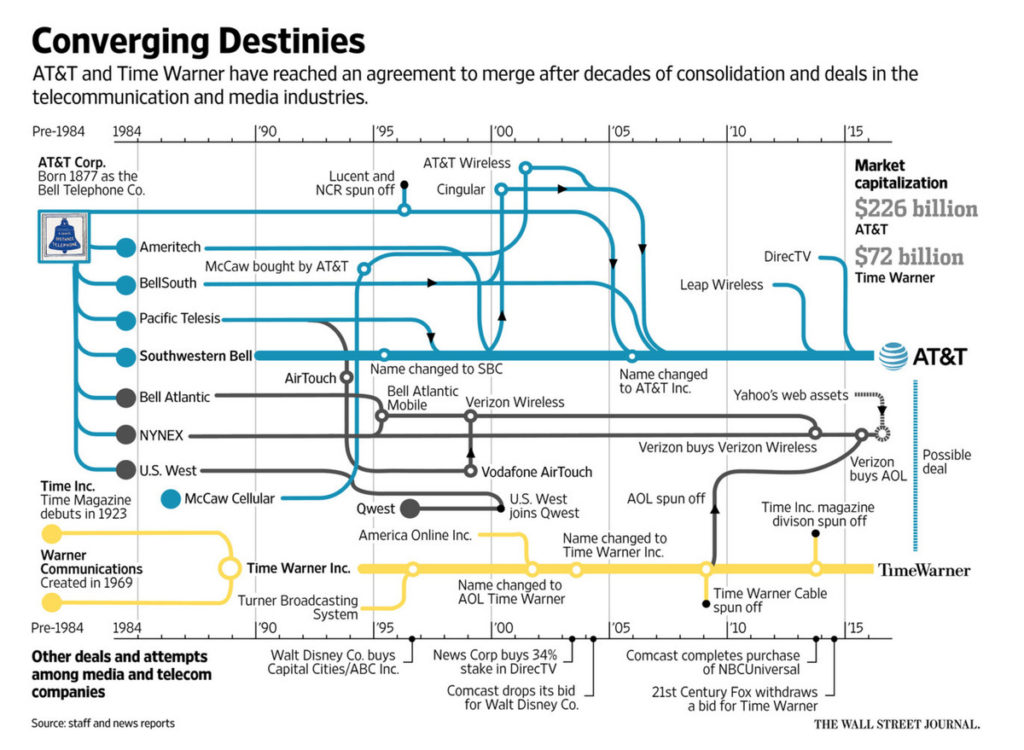

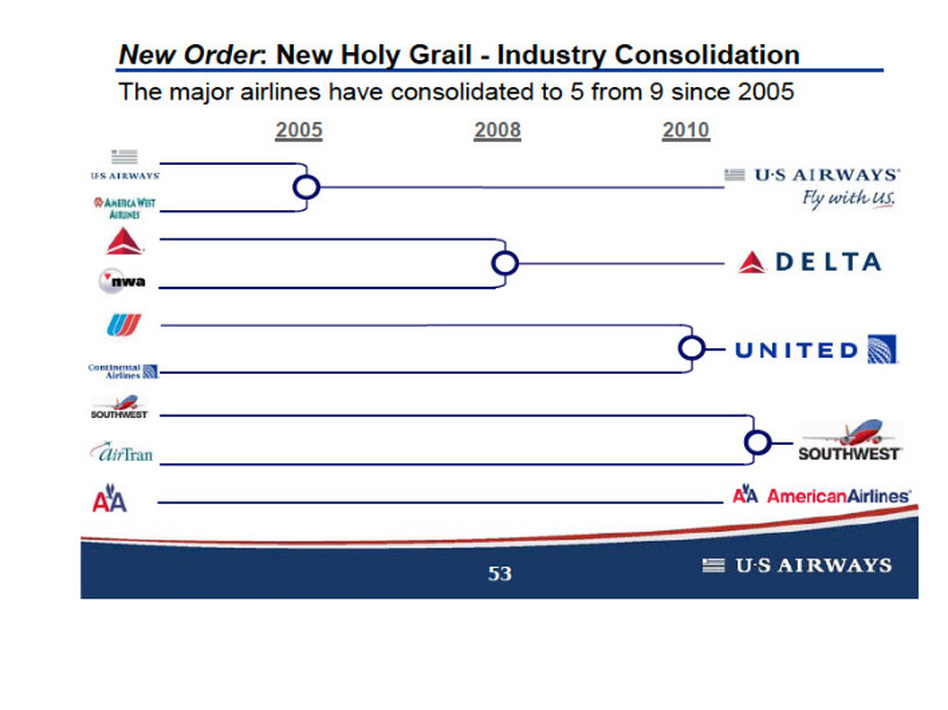

As evidenced by some of the largest mergers in recent years–Chevron buying Texaco; Oracle buying PeopleSoft (which had already purchased J. D. Edwards); NationsBank merging with Bank of America); Pfizer’s purchase of Wyeth, a giant corporation in significant industries, has led to higher prices, more enormous bailouts, and failures in bad economic times. Do you think that “too big to fail” came out of nowhere? No. They came from mergers in the airline, financial, and banking industries. Higher drug prices? That is mainly attributable to larger drug companies that hold more patents under one corporate umbrella. Tax breaks for hedge funds and corporations?

The failure to enforce anti-trust laws has occurred for decades under both Republican and Democratic administrations. This is no surprise since giant corporations routinely make huge contributions to both parties. Whether the cash goes to Peter or Paul, the outcome is the same: No enforcement of anti-trust laws from the weak and increasingly politicized US Justice Department.

Under the Trump administration, the US Justice Department is essentially an external corporate and criminal defense law office for its most significant contributors.

Anti-trust is Another Problem With Capitalism

However, it would be a mistake to think that the failure to enforce antitrust laws occurs in political and economic isolation.

The system is rigged by unregulated capitalism. This is old news. It is why corporations and financial institutions, among other businesses, hate regulation.

Regulation means accountability. Corporations do not want to be accountable, so they fight to be regulated. It’s simple once you realize that corporations make greater profits when they are unregulated, do not have unions, will not pay fines for pollution, and hold back pay raises so they can buy back more of their stock.

Today, we see late-stage capitalism and capitalism that is in trouble. It is called monopoly capitalism, and this economic perspective explains the links between big finance, corporate ideology, and political power. This explains why we are seeing big mergers that continue unabetted. More corporate concentration is an unjust but inevitable result of unregulated capitalism.

As a result, corporations are becoming more monopolistic in the current pay-to-play political system. More giant corporations beget large lobbying forces and more political power at the expense of average citizens.

The net result is that consumers in a capitalist society have less power. They can see the difference in their pocketbooks, the declining quality of their elected officials, and their quality of life. Change will only come from the bottom up, and that means an energized citizen movement to regulate capitalism with new leaders who understand today’s very compromised system. People need to recognize that capitalism is in trouble.

This article was originally published on Feb. 11, 2020

[…] aerospace, and specialty industries, such as private prisons. These are all beneficiaries of monopoly capitalism and the privatization wave that swept Europe and the US in the […]

[…] Source: theprogressiveinvestor.org […]