“The business model of Wall Street is fraud.” Or, to put it another way, “The business model of Wall Street is conflict-of-interests.”

By far, the most pointed statement made so far in the 2016 presidential campaign (at least, as far as the financial services industry is concerned) has been the single sentence by Democratic Candidate Bernie Sanders that “The business model of Wall Street is fraud.”

This statement would receive wide agreement from Tea Party, Progressives and many voters in the middle who have just watched (after all, that is all we can do) as the 2007 mortgage-fraud produced a recession that wiped out over $16 trillion in household wealth*, destroyed thousands of jobs and created a lost decade of wealth creation for millions of average Americans.

Yet even though elected officials and appointed regulators at the state and federal levels knew who the perpetrators were, nothing happened. No one in executive authority at the perpetrating institutions and firms was ever charged, went to court or jail for their fraud. This is the open wound that festers for millions of homeowner, voters and investors whose sense of basic justice has been perverted.

The best and most viable explanation for this injustice is that the hundreds of millions in lobbying money paid over decades to elected officials at the state and federal levels, accompanied by getting cronies appointed to regulatory bodies, has corrupted the system in favor of the monied institutions.

Yet to placate the outrage, the system finds that major institutions can just write huge checks that act as “Get-out-of-jail free” cards by paying billions in fines without publicly agreeing that they did anything wrong. This allows them to continue to do business as usual. Worse, executives of the major institutions that created, participated and benefited from the fraud have never shown any remorse or desire to change their corporate cultures.

As a result, Sanders succinct soundbite, which has been repeated in scores of books and articles in some form, is that “The business model of Wall Street is fraud.”

This statement makes headlines and should create turmoil in the financial services industry, but the industry has been strangely silent. There has been no public rebuttal or defense from Wall Street. This is because the industry has been working in the shadows by spending millions through its PACs and lobbying firms to defeat Mr. Sanders. It also faces a public relations nightmare because a presidential candidate has basically said that the engine which runs the capitalists financial system is corrupt. No presidential candidate has ever said this.

Even worse, Wall Street’s nightmare scenario is the Mr. Sanders will pick Senator Elizabeth Warren (D-Mass.) as his running mate. If this happens, Wall Street will face its greatest reform Armageddon since the SEC was formed in 1934.

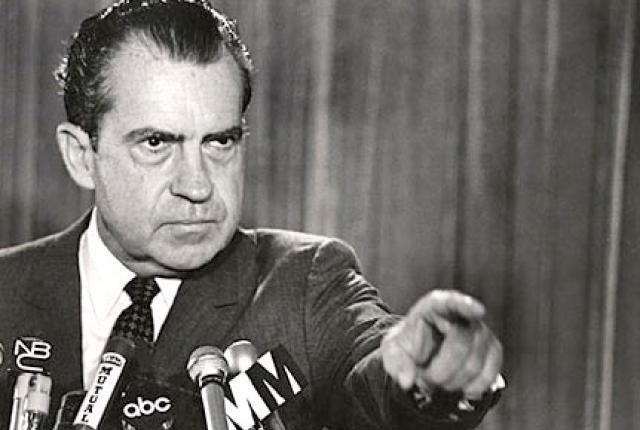

Yet even if some intrepid Wall Street executive wanted to mount a defense, they would be put on the defensive since the historical evidence is overwhelming that something went terribly wrong in their blind pursuit of profit-at-any-cost. The best defense they could offer is something akin to Richard Nixon’s pathetic statement, made in November 1973 as the Watergate investigation unfolded, that “I am not a crook.”

But even Nixon (who resigned in 1974 as a result of the Watergate break-in and cover-up) was more authentic from the people who created and personally gained from the recent 2008 massive fraud. The reason is that the second part of Nixon’s famous statement was: “Well, I’m not a crook. I’ve earned everything I’ve got.”

Earning What You Get

By definition, the people on Wall Street who made money from the fraud, did not earn everything they got. Those billions in profits were the fruits of ill-gotten-gains, which is legalese for the money derived from a crime. In this case, the systemic top-down and bottom up mortgage fraud that involved realtors, appraisers, rating agencies, derivatives traders, executives and salespeople, who were aided and abetted by sleepy regulators and high-ranking officials at the Fed, SEC, Treasury and securities regulators and attorney generals in every state in the union. Any one of these people had the jurisdiction to bring charges for fraud against citizens in their states or nationwide. Very few, if any, did.

So Mr. Sanders’ succinct statement is correct. If we expand the definition of “fraud” to include incomplete disclosure, the use of intentionally misleading statement to mislead investors, the use of under-the-table revenue sharing and 12b-1 payments to incent financial reps to push one look-alike mutual fund over another, and many other deceptive practices, we have a business model which is inherently based on selling products based on conflicts-of-interest.’

Addressing the Conflicts-of-Interest Inside of Financial Firms

There are hundreds of thousands of honest, financial salespeople who genuinely have the best interests of their clients as their prime concern. Yet, their good works are too often twisted at the corporate level when large financial firms make lobbying contributions that are intended to promote the (for lack of a better term) fraudulent business model.

What is needed is a movement by the thousands of financial salespeople in the insurance and investment industries to put their clients’ interests before the need to push proprietary products.

This means there is a conflict-of-interest inside of every financial institution, which makes it mandatory to continue that conflict-of-interest relationship with unsuspecting clients. This conflict-of-interest is between management (which makes the lobbying contributions that are then used against clients’ interests) and the well-meaning employee-salespeople, who genuinely are concerned about the best interests of their clients.

As it is today, the only recourse well-meaning salespeople have is to leave, go independent and become a RIA. To date, I have not heard of one major, old-line financial firm that has changed its business model by embracing the fiduciary standard, transparency and abandoning the sale of ill-suited proprietary products over better-suited, cheaper ones.

This is essentially what Mr. Sanders’ incisive soundbite is all about. Strangely, the hundreds of public relations professionals on Wall Street, including the ones at the major investment banks who make about $200,000 annually, have not even responded. Their silence is deafening. Maybe this is a sign that Mr. Sanders is correct.

# # #

*U.S. household wealth fell by about $16.4 trillion of net worth from its peak in spring 2007, about six months before the start of the recession, to when things hit bottom in the first quarter of 2009, according to figures from the Federal Reserve. (CNN Money, June 2011)