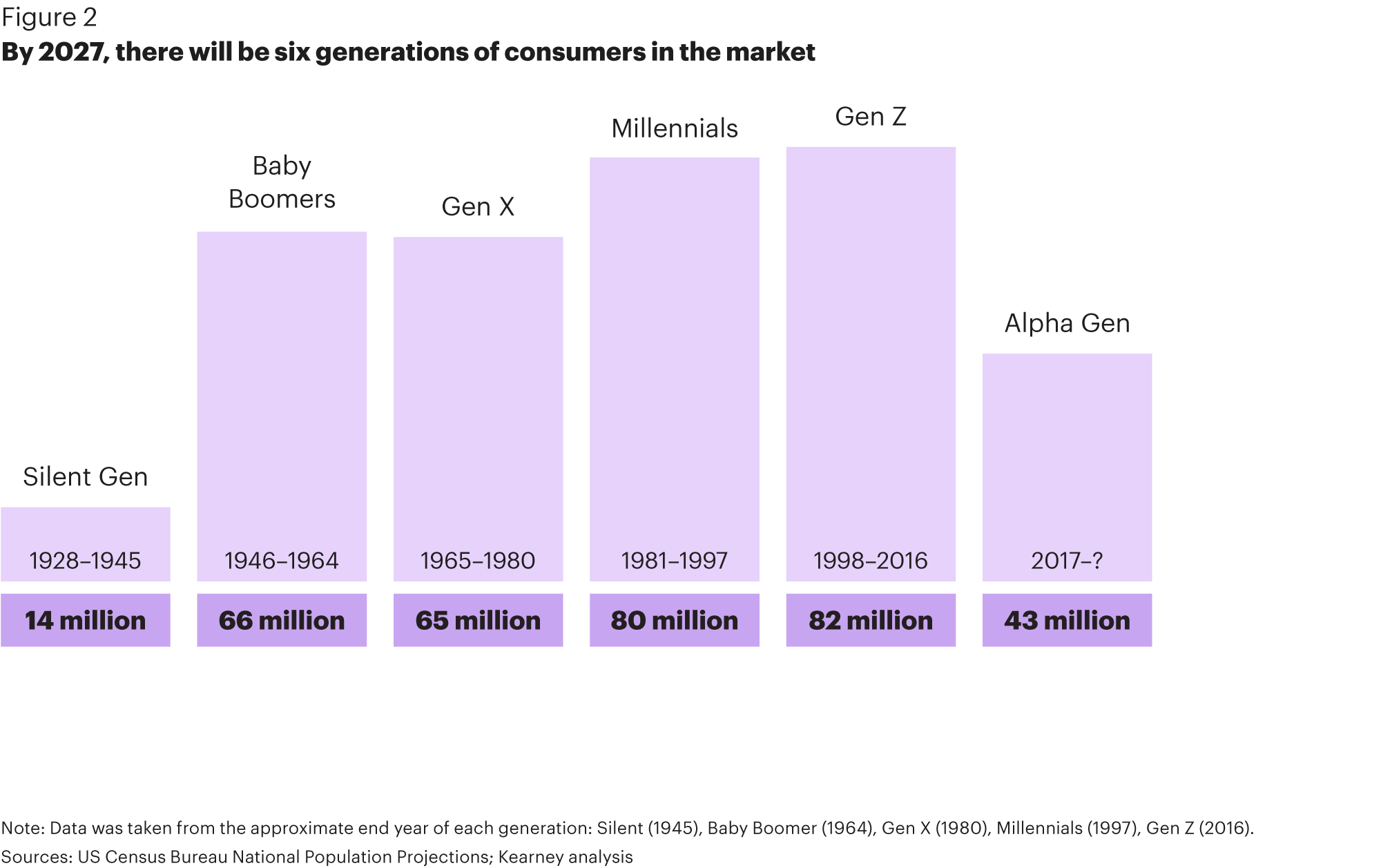

By 2027, There Will Be Six Generations in the Marketplace

While everyone has an opinion about the markets, few people dispute demographic trends, especially when they become available globally.

A new report by the consulting firm of A.T. Kearney, the Global Maturing Consumer study, claims to be the first to interview 3,000 people older than 60 in 23 countries.

While the study primarily focused on product and consumer results, it did contain information of interest to people following retirement trends.

Among its Findings:

–The composition of families will change the world and “could evolve with three, sometimes four, generations living on a single income and under the same roof.”

–“In 1998, the number of people older than 60 overtook those younger than 15-years-old in the G7 countries. Based on current worldwide demographic trajectories, by 2047 there will be more people older than 60 than younger than 15 worldwide.” (See chart above.)

–People worldwide are living longer and healthier than ever. In the U.S., a person under age 60 can expect to live 19 more years, on average.

–In developed societies, older people control much of the wealth, even though their nominal incomes often decline after retirement. In the United States, people over-50s own 80% of U.S. financial assets and are responsible for 50% of discretionary income spending.

Since Baby Boomers and their older cohorts are living longer and remaining active, they are vested in increasing their retirement incomes and preserving their retirement wealth by closely monitoring their fund investments and expenses. Expenses can be controlled, so one lesson from this new study is that the investment clout of older Americans should be applied to preserving their self-interests, including the demand for lower fund expenses.

Comments are closed.