This article was updated on Jan. 25, 2022.

Unethical investment websites have intentionally hyped crypto and SPAC scams to naive investors in exchange for ad money and it is creating unprecedented bubbles, market volatility, and big losses for naive investors.

Thanks to click-bait business models, financial journalism has entered a new phase of Google-inspired Yellow Journalism. Today, more financial websites are blatantly pursuing advertising dollars by promoting SPACs, crypto scams, and IPOs to unsophisticated retail investors who they know will suffer large financial losses.

The growing trend of unethical financial journalism, combined with online brokerages that offer “free” stock trades, is the driving force pushing novice retail investors with little or no investing experience into new instruments that are masterfully managed by professional traders, pump-and-dump operators, and investment banks.

In the process, unsophisticated retail investors, many of whom have never heard of a balanced stock-bond portfolio, are being lured in IPOs and SPACs with the express or implied message that they can make a lot of money quickly.

Unfortunately, we all know that’s not true.

Greedy Financial Websites and Editors Behind the Crypto Hype

During the week of Jan. 17, 2022, Bitcoin declined from November 2021 and has wiped out more than $600 billion in market value. Over $1 trillion has been lost from the aggregate crypto market. This could rank as one of the largest pump-and-dump scams ever as wealthy investors dumped the hype currency that has zero investment fundamentals.

To power this misleading message, some second-tier financial websites (websites that don’t produce original reporting, equity, or strategy research) have assembled teams of contributor-editors-writers dedicated to tracing new crypto hype, IPOs, or SPAC news as soon as they appear on the EDGAR database, NASDAQ or NYSE websites.

How powerful is this combination of social media-free stock trading crowd behavior?

Let’s take the case of Robinhood, one of the largest online stock trading company abusers. Robinhood has hyped day-trading as a viable activity, despite its pathetic history of losses for non-professionals. History will show that Robinhood stole from the poor and gave to the rich, a total perversion of the original legend.

According to the “RH Top 100 Fund,” a weighted index of the most traded stocks among Robinhood’s users, “the hivemind-like behavior and frictionless access to free trades may have been day-trader’s biggest pitfall in 2021. Robinhood’s users struck gold at the beginning of last year, peaking at a 102% increase, blowing every other major index out of the water. Yet, throughout the rest of 2021, the “RH Top 100 Fund” took significant dips, eventually ending the year at -55.3%,” Richard Smith, author of the Risk Rituals Newsletter, said.

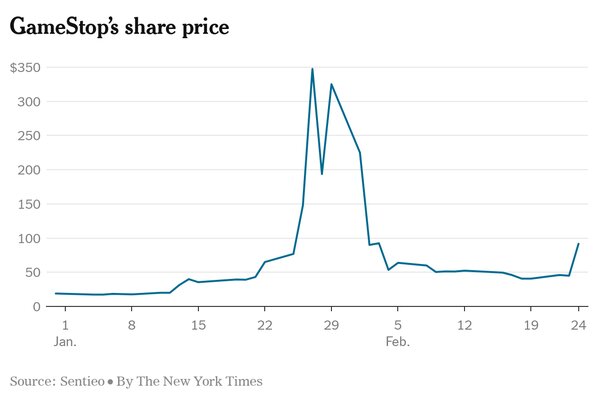

As part of the race to get the new SPAC or IPO information posted, these same sites have failed to post any forms of disclosures about how SAPCs of IPOs work in the short- or long terms. Worse, they all knowingly fuel the frenzy to chase ad clicks. How else do you explain this price chard for GameStop.

Nor, do the unethical sites mention that these types of glittery and highly-touted investments are highly speculative, volatile, and can suffer serious and fast price declines. It’s true, some of these sites mention that they are being compensated when readers visit a brokerage firm’s website, but these disclosures fail to mention the high-risk nature of these investments.

Some of these sites also fail to mention that long-term, passive investing strategies using stock-bond portfolios should be the core of any legitimate financial planning strategy. When I mentioned this to one second-tier website editor, he told me they would be adding those types of stories later.

What’s driving this foray by financial websites into unethical Yellow Journalism is advertising, or more specifically the ad clicks these sites generate when unsophisticated investors read the basic story about the new potential companies and how they plan to shake up the established world.

Then, investors click on a brokerage firm’s name and the website generates ad revenue. In one case, one second-tier site is making about $25,000 a month by pushing SPAC and IPO stories without any caveats about how they work or explaining the long-term investment history of SPACS and IPOs.

SPACs Benefit Hedge Funds and Inside Owners, Not Public Investors

Many financial reporters I spoke with who have over 30 years of experience covering markets have never heard of SPACs until recently. Many had to look up the definition since IPOs were the accepted method of going public and SPACs, a sub-set of IPOs, were rarely used.

For people who know about Robin Hood, hedge funds, GameStop, Reddit, the gamification of investing, and payment for order flow, SPACs were just another esoteric, hard-to-explain investment vehicle.

But what they have in common with the entire GameStop- RobinHood saga is hedge funds. Because of their role, position, and priority in the IPO process, hedge funds take a risk-free profit from SPACs before a dollar in public money is invested in the new company.

This is why Jeremy Grantham, the co-founder and chief investment  strategist of Boston’s Grantham Mayo Van Otterloo, said SPACs are “a complete rip-off because the hedge funds take the premium for themselves.”

strategist of Boston’s Grantham Mayo Van Otterloo, said SPACs are “a complete rip-off because the hedge funds take the premium for themselves.”

When the SPAC goes public, the risk is added back into the pricing, and supply-and-demand, hype, information, and misinformation all get traction and all the risk is now assumed by less-sophisticated retail investors. The prices gyrate until they find an equilibrium, however temporary, and then the game of musical chairs starts again.

A SPAC is a Special Purpose Acquisition Company, a shell that is created for the specific purpose of merging with some private company to take that company public more quickly than could have been the case with a normal initial public offering (IPO) process.

In 2020, there were 480 IPOs (including 248 SPACs) compared to the 406 IPOs listed in 2000.

The year 2020 could be marked as when the SPAC phenomenon became a retail frenzy. Financial websites covered this as a get-rich-quick story, with little or no mention about how SPACs work, their potential downside, and who is getting the lion’s share of the risk-free profits.

For their part, some unethical financial websites didn’t find this a problem. The reason is that the ad clicks began to payoff instantly. This meant that writing a story of the mechanics of SPACs could wait until later, or better yet, not be written at all.

In the interim, the SPAC and IPO frenzies dominate the news as they generate ad clicks as more retail investors piled into the scrum.

So How Bad are SPACs?

In a Jan. 22, 2021 interview with Bloomberg, Grantham, called SPACs a “completely reprehensible instrument.” Grantham has a similar reputation in the industry as Warren Buffett, so his declaration that SPACS should be “a completely illegitimate instrument” carries some weight.

In the Bloomberg interview, Grantham said “SPACs should be a completely illegitimate instrument.

“They are just an excuse for people with reputation and marginal ethics to raise a lot of money and take 20% of it for themselves and then to take a quick dash around the country for six months and are a complete rip off in the sense that the professional hedge funds then always liquidate before taking any real risk and take the premium they can get and the few warrants and leave the half of the marketplace that retains it who put their money up with, on aggregate, a very bad return, and of course, they’ll make some money in the late stages of the bubble.

“But if you look at the first six years, they have a handsomely sub-average return for taking all the risk. They don’t have enough legal requirements and enough restraints, enough checking.”

The Role of Yellow Financial Journalism in Crypto Hype

The fuel to the fire and the Pied Piper leading many investors to IPOs and SPACs are a few profitable financial websites that are driven primarily by ad dollars. When an editor at one site was asked why there were no educational articles on SPACs, how they work, and their investment performance a few months after their listing, he said that article could come later.

In the interim, he was focused on researching new, more effective Google words and phrases, so the site’s SPAC stories could get a higher Google ranking and more clicks. This is modern financial web journalism now being practiced by some unethical websites.

So, when investors complain about being led to the slaughter as IPO and SPAC investments lose money, they should remember which financial websites gave them the “hot tips” in the first place.

[…] firms that offer SPACs. (For more on the SPAC scam for retail investors, see the comments in a story on this site by Jeremy Grantham who said that “SPACs should be a completely illegitimate […]

[…] the SPAC frenzy is also fueled by two new factors: online brokerage firms that cater to day traders and fast-money […]