We live in the age of the “big lie,” but it would be a mistake to think this mass deception is restricted solely to politics.

It’s now evident in the once-staid world of investing. Today, the world of investing, including federal regulators and the financial media, has caved into social media pressure, faddism, anti-government movements, and “democratized investing” (whatever that is) to create the global bubble and hype surrounding crypto.

Crypto is a $2 trillion global market, and it has created a black hole of hype fueled by some 1,400 crypto companies in the U.S. today. However, while this extraordinary promotion and price volatility mainly go unchallenged, one of this industry’s biggest lies is that crypto is an asset class.

Nothing could be farther from the truth.

Being considered an asset class is based on the academic definition and its application in modern portfolio management.

This will sound nerdy to those hyping cryptos and all of their iterations, including coins named after dogs and fantasylands. Still, an asset class is a legitimate investment category that determines real-life portfolio allocation and risk management decisions.

The people hyping crypto know this. They also know they lack the rigorous data and solid factual foundation to convince investment professionals and informed adults that crypto is an asset class.

Crypto As a Fantasy Investment

So, what is an asset class, and why do crypto propagandists want their fantasy investment categorized as such?

The reason is simple: the key to being included in an institutional and extensive wealth portfolio is to be named an asset class. This category means the asset in question can be considered an element in a diversified portfolio. When this happens, portfolio managers who make the allocation decisions analyze the asset class, its inherent risks, and potential benefits to hold it as a diversifier and risk reduction instrument.

This process also means that the value of the asset class in question can grow dramatically once legitimate portfolio managers decide to include it in their portfolios.

That’s why crypto hypesters float the big lie that crypto is an asset class. Unfortunately, many financial media and some questionable financial professionals buy crypto and use the lame excuse that it is an asset class. Unfortunately, this is one of the biggest lies in the investment world.

What Is an Asset Class?

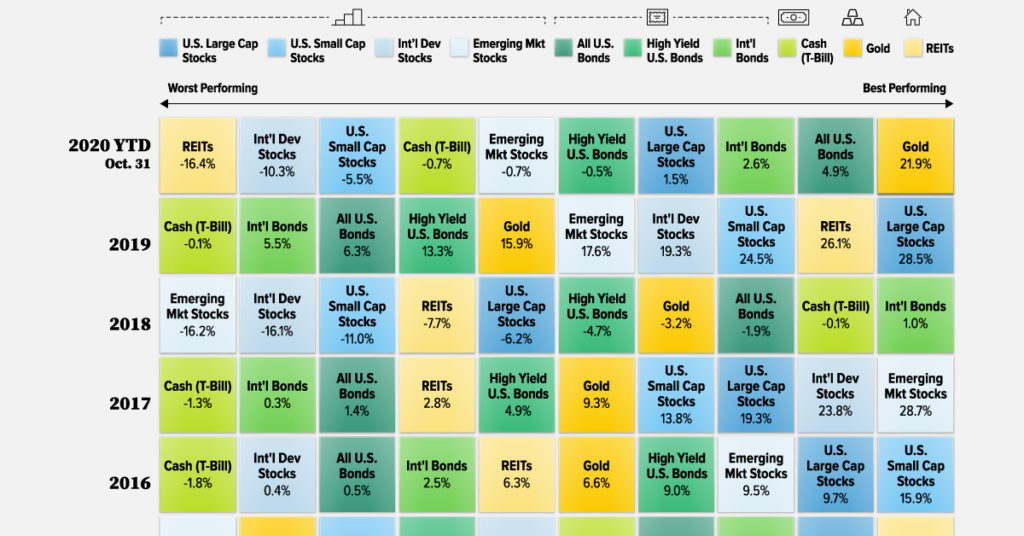

Academic finance has objective criteria to empirically evaluate an asset class based on risk, efficiency, and actual returns over time.

The traditional asset classes are stocks, bonds, Treasury bills, precious metals, and real estate. In addition, academics have included different investment strategies, such as those involving futures, options, private equity, and hedge funds, as vehicles and instruments that offer different and expanded risk management and return characteristics.

This process is used when analyzing any asset class mix in a diversified portfolio. When managed futures were considered an asset class supplement, academics relied on historical data, standardized definitions, and indexes to see what benefits futures made in a diversified portfolio.

As noted in the book I edited, Managed Futures in the Institutional Portfolio, consultant Harry Marmer wrote: “Traditionally, finance academics have analyzed anything that wants to be considered an asset class to analysis using modern portfolio theory techniques. This involves plotting historical prices against an efficient frontier to determine risk returns, often using mean-variance analysis (MVA). MVA is based on the belief that rational investors (which probably does not include many crypto people) choose investments that maximize expected return for a given degree of risk and minimize risk for a given level of return.

Given this rule, academics run an optimization model to determine the efficient frontier. This efficient frontier is plotted as a curve that contains all the portfolios that maximize expected returns at each level of risk. (Risk is measured as the variance or standard deviation of returns.)

But all this is just the starting point. While breathless crypto news reporting is daily, the hypesters have not yet produced a serious, impartial academic paper that approaches this rigorous analysis. Instead, we have celebrities like Matt Damon and Tom Brady hyping crypto.

Even someone named Alexis Ren, who has appeared as a swimsuit model and contestant on Dancing With the Stars, opines that “the economic structure we have been living on is a lie and it’s delusional, and it’s just an agreement, and so we need to find something better, and I think bitcoin and cryptocurrency are that.”

According to Yahoo Finance, Ren continued that “the economic ‘agreement’ (maybe she means hard currencies) that had been in place for a ‘very long time’ needed to be changed for something new and acknowledged that was ‘scary.'”

So, what does Ren suggest? Crypto, of course.

Her observations about the state of global finance can now be added to a young crypto buyer who told CNBC that he bought “a meme coin,” called unisocks, or $SOCKS, a digital token representing a claim on a physical pair of socks.

Sad News for Young Investors

The dangerous part of crypto hype is that 80% of crypto buyers are Gen Z and Millennials. Most people in this age group have little or no knowledge of traditional investing, distrust traditional banks, or claim they don’t have access to these firms.

Interviews with crypto buyers who claim they have some investment knowledge sound as if they never heard of portfolio diversification, the role of fixed income, or even high-beta stocks or precious metals that have more benefits than crypto.

This should not be surprising. Global surveys have found that Americans have very low literacy rates in investing and politics.

According to the 2014 S&P Global Financial Literacy Survey, only 57% of US adults are financially literate, as measured by their knowledge of at least three of the four basic financial concepts assessed by the survey: risk diversification, numeracy, inflation, and compound interest.

An earlier 2008 study by the IMD World Competitiveness Yearbook found that the US ranked 22 out of 55 nations in financial literacy. (Singapore, Finland, and Ireland were in the top three.) A few years ago, 401(k) educators launched “financial wellness” programs to educate participants about investing.

Uninformed investors cannot manage retirement planning, household finances, debt, and credit management and are susceptible to hype and lousy advice. A 2021 study by the Milken Institute said that “financial literacy is critical in the US, where individuals are—to a large extent—solely responsible for ensuring their financial security. Indeed, with Americans having more access than ever to increasingly complex financial products and services, financial literacy is crucial in preventing ill-informed decisions that could have negative long-term consequences on their financial well-being.”

So, who benefits when Americans are uninformed about investing and politics?

That is a loaded question. Entire industries, such as those in payday loans, people who buy Medicare Advantage plans, rent-to-own, used car leasing, and crypto, are based on selling expensive items to uninformed, often lower-income individuals.

Crypto Scams, Tax Evasion, Online Gambling, and Avatars

Finally, while crypto has been around for a decade, the hype machine now in high gear comes at a time when online gambling, Facebook pushing avatar identities, money laundering, online scams, and tax evasion are all reaching new heights.

Crypto is a great way to evade taxes and launder money. It is even better if the user has an avatar, distrusts the government, or, as the swimsuit model cited earlier, who also has an Instagram channel that links exercising and dispensing financial advice, says the hard currency global system is on the verge of collapsing.

This must-have merit is evident in Forbes, Business Insider, Yahoo Finance, and shady websites that survive on ad revenues generated by sending unsuspecting Millennials to brokers selling crypto. These sites hyped SPACs to naïve investors who thought they were getting the “insider” prices on IPOs.

A Bad Mix of Greed and Hype

Today, Millennials day trade crypto and ignore the basic observation that only greed and hype are the driving forces of these anti-government currencies. This must amaze traditionally trained investment people in established firms, who are looking on in amazement at descendants of the mob that fueled the tulip bulb mania in the early 1600s. At its height, people who bought the bulbs were “spending a year’s salary on rare bulbs in hopes of reselling them for a profit.”

So, what should rational investors do?

The Big Lie about crypto is that it is not an asset class. It has the same role in an investment portfolio as a flyer in a high-beta stock, but even that stock has fundamentals to analyze. Instead, crypto has the same role as roulette, except, unlike a crypto buyer, a casino will give a player a free drink.

Kindly delete my previous comment. You mean “asset” in its accounting sense, meaning something with a reasonable expectation of appreciation. Naturally agriculturals don’t qualify, and bitcoin’s biggest problem there is that it’s a snake eating its own tail.