Want to increase your 401(k) ‘s returns by up to 28%?

Here’s a simple way to do it:

Don’t focus on fund selection or the asset mix; look at the most mundane, boring statistic in investing: fees.

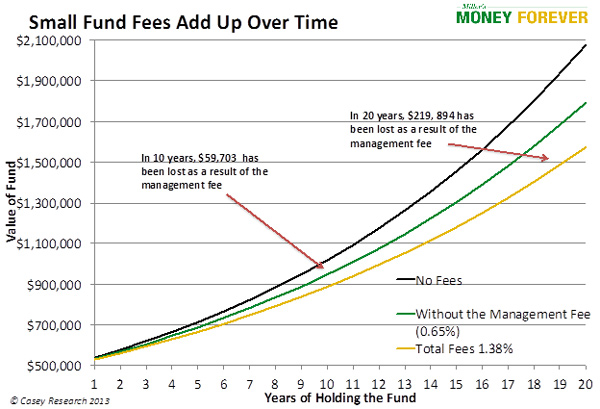

Fees are off the radar screen for most 401(k) plan participants and, sadly, even their 401(k) plan administrators. However, in today’s higher-risk, low-return environment, one of the very few things an investor can control is fees.

Here is some of the simple arithmetic from the U.S. Department of Labor that drives home the importance of fees in a 401(k) plan:

“Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. Suppose returns on investments in your account over the next 35 years average 7%, and fees and expenses reduce your average returns by 0.5%. In that case, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. However, if fees and expenses are 1.5%, your account balance will grow to only $163,000.

In this example, the return is reduced by a staggering 28%. To make matters worse, investors do not receive anything aside from a four-page quarterly newsletter from paying all those fees after 35 years.

While administering 401(k) plans certainly costs money, this example shows room for improvement for plan administrators to reduce expenses.

This DOL example also assumes a 7% return over 35 years. While that may be close to the historic equity return norm, the 7% return is open to question given the prolonged global recession and real estate crash. If the return is lower, your retirement lump sum drops significantly. But again, the investment return is outside of an investor’s control.

Fees and Expenses Can Be Controlled

However, the most important variable you can control is fees, and even that is essentially the responsibility of your employer, who may or may not be acting in your best interests.

One of the few decision options open to employee investors in 401(k) plans is to firmly ask your plan administrator for a detailed breakdown of the plan’s costs.

Since the DOL example dramatically points out what can happen to an investor’s money over 35 years, it is imperative to get answers demonstrating that the corporate 401(k) plan administrator works on behalf of the plan’s employees, not 401(k) plan providers.

Savvy investors know that the risk of loss is more important than posting investment returns. Reducing expenses, which directly reduces total investment returns, can quickly reduce this risk.

Another great reason is even more straightforward: It’s your money. Don’t let anyone else do it if you don’t watch it.