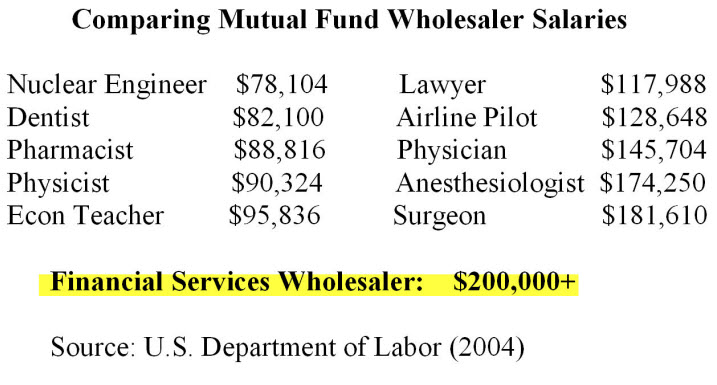

Any experienced financial professional knows mutual fund wholesalers are overpaid. These salaries have been discussed and criticized in my book (How 401(k) Fees Destroy Wealth and What Investors Can Do To Protect Themselves) and on this site as early as Oct. 29, 2011.

Now, U.S. News & World Reports agrees.

In their March, 21, 2013 issue, wholesalers are listed in an article entitled, “The 10 Most Overpaid Jobs,” with an average salary of $109,000.

And while the magazine’s criticism is short (“Is one insurance policy or mutual fund really that much better than another? The sales pros who pitch financial products to businesses (which might offer them to their own employees or customers, in turn) strive to make their offerings seem best, but skepticism is an occupational hazard in this job.”), the citation is noteworthy for a few reasons:

First, any public discussion about wholesalers, let alone their salaries, is very rare. Most investors do not even know they exist, even though investors pay their salaries.

Second, the fund industry does not discuss wholesalers and their salaries since it leads to some very embarrassing questions. The main problem is that while they are highly paid, wholesalers do nothing for investors. They do not help the investment process, aid research or reduce fund expenses. Just the opposite: while they raise significant money for themselves and the fund company, fund companies do not reduce fund expenses often enough to help investors.

Instead, wholesalers raise a fund’s total expense ratio, which means less money in investors’ pockets. Another embarrassment is that wholesalers make their big sales using revenue sharing, a controversial practice in which the fund company pays investment advisers a commission to buy their funds.

As the U.S. News article notes, most mutual funds and insurance policies are essentially commodities; one looks very much like another. The industry has known that for years, which is why the insurance industry invented revenue sharing after the Civil War.

And while the article notes the high wholesaler salaries ($109,000), it does not say that 100% of wholesalers’ activities are reimbursed. This total reimbursement package does not exist in the medical or legal professions where malpractice premiums, for instance, are paid by the professionals. The wholesaler sales process is also entirely fueled by revenue sharing, in which commissions are paid by the fund company as an enticement to advisers. (More on revenue sharing below.)

Salary Caps Proposed In Europe

It’s also no coincidence that this discussion of wholesalers salaries are in the news at the same time the European Parliament is considering caps on bonuses in the asset management industry. According to Bloomberg News, (“Europe’s Bonus Clampdown Hits Two-Thirds of Fund managers”), the bonus cap is being proposed on European mutual fund managers who are regulated by the European Union in funds known as UCITS. These products are sold within Europe’s 27- nation trading bloc.

The bonus cap is far-reaching and could affect hedge fund managers, as well, Bloomberg reports. Of course, the fund industry is responding by saying they will move elsewhere if the caps are imposed (a similar threat used by U.S. hedge fund managers whenever they are asked to pay higher taxes or face new regulations).

The European proposal is being introduced to curb the “gambler’s mentality” of fund managers, who contributed to financial losses suffered in the 2007 recession. The caps are also coming on the heels of similar caps imposed on European bankers which limited bonuses to more than twice that of their fixed salaries.

Salary Discussions Are Now Fair Game

So is there a link between what is happening in Europe and more public discussion about wholesalers’ salaries. I think there is. Individual investors are moving more towards self-directed accounts because they do not believe advisers are acting in their best interests. If investors knew what wholesalers did and what they are compensated, this distrust would grow larger.

I was one of the first to publish wholesalers’ salaries on this site an in my book. In both, I noted that while wholesalers serve a purpose, that purpose is derailed when fund companies bring in huge new inflows of new money, but do not cut fund expenses.

Worse, full-service, actively-managed fund complexes are essentially sales organizations, so wholesalers have extraordinary clout and are well paid since their salaries generate more commissions for the entire sales side of the company (primarily internal wholesalers and sales execs) who also do not benefit the fund’s shareholders.

So expect more public discussions as investment professionals’ salaries, including those of portfolio managers. Since 75% of active fund managers do not even beat their own benchmarks, those salaries should also be scrutinized to determine what shareholders are getting in return for the higher fund expenses compared to passive funds and ETFs.