The progressiveinvestor.org is the successor site of mutualfundreform.com, created in 2011.

The mission of both sites remains the same: helping individual investors, firms, funds, and RIAs grow and protect their money, while also pursuing a progressive financial agenda.

Progressive political beliefs have to be implemented in the financial industry.

This is because there is a strong link between money and politics. And since the financial sector has the most contact with the investing public, it has primarily evaded regulatory and political pressures to reform.

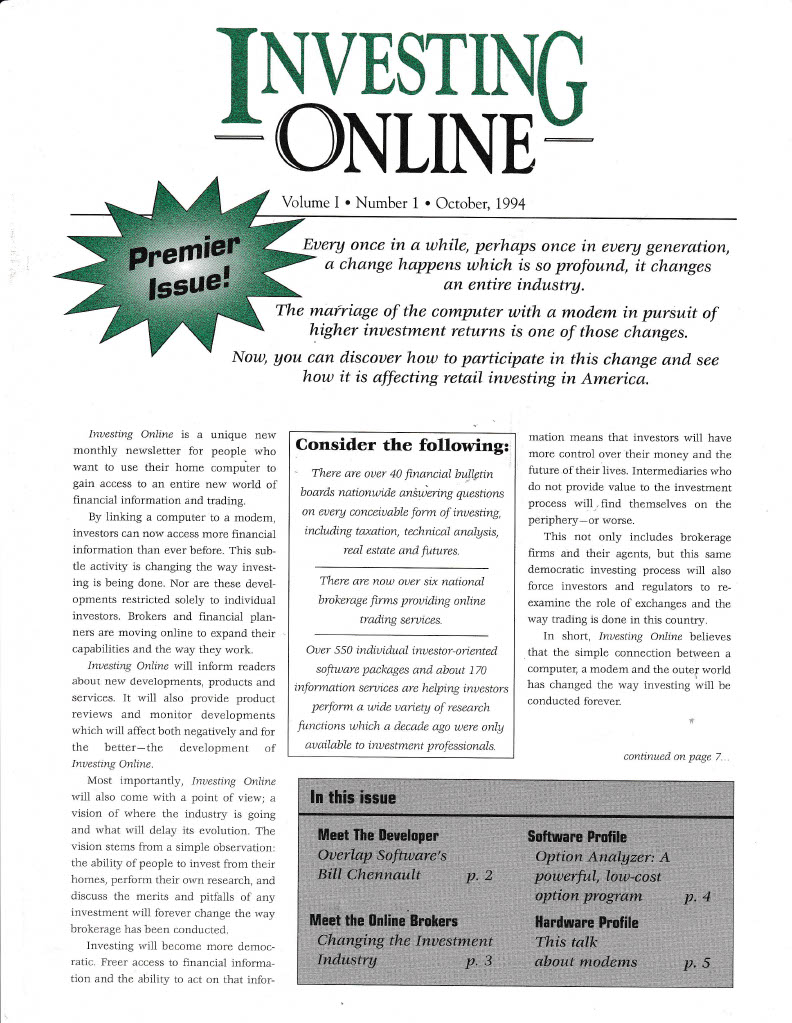

This situation has existed for decades. This is why I started the Investing Online newsletter in October 1994. This was the first newsletter to link the home computer and individual investors to retail brokerage firms for trading and portfolio management.

Today, the $3 trillion investment industry (funds, ETFs) plays a critical role in determining the financial well-being of millions of Americans. But the investment industry has become a quasi-government. It rejects regulation, works with a corrupt administration, engages in money laundering, and works with international criminals, as long as they have the assets and can pay the fees.

Today, the $3 trillion investment industry (funds, ETFs) plays a critical role in determining the financial well-being of millions of Americans. But the investment industry has become a quasi-government. It rejects regulation, works with a corrupt administration, engages in money laundering, and works with international criminals, as long as they have the assets and can pay the fees.

In the past, this select corruption among the largest financial institutions endangered Americans’ financial security. Today, it affects the type of government Americans will have: democracy or fascism. Unfortunately, the nation’s largest financial firms, including private equity, hedge funds, and real estate developers, capitalize on loopholes, secrecy, and work against the interests of Americans.

A Progressive Financial Agenda Matters to Investors

Progressives recognize that the financial sector is overdue for change. The surrect system seeks to evade regulation and accountability and serves as a vehicle for economic benefits that are unavailable to individuals.

For individual investors, this site believes that if the investment industry is forced to change, then democratic institutions will also change. Educated investors must become politically astute to see the link between political corruption and elected officials, regulators, and the global financial institutions that manage, trade, and transfer funds globally.

When Investing Online was founded in 1994, the emphasis was on finding mutual funds that charged low fees and commissions. ETFs, and online investing in all investment sectors have opened great opportunities for high returns. However, those returns mean nothing if a corporate monolith governs the nation.

Your comments are welcome at epstein.chuck@gmail.com