Risk is an inherent part of any investment.

Since there is always the possibility an investment will decline in value, investors must identify the risks that can degrade returns and then develop a plan to minimize the effects of risk on their overall portfolio.

The key to controlling risk and portfolio volatility is asset allocation.

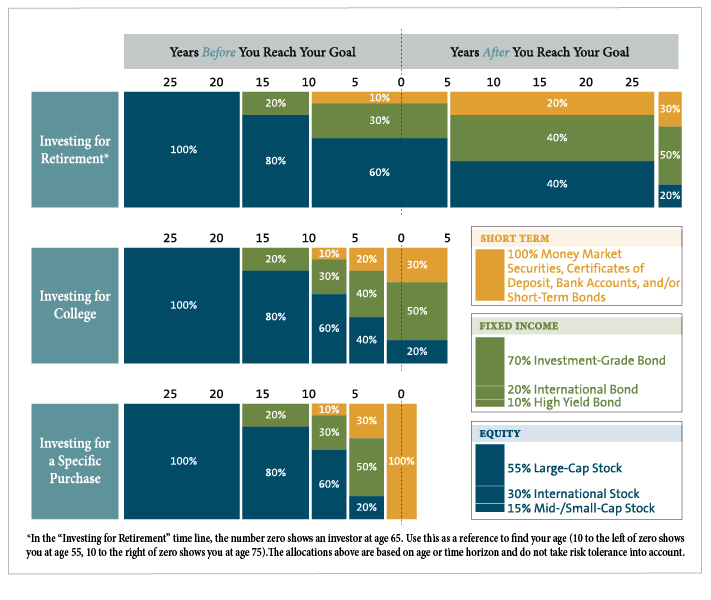

Asset allocation is a critical investment decision that can help you become wealthy but also help you keep your money by reducing risk. Based on your time frame, needs, and risk tolerance, portfolio allocations are made by dividing your money between assets, such as stocks, bonds, commodities, and real estate.

This allocation process is critically important because one expert predicted that no matter what investment you pick, during your lifetime, any investment will fall in price by 50% to 70%. For instance, in two recessions in the 1990s, each downturn caused a 50% stock market decline.

Risk, or the variability of achieving a specific investment return, relies on various factors, such as those related to one particular investment and the overall economy.

Economic risk comes from such factors as news about inflation, industrial production, Fed monetary policy, employment, consumer sentiment, and international events.

All of these factors influence the stock and bond markets in different ways. By diversifying across asset classes, you can reduce investment risks affecting the variability of returns. Investors who diversify but limit themselves to a single type of asset class, such as small-cap stocks, assume more risk than those who invest across different asset classes. It’s also important to note that cryptocurrencies are not an asset class and have no functional role in diversification.

Since behavioral finance has found that most people fear losses more than gains, investors should divide their investments into more secure ones or potentially deliver more significant growth accompanied by higher risk. This includes stocks and bonds but, surprisingly, not real estate. That’s because home prices (adjusted for inflation) have not increased for about 100 years, except in market bubbles. The caveat is that homes deliver tax advantages and, potentially, rental income.

Modern Portfolio Theory and Risk

Risk management today has its origins in Modern Portfolio Theory (MPT). This Theory traces its roots to a paper written in 1952 by Harry Markowitz, who used statistical techniques to describe the efficient frontier concept. It is considered so important that the paper earned him the Nobel Prize in Economics nearly four decades later.

In his short paper, as well as in other works, Markowitz proposed that the overall risk in any investment portfolio can be identified and managed by examining the risk relationships between combinations of investments. The risk could be spread, or diversified by looking at these relationships throughout the portfolio.

In short, he proved that rather than looking at the risk of each asset, he showed that a diversified portfolio is less volatile than the total sum of its parts. The entire portfolio’s volatility can be low, even though each asset might be pretty volatile and riskier.

This was a landmark concept. By the early 1960s, Markowitz’s ideas were largely credited as the basis for MPT. An essential part of this Theory is that risk can be managed through diversification and that a better risk-adjusted performing portfolio can be built using combinations of different assets.

One landmark study by Roger Ibbotson and Rex Sinquefield found that asset allocation policy is so vital that it determines more than 90% of a portfolio’s performance variability over time. (Copies of these important academic investment papers are contained in the book, The Handbook of Corporate Earnings Analysis.)

Implementing a Diversification Plan

Portfolio diversification is achieved in numerous ways:

- Within an asset class, such as bonds (that include long-term, medium-term, government, municipal, and junk) and stocks (that include internal, large, small, and medium cap, dividend-paying, and international), and

- Between asset classes, such as a portfolio comprised of bonds, equities, ETFs, options, real estate, and precious metals, and;

- By using different strategies or exposures involving mutual funds and ETFs.

Identifying Risk

Thanks to MPT, several different ETFs and mutual funds today can deliver a diversified portfolio of investments, usually within a single asset class in a single fund and in a single purchase.

While Markowitz’s idea of MPT is over 50 years old, his Theory of linking risk to return has helped create an entire industry devoted to risk management. For investors, this has made it possible to quantify a portfolio’s risk level, so investors should expect to get a higher return if they assume more risk. That simple idea has re-shaped investing.

Asset allocation should be considered a risk-growth proposition. This is because no asset class appreciates continuously, and since markets run in cycles, it’s possible to lose all gains without adjusting the portfolio.

Asset allocation is done by investing in the seven main asset classes–stocks (including ETFs), high-yield bonds, real estate, commodities, currencies, collectibles, and structured notes–across markets and in different time frames. Many experts, such as John Bogle, the founder of Vanguard Funds, said the easiest way to get diversification is by investing in low-cost index funds, which provide a tax advantage and broad equity exposure. That same strategy can be used via ETFs.

Building a Portfolio That Mirrors Your Risk Level

Each investor has to know their risk level before considering what type of portfolio to own or build. The basic rule of thumb is that risk levels depend on age and comfort level. Younger investors can take more risks because they will live longer and have more time in the market. If younger people suffer a loss, they will have more time to recoup the decline.

Older investors do not have the luxury of time, plus they may be soon exiting out of the workforce. This means they must preserve their investment principal since any losses will take longer to recover. Time is not on the side of older investors in this situation.

So, with that in mind, here are some basic outlines of different risk-level portfolios for investors to consider.

What is a Conservative Portfolio?

The purpose of a conservative portfolio is to preserve capital and minimize the risk of loss. In this example, portfolios are over-weighted with fixed-income instruments (including tax-free bonds) and money market funds, supplemented by large-cap stocks. Conservative portfolios do not suffer the same price fluctuations as portfolios with riskier assets. Investors with a short-term time horizon who want to preserve capital, are retired, or are approaching retirement often choose conservative portfolios.

What Is a Moderately Conservative Portfolio?

This portfolio is designed to generate income through dividends and bond coupon payments while preserving capital. It can also include Treasury Insured Protection Notes (TIPs) that provide inflation protection.

What Is a Moderately Aggressive Portfolio?

Also known as a “balanced portfolio” with a near-equal mix of stocks and bonds, this portfolio is commonly known as the 60%-40% portfolio and has a mix between growth stocks and income-producing bonds and cash. It is best suited for investors with moderate risk tolerance and a longer (more significant than five-year) time horizon.

What Is an Aggressive Portfolio?

To achieve more significant growth and capital appreciation, this portfolio has greater exposure to equities, especially small-cap and international equities with higher risk exposures. This portfolio is better suited to younger investors early in their careers and can withstand any short-term losses that can be rebuilt over time.

What Is a Very Aggressive Portfolio?

This portfolio is for investors with the most prolonged time before retirement and more incredible risk appetites. It includes the highest percentage of equities and more volatile instruments, such as leveraged instruments, and exposure to more exotic asset classes via ETFs with exposure to emerging markets, small-cap stocks, and international bonds. The goal here is to generate the highest possible capital appreciation over time. It is best suited for people with solid risk tolerances who can accept the risk of losing some of their money.

Managing Risk in a Fixed Income Portfolio

Fixed-income portions of portfolios are subject to different market situations which affect prices. In a rising interest rate environment, investors in bond funds of all maturities will see their principal decrease while their yields remain at their current low historical levels. For instance, 30-year bonds may yield about 4.3%, but investors have to assume more risk to get that yield. If investors want bond yields in the 6% to 7% range, bondholders should shorten their maturities to three months.

While bonds are less volatile than stocks, the push into bonds is not risk-free. In the past, fixed-income investors should recognize that a bond fund’s total return is attributable to capital appreciation and yield. But today, yields on the 30-year bond range are around 4%. This has made capital appreciation the main engine for propelling bond funds higher in price.

However, betting on appreciation carries risks related to capital losses versus the current yield. Individual investors often pursue under-valued assets, or higher-risk assets, such as high-yield bond funds, to generate income. However, the problem is that bond funds sell bonds as they reach maturity and replace them with similar bonds that will mature later. The better choice is for investors to buy individual bonds, not bond funds, and hold them to maturity when they return their face dollar amount.

However, since many individual investors do not buy individual bonds, they should diversify across the fixed-income investment category to include high-yield, corporate, municipal, and international bond funds. This type of exposure is available in mutual funds (Franklin Total Return Fund and the JP Morgan Income Fund) and ETFs (Vanguard Total Bond Market ETF (BND) and the Invesco Total Return Bond ETF).