The US Supreme Court ruled on Jan. 24, 2022, that investors can sue employers and managers if they charge excessive mutual fund management fees.

In the 8-0 decision in the case, Hughes v. Northwestern University, the conservative-leaning Supreme Court found that “401(k) plan participants could continue to take legal action against employers for including high-fee, high-risk investments in their 401(k) lineup, even if they also included lower-fee, lower-risk options,” according to a story by Mathew Cunningham-Cook in The Daily Poster.

The ruling applies to 401(k) plans, but not pension plans. The ruling again points out the importance of investment fees and expenses embedded in 401(k) plans that are often not fully disclosed to participants. As noted for years, some pro-investor professionals have said that fees are critical in determining an average 401(k) participant’s net portfolio return.

The article said that the median 401(k) balance for Americans 65 and older is only $64,548, however, amount could be as much as 40% higher, if it wasn’t for fees paid to Wall Street investment managers and 401(k) administrators.

Mutual Fund Fees Are Critical

As noted in my book, How 401(k) Fees Destroy Wealth and What Investors Can Do To Protect Themselves, 401(k) participants pay over $164 million in fees on a daily basis to the financial services industry. These fees, plus an old arrangement called revenue sharing between employers and investment firms, cost investors over $10 billion annually. (See the press release here.)

All of these fees come at the expense of individual 401(k) participants, and they all ultimately affect the dollar amount in their individual retirement accounts. Worse, many employers don’t police these numerous fees, so they violate the fiduciary role that exists between employers and their workers to protect these financial assets.

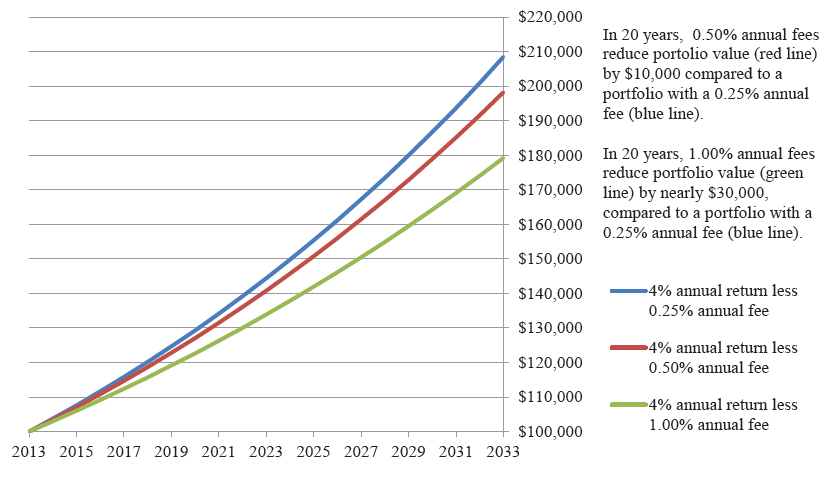

Studies have shown that high fees can reduce the value of a $100,000 401(k) portfolio by as much as $30,000 over 20 years.

Some Financial Industry Groups Oppose Lower Fees

As they have done historically, an array of investment management lobbying groups and managers filed briefs in support of the defendant, Northwestern University. These groups included the Committee on Investment of Employee Benefit Assets; the American Benefits Council; TIAA-CREF, a major manager of 401(k) plans; and, the Investment Company Institute, the mutual fund company trade association whose members profit from 401(k) fees.

As they have in the past, many investment industry lobbying groups openly oppose regulations that would favor individual investors.

In the Supreme Court decision, Judge Sonya Sotomayor wrote that “in Tibble, this Court interpreted ERISA’s duty of prudence in light of the common law of trusts and determined that ‘a fiduciary normally has a continuing duty of some kind to monitor investments and remove imprudent ones.’” The keywords here are “continuing duty” and “removing imprudent (more expensive) ones.”

Commenting on the rare-pro-investor ruling, Chris Tobe, a financial analyst who works with lawyers seeking accountability from 401(k) plans, said the Supreme Court’s 8-0 decision “shows that even conservative people in 401(k) plans don’t think that they should pay excessive fees.”

How Investors Can Protect Themselves

Individual investors can protect their investment portfolio by doing the following:

- Invest only in the lowest cost mutual funds and exchange-traded funds (ETFs). If a fund has a lower cost but is not have the highest return over time, pick the lower-cost fund. Lower fees over time convert into a higher net return.

- Buy funds from low-cost managers, such as Vanguard. Vanguard is a co-op company, so it passes along lower costs to its investors.

- Chose managers that follow the fiduciary standard. Many companies violate the fiduciary standard when it comes to disclosing executive salaries, as well as for investment firms that work to bury fees and make them as opaque as possible.

- Buy ETFs that have lower fees, but provide the same or better investment sector coverage than mutual funds.

- If you see that your employer is not offering lower-cost mutual funds in your 401(k) plan, contact the company’s HR Department. If they don’t act, contact a securities lawyer.

- To see how employers work against the interests of their own employees in their 401(k) retirement accounts, see this video from PBS.