It looks like the gang at the RobinHood brokerage firm are declaring they have started a revolution for young people who “don’t have access to generational wealth or the resources that come with it to begin investing in the U.S. stock market.”

That’s a pretty bold statement since more firms than ever offer commission-free trading and access to more investment instruments than RobinHood offers.

Still, suppose RobinHood wants to be in the vanguard of declaring war on hedge funds and other “elitists,” such as the 91-year-old investment guru Charles Munger, the legendary partner of investor Warren Buffett. In that case, they may as well go all the way and push for a higher minimum wage and closing all tax loopholes that benefit America’s top corporations, especially hedge funds, private and real estate developers.

Robinhood’s selective myopia about these related inequities should be part of their overall message about enabling disenfranchised Americans into the stock market.

But if RobinHood was honest, they would be educating their clients about dull stuff, such as the benefits of a diversified stock and bond portfolio, accompanied by the miracle of compound interests that only takes flight over decades rather than days.

They also would point out that chasing IPOs and SPACs on opening day is another form of gambling. SPACs are bad news for retail investors, but you would never learn that from the unethical financial web sits that make big ad dollars from directing unsophisticated investors to brokerage firms that offer SPACs. (For more on the SPAC scam for retail investors, see the comments in a story on this site by Jeremy Grantham who said that “SPACs should be a completely illegitimate instrument.”)

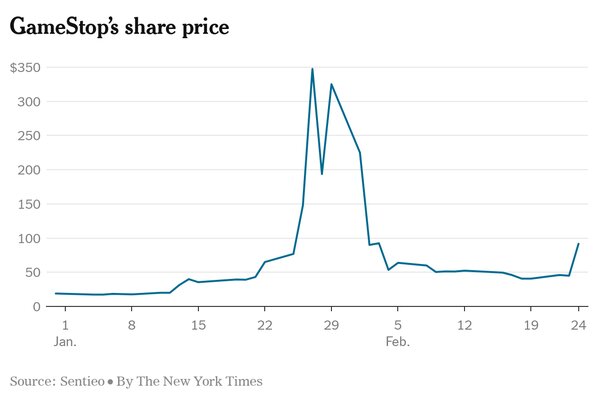

Then, RobinHood should explain the chart below to its clients.

Is this a chart of a company with long-term growth potential, or is it a first-grade drawing of a mountain in the Alps? Well, the chart is GameStop, and it’s a pathetic example of technical analysis. There are no head-and-shoulders or ascending triangle formations here. Only a rocket launch that never went into orbit.

And that dovetails with the rebuttal comments by the GameStock spokesperson Jacqueline Ortiz-Ramsay to Munger’s observation that RobinHood’s “new investors have a ‘mindset of racetrack bettors.’”

While Ortiz-Ramsay said Munger’s comments were” disappointing and elitist,” she forgets that Munger and Buffett are two of the most politically liberal people in the financial world. They have been proving that over the past 50 years by advocating for closing tax loopholes and pushing for a higher tax on the wealthy. Their Berkshire Hathaway meetings have made the financial news and been attended by thousands annually for decades.

RobinHood can make some great claims about what they are doing, but they are not leading any revolution in the investing world or elsewhere. Commission-free trading is excellent, but the firm is very limited in its product offering. It does not offer mutual funds and bonds, and only taxable investment accounts are available, so there is no way to save for retirement.

You can build diversified portfolios using ETFs for stocks and bonds. Still, the firm doesn’t even address retirement, so maybe the key is for their clients is to get-rich-very quickly by linking up with rumor-generating message boards or targeting hedge funds. But, alas, that’s not a recipe for financial success.

If RobinHood wants to wave the flag of a financial revolution, they should focus on three key things:

- Pushing for legislation to revoke the carried interest tax loophole that allows hedge, private equity, and real estate developers to stay in the black by not paying their fair share of taxes.

- Educating clients about the benefits of a diversified stock and bond portfolio and partnering with a firm that offers the full range of retirement accounts.

- Push for a raise in the minimum wage to $16, so their clients, many of whom are probably gig workers (aka marginally employed), will have the more disposable income to pay their bills and invest.

This would mean RobinHood needs to take a political position and stop being on the defensive. Their current message is weak. They are not leading the lumpen-proletariat into the stock market. Those avenues exist already.

It’s also a stretch when Ortiz-Ramsay says “it should be celebrated that we are seeing market investors begin to diversify, and that education and awareness about the values of investing are diffusing further into previously untapped generations.”

It’s not clear what they are “diversifying” into and that the younger generation was unaware of investing. Simply stated, they don’t have the money.

That’s why it’s time to raise the minimum wage, and even then, younger people will have very uncertain and unstable future job prospects. They will work and be laid off more than their parents. This means they will have considerable gaps in their payments into Social Security and 401(k) plans (even if they are offered), so they will receive less in retirement benefits in the years ahead.

Robin Hood was a rebel bandit in English folklore who legend says took from the King’s property and the rich and distributed the loot to the poor. His enemy was the Sheriff of Nottingham, who is not connected to the SEC. The legend also says Robin “treated women, the poor, and people of humble status with courtesy.”

Lightening up on the name similarities, the RobinHood firm can benefit its clients by broadening out if a political-investment appeal by adding the points listed above. That would make a difference in their clients’ lives over the long term.

[…] Here are the options: Personal Capital, Betterment, SoFi Invest (formerly SoFi Wealth), Ellevest, RobinHood, Wealthsimple, SigFig, TD Ameritrade Essential Portfolios, and Vanguard Personal Advisor […]