The huge $ $2 trillion coronavirus relief package enacted April 1, 2020, was the largest bailout bill in US history, but while it provides relief for small business and individuals, particularly lower-income families, it also contained a $500 billion bailout fund that benefits big businesses, including a $170 billion tax break for real estate investors like Trump.

In an election year, the Democrats gave the Republicans some great ammunition for bolstering the Trump administration’s talk about helping small businesses and individuals.

Yet, aside from that fluff, the greatest benefits of the bailout fund and tax breaks flow directly to Trump’s wealthy core supporters. As far as what the bill gives large businesses, Politico said the bill is “dramatically different from any bailout the U.S. has ever done before.”

In addition to the $500 billion bailout fund for big businesses, and $280 billion worth of business tax cuts, the bill also contains an intricate and intentionally hard to decipher $454 billion corporate bailout programs that involves lending and buy-backs to stabilize the financial markets.

Even Politico, which follows arcane legislation full time, said “the language is very confusing.” But then it said “at a moment when the Fed is already rerunning much of its playbook from the 2008 financial crisis, using its role as a lender of last resort to keep credit flowing, the CARES Act seems to encourage the Fed to take very un-Fed-like new risks in very un-Fed-like ways.”

The similarities between the 2008 mortgage fraud-led recession and the current plague-related corporate bailout both resulted in historic redistributions of taxpayer money to huge corporations. In 2008, these corporations were mismanaged. In 2020, the corporations were dealt into a card game they normally run, except this was an unexpected one. And like past bailouts, “for every condition, there’s a loophole,” according to ProPublica.

The Rigged Game

How do corporations and Wall Street always seem to come out like bandits in these national crises?

The answer lies in the who writes the rules, regulations, and the legislative language for these financial re-distribution packages.

History gives us some good examples. When Barak Obama signed the controversial and secretive Trans-Pacific Partnership (TPP) trade agreement in 2018, he put it on a fast-track. so that it was submitted to a vote provided it was not amended or debated. To help execute this and other top-level trade programs, the nation’s largest banks paid some of their own staff members to leave their jobs and take new ones in the Obama administration. Bank of America paid Stefan Selig a $9 million bonus to leave BoA to become undersecretary of commerce for international trade the U.S. Department of Commerce from 2014-2016.

In addition, Goldman was a prominent member of the U.S. business coalition lobbying for the TPP. According to the web site Inequality, Faryar Shirzad, the head of Goldman’s Government Affairs Department, “urged the inclusion of “investor state dispute settlement” (ISDS) provisions in trade agreements. Such provisions would allow businesses making cross-border investments to sue signatory governments for damages if rules or regulations interfered with expected corporate profits, and to have their lawsuits heard by special tribunals staffed with private attorneys who often have close ties to corporate interests.” Goldman would be a prime beneficiary of this rule.

At about the same time, Citigroup paid Mitch Froman $4 million to leave Citicorp to become a US trade representative. While working for Obama, Froman as also collecting a salary from Citigroup.

These banks actually paid these employees to leave to take jobs in government. And they are not alone. As reported by Lee Fang in the Republic Report, as seen on an exceptional Bill Moyers show (Plutocracy Rising, Oct 19, 2012), Blackstone, Citicorp, Goldman Sachs, Morgan Stanley, Northern Trust, Fannie Mae and JPMorgan Chase all give multi-million dollar bonuses and extra retirement benefits to trusted employees who leave to take federal jobs.

So, what would be expected of an ex-employee who goes to work for a federal agency?

Any adult can use their imagination, but it should not be bothered by concerns about the former employee providing dispassionate and critical evaluation of any topic that involves their former employer, client or future clients. That would go against human nature.

Being Paid Millions to Leave Your Job

If this and other legislation always seems to benefit Wall Street, it’s because the financial services lobby is the most powerful in Washington. It should be considered the fourth arm of government. The lobby and its financial services firms use their money as a club. It is swift, apolitical, and focused on what benefits its global policies, and the wealth creation and preservation of its top management.

It also works freely with both parties. Goldman Sachs gave more money than any other major American corporation to Barack Obama in 2008, but when Obama made some tepid attempts at financial reform, it shifted its contributions to then-Republican presidential candidate Mitt Romney. In the COVID bailout, Trump and the Republicans provided lucrative tax breaks for the top 1%.

Under the Trump administration, Goldman Sachs has been the primary beneficiary of top appointments. “In choosing Gary Cohn as National Economic Council Director and Steve Mnuchin as Treasury Secretary, along with Jay Clayton at the Securities and Exchange Commission, Trump has turned to Wall Street veterans with deep knowledge of the financial crisis—knowledge gained as champions of the dangerous practices that helped cause it,” according to the site Inequality.

Wall Street Rewards the Most Loyal

Wall Street can also be counted on to hire top military or elected officials for lucrative jobs. Here are some examples:

- When General David Petraeus was relieved as head of the CIA in 2012, he went to Kohlberg, Kravis Roberts as chairman of the firm’s newly created KKR Global Institute in May 2013. Many generals end up on the boards of defense contractors after they leave the military.

- Former Senator Phil Gramm (R-Tex), who is widely-credited with creating the conditions that created the 2008 mortgage crisis via his push for deregulation and liberalizing exotic derivatives, left his job and ended up with the lofty title of vice-chairman of the Investment Bank at UBS. He joined UBS immediately after leaving the Senate.

- Rahm Emanuel, while working on the campaign for Bill Clinton, received a paid retainer from the investment bank Goldman Sachs. Later, after he left his post as former chief of staff to Clinton, Emanuel got a job as managing director with the investment firm Wasserstein Perella. Congressional disclosures show he made $16.2 million during his 2 1⁄2 years as a banker, even though he never earned an MBA nor had any

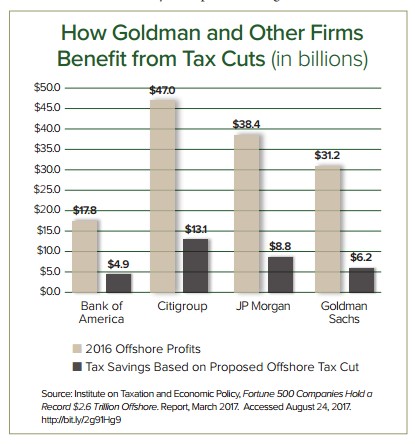

NOTE: This chart does NOT include the 2020 COVID tax cut benefits to these banks. previous experience selling bonds. Later, Clinton named venal Emanuel to the board of Fannie Mae before it became the subject of an investigation into financial and federal election irregularities. Emanuel resigned from the board before the investigation concluded. During his 14 months with Fannie Mae, he made at least $320,000, according to the Chicago Tribune.

The Unchallenged American Plutocracy

In all of its many iterations, shapes, and disguises, Wall Street lobbying via money and personnel are more powerful than any changes that can be brought about through elections. Money buys people and legislation and the money works in all conditions, day and night.

The COVID bailout is a replay of the 2008 mortgage fraud bailout. Both represent huge income redistributions. A 2012 study of the 2008 mortgage bailout found that the top 1% of Americans owned 93% of the national wealth, but even more startling was that 37% of that income is owned by the nation’s top 0.01%, according to Chrystia Freeland, author of Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else.

My bet is that is Trump’s real base, not the high school-educated white males who wave Trump flags at demonstrations. The superrich magnify their political preferences via think tanks and donating to groups that sway elections by any means possible. Wall Street is the engine behind these efforts. So, as corporations try to re-shape their images as a result of the Black Lives Matter protests, don’t let the big donations and TV commercials from Wall Street banks fool you. They will never change. To them, any regulation or modicum of reform is communistic or socialist. These are the people behind the throne and they will never stop defending it.