One of the biggest problems facing the mutual fund industry’s relationships with its millions of shareholders is justifying fund wholesalers’ salaries.

This is a contentious and sticky issue for a few reasons:

First, mutual fund wholesalers really don’t add anything that directly benefits shareholders, especially their net portfolio returns.

Second, maintaining a national wholesaler network in the COVID world is more expensive than ever.

Third, Robo-advisors and better technology make the door-to-door mutual fund wholesaler job a relic of the horse-and-buggy age.

In theory, they should be reducing overall fund expense ratios by increasing the asset base of mutual funds. They should also be reducing the overall costs of administering 401(k) plans.

This would then lower the overall expense ratio for all shareholders. That was the original theory and rationale behind allowing 12b-1 fees to be charged in the first place about 30 years ago.

But since then, fund wholesalers have been selling funds, receiving huge salaries, having all of their expenses paid by the fund companies, and(in many cases)receiving commissions based on revenue sharing deals with registered reps.

Salaries That Cannot Be Justified

The problem today is how to justify these huge salaries when they do not directly benefit shareholders.

It’s a dilemma that has not been publicly discussed before and that is surprising due to the abundance of financial journalists and financial media outlets, which are supposedly working to educate investors about the optimum ways to invest.

Yet almost everyone agrees that the best way to increase overall fund returns is to invest in funds with low expenses. Since that is the case, how can so many funds justify these large salaries without decreasing their expense ratios?

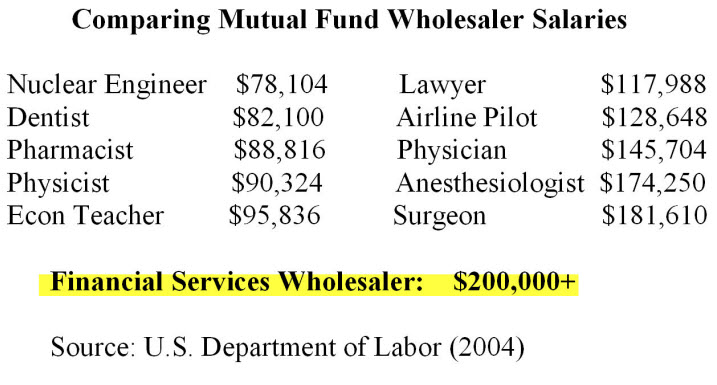

So with that as a brief background, this salary chart (which comes from U.S. Department of Labor statistics and Kassina) shows the salaries of various professions, many of which provide specific, tangible societal benefits.

Since the late 1990s, mutual fund asset growth has declined significantly from the record levels seen during the mid- to late-1990s. Yet according to Kassina, a mutual fund consulting group, wholesaler compensation has not declined despite the downturn in the industry and the significant layoffs.

Data from Kassina shows external wholesalers typically receive an average annual base salary from $65,000 to $98,000, with an average of $83,000. Total target compensation can range broadly from $225,000 for an average-performing wholesaler to over $500,000 annually for top performers.

This puts mutual fund wholesalers at the top of the compensation list, based on government and fund industry statistics.

What Benefits Do Wholesalers Provide Shareholders?

Now, the mutual fund industry’s largest funds should justify why, and how much, mutual fund wholesaler salaries benefit their own shareholders.

Ideally, this should be shown using correlations between wholesaler salaries and a specific fund company’s decrease in its total expense ratio over time. If such a correlation exists, it would make a great marketing message and allow some fund marketing exec to differentiate their fund.

This would be a historic revelation.

It also would be especially welcome now since the fund industry is so openly antagonistic and has vehemently lobbied against all issues related to fiduciary responsibility, transparency, fee reduction, and any modicum of financial reform.

But this again raises the simple question: What benefits do fund wholesalers deliver directly to their fund companies’ individual shareholders to justify their large salaries?

It’s a simple question that deserves a simple answer.

The real question is… How do we justify the absurdly low wages of laborers and the huge disparity in earnings of all employed?

If this author’s pet peeve happens to be a person that earns a good living for having fun, then, please, join in that career & abandon your jealousy.

If you truly are concerned about justifying earnings, investigate the basis of all corporate executive compensation, that might prove to be a whole lot more fruitful investigation.

Since its inception, this site has covered wage disparities and stagnant real income that began in the Reagan Administration. The role of mutual fund wholesalers is that are among the most highly paid people in the fund industry, but they do not contribute one cent to the net return of investors. There are many reasons wages are so low, such as productivity has not kept pace with wages; Republicans consistently vote against a higher minimum wage; there is rampant job security and more automation; the decline in union memberships; changes in demographics; outsourcing; and a corporate mentality which diverts investment into stock buybacks and executive compensation rather than expanding the workforce.

Chuck,

Thank you for bringing attention to those of us leaving our families every week to help distribution for mutual companies both big and small. You raise a very important question, what value do consultants offer? I don’t have enough characters available to help you understand the value we bring to the table. The piece I will address is cost. There are many great funds available in the marketplace that we may never know about because they lack a distribution team. The cost to run those funds can be very high due to size and trading costs.

One of many value-adds a consultant brings to a fund is increasing the AUM. Many funds are able to lower their management expense as the AUM increases. If you’re not a Blackrock, Capital Group, Janus Henderson, etc. it’s very hard to grow assets without a distribution team. The marketing budget for those companies is more than he annual revenue for smaller mutual fund companies.

Not only are we increasing AUM, we are helping financial advisors educate their clients. We free up time for advisors to spend more time planning with their clients. You cannot put a price tag on the value of a great consultant.

If you’d like t join our industry I have a couple slots open in the West. Want to give it a shot? It’s not that easy.

Justin Terman

VP, Sales (over paid wholesaler)

Comments are closed.