[sgmb id=”2″]

Vanguard, the industry’s biggest proponent of lowering fees and expense rations for its mutual funds and ETFs, continues to remain far ahead of the industry by announcing that it has reduced fees again.

In a May 26, 2016 release, Vanguard said:

“Vanguard investors saved $71 million as a result of lower expense ratios reported for more than 70 share classes offered by a variety of Vanguard mutual funds, including the world’s largest bond fund and two largest stock funds. That number increases to $77 million when adding in 14 Vanguard Variable Annuity Fund portfolios that also announced reductions.”

In a very straight-up communication, Vanguard CEO Bill McNabb said: ““It’s a virtuous circle; investors continue to entrust us with their assets and we continue to pass along savings in the form of lower fees, while at the same time investing to improve the quality and breadth of our services.”

Simple enough. So where does the rest of the industry stand when it comes to discussing fees and expenses?

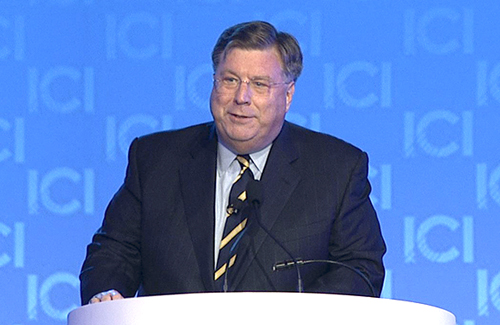

The answer is that the fund industry’s response has been pathetic. Even the mutual fund’s industry lobbying group in Washington, the Investment Company Institute (ICI), led by its president Paul Schott Stevens (annual salary: $1.797 million), is working to water down the fiduciary standard. Even worse, the ICI is totally funded by shareholder money.

When I worked for Principal Financial and Russell Investments, fees were never discussed unless the few sentences that mentioned it were sent to the corporate attorneys and an outside counsel. Fees were something that were never discussed, especially if the investment company also maintained a national network of wholesalers (internal and external) that were very expensive to maintain and added to shareholder expenses and never contributed one penny to total fund performance. Just the opposite.

So the bottom line is that investors should consider transferring to another fund company that does not visibly address the issue of fees and fund expenses. The industry will always argue that the fees are necessary because they give you great service and active management, but this is an old cannard. The service is basic and the funds are more automated today than they were a decade ago, so those fund administrative expenses should have fallen dramatically.

So the bottom line is that investors should consider transferring to another fund company that does not visibly address the issue of fees and fund expenses. The industry will always argue that the fees are necessary because they give you great service and active management, but this is an old cannard. The service is basic and the funds are more automated today than they were a decade ago, so those fund administrative expenses should have fallen dramatically.

Investors should also re-visit the idea of active management versus index funds that deliver lower costs.

The reason is that the only thing an individual investor can control is fee, expenses and how much you save. Everything else you hear about in the financial media–the price of oil, Brexit, corporate buy-outs, CEO changes–are all totally unpredictable and outside of your control, yet they impact your bottom line.

So individual investors should seriously heed Vanguard’s public announcement and then ask their own fund companies “When was the last time the fees were lowered on my mutual fund, even as it grew in assets under management?”

If you get a flimsy answer, I’d close the account and move to a low-cost fund or ETF provider. It’s your money and most fund companies can only be relied up to take more of your money in the form of fees and expenses. The fund industry has been bamboozeling the public for years about how they are able to divine the future and deliver exceptional market performance. The studies are emphatic that this does not happen with active management.

As for where the overall fund industry stands on the issues of fees and expenses, they are silent. Instead, they are spending millions of dollars trying to repeal the fiduciary standard, which clearly is in the best interests of average investors.

So when your financial advisor says the mutual fund industry is working diligently on the behalf of investors, think again. Then, look for another advisor.