Wary of the high volatility in equities and low returns from CDs and money market funds, investors have been moving into bonds in search of stable returns accompanied by more price stability.

Investing in bonds during high equity volatility is an understandable investment strategy. In addition to portfolio diversification, bonds have their own risk and return characteristics that can come into favor during specific periods of market cycles or in response to changing interest rates and economic uncertainty.

For these reasons, knowing the basics of investing in bonds, especially selecting the right mix of corporate, municipal, and international bonds, can complement any diversified portfolio and help anyone planning retirement. This is why knowing the key factors affecting bond selection is essential. These include credit ratings, bond time frames (duration), and whether buying a bond fund, ETFs, or individual bonds is best.

Bonds are loans issued by a lender to a borrower. The lender, or bond issuer, can be the U.S. government, state, federal agency, corporation, municipality, or foreign nation. Bond issuers agree to pay purchasers a rate of interest throughout the loan and the principal (the face value of the bond) at the bond’s maturity date. What makes bonds attractive is that they pay interest on a regular schedule, often semi-annually, and are used for capital preservation since bond defaults are rare.

Bonds come in many forms and qualities and are issued for different time frames. US Treasury bonds, for example, are commonly issued from one to 30 years. The price of a bond is determined by its interest rate, yield, maturity, redemption features, default history, credit ratings, tax status, and market factors. Each of these critical features has specifics that allow bond investors to conduct detailed research to make more informed decisions about which bonds or bond funds and ETFs are most appropriate for their portfolio.

Interest rates are considered the most crucial variable. They can be fixed, floating, or payable at maturity. A bond’s return, or yield, is determined by its interest rate and price.

There are two main types of yields: current yield and yield to maturity. The current yield is how much the bond will return in a year based on its price and interest rate. This calculation is made by dividing its interest payment by the price. Yield to maturity is the sum of all the interest payments you receive until the bond matures. In some instances, bonds are quoted as a yield to call. This is almost the same calculation as yield to maturity, but since the issuer calls the bond before the maturity date, the amount of interest received will be diminished.

Bond prices fluctuate due to supply and demand forces and changes to the issuer’s credit rating, such as changes in interest rates.

Bonds are very mathematical, and each variable can be calculated precisely. However, market factors affecting bond prices, such as changes in inflation, robust job reports, and increases in housing starts, are difficult to predict and often push bond prices lower since they may foreshadow interest rate increases.

Buying Bond Funds and ETFs

Most investors buy bond funds or ETFs rather than individual bonds. This makes it easier to gain broad exposure and, in some cases, professional management to the fixed-income segment that meets investor needs.

The largest of these categories includes corporate and U.S. Treasury bond funds. According to the Investment Company Institute, bond mutual funds (comprised of Treasuries, corporates, and municipals) saw net inflows through most of the past decade, partly due to the aging population. The ICI said that investors also bought funds with exposure to investment-grade corporate bonds, government bonds, and multisector bond mutual funds.

Bond ETFs have also proven very popular, as the 30-year Treasury bond yield fell to an all-time low of 1.9% in August 2019. This decline pushed prices higher, accompanied by investors seeking the safety of US Treasuries. As a result, bond ETFs had their best year ever in 2019, according to FactSet. This also included international bond ETFs that invest in the national debt of countries outside the U.S. In some of these ETFs, the price moves are hedged against currency fluctuations to protect price declines that can impact U.S. investors.

The industry has developed multisector bond portfolios for those who want the broadest bond exposure in a single fund. These portfolios aim to generate income by diversifying assets among several fixed-income sectors, often U.S. government obligations, U.S. corporate bonds, non-U.S. bonds, and high-yield U.S. debt securities.

Some funds have a broader mandate and can delve into more esoteric fixed-income investments, such as corporate debt securities of U.S. and non-U.S. issuers, including convertible securities, corporate commercial paper, inflation-indexed bonds issued by corporations, structured notes, including hybrid or “indexed” securities and event-linked bonds.

Risk-Returns in Dividend Funds

The risk-return in dividend funds has also shifted because the two main engines contributing to total fund appreciation—dividend yield and capital appreciation—have undergone historic shifts. The S&P 500’s dividend yield is currently at S&P 500 Dividend Yield, which is at 1.35% compared to the long-term average of 1.84. For instance, when the dividend yield was near 2%. So, investors should recognize that it carries significantly more risk if a blue-chip stock posts an attractive yield comparable to its 10-year bond.

Managing Interest Rate and Inflation Risk

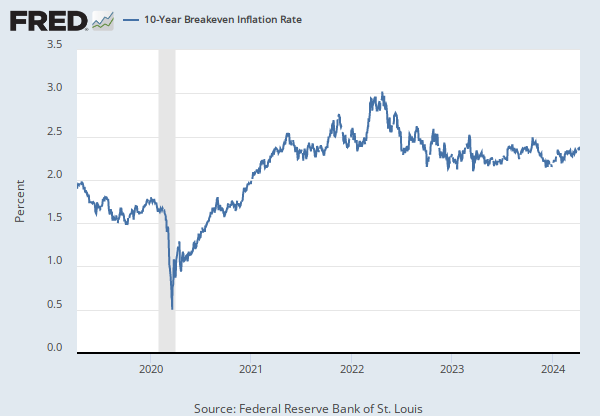

Bond prices move inversely to interest rates. Inflation causes interest rates to rise, which decreases the value of existing bonds.

While bonds are negatively affected by rising interest rates, Treasury Inflation-Protected Securities (TIPS) offer some protection. The US Government guarantees these bonds. TIPS prices can increase in value as inflation rises or decrease in deflationary periods. Their principal value changes in response to inflation, while their yield is calculated by subtracting the inflation rate from the Treasury bond yield.

Since TIPS has a 10-year time horizon, investors buy them when they think inflation will increase. However, if you believe inflation will not rise above 1.75%, you should purchase nominal T-bonds, not TIPS. These bonds can be crucial to retirees with fixed incomes whose buying power can be eroded by inflation.

While record sums have been invested in bond funds, this big push is not risk-free. In the current environment, fixed-income investors should recognize that bond fund total returns over the past decade were attributable to capital appreciation and yield. But today, yields are at historic lows for the 10-year Treasury bonds and corporates. This has made capital appreciation the main engine for propelling bond funds higher in price.

To generate income, individual investors have been hunting for undervalued or higher-risk assets, such as high-yield bond funds. The problem is that these funds sell bonds as they get close to maturity and replace them with similar bonds that will mature later. According to some financial experts, the better choice is for investors to buy individual bonds, not bond funds, and hold them to maturity when they return their face dollar amount.

In a falling interest rate environment, investors in bond funds of all maturities will see their principal increase while their yields remain at their current low historical levels. For instance, 30-year bonds are now yielding about 0.66% (as of June 2020), but investors have to assume more risk to get that yield. A few years ago, yields were in the 6% to 7% range, but the risk was comparable to today’s. The bottom line is that investors assume more risk to get the same yields.

Holding Bonds Is Not Risk-Free

However, owning bonds is not risk-free. Fixed-income investors should recognize that a bond fund’s total return is often attributable to capital appreciation and yield. When yields are at historic lows, capital appreciation has become the main engine for propelling bond funds higher in price.

But betting on appreciation carries enormous risks. In an article, “The Great American Bond Bubble,” Wharton Business School finance professor Jeremy Siegel and Jeremy Schwartz, director of research at WisdomTree Investments, said, “The possibility of substantial capital losses on bonds looms large. If, over the next year, 10-year interest rates rise, bondholders will suffer a capital loss equal to the current yield.” Today, with rates around 4.4%, the capital loss can be greater than the current yield.

However, since many individual investors do not buy individual bonds, they should diversify across the fixed-income investment category to include high-yield, corporate, municipal, and international bond funds.

In the short term, many government bond funds have negative yields because management fees are eroding them. In these situations, investors may be better off in a money market fund yielding 0% or 0.05%. This is a dilemma for investors who do not have many choices at either end of the maturity spectrum.

Yet for those who have reduced their equity exposure in favor of U.S. Treasuries, consider this: Over the long term, Government bond returns have delivered an average return adjusted for inflation of around 4%. To generate significant income at these rates, an investor must invest multi-millions of dollars in U.S. Treasuries.

Bonds Belong in Every Portfolio

Bonds come in many maturities, qualities, risk levels, prices, and types of issuers. Government bonds can provide capital preservation, regular income, stability, and tax benefits. Bond funds and ETFs offer packages of bond exposures in a single investment that can provide portfolio diversification and a higher level of professional investment management than if you managed a bond portfolio yourself. When added to any portfolio, bonds can offer more diversification into investments with very different characteristics than equities. As a result, investors should take the time to learn how bonds can supplement any portfolio in the short- and long term.