In an October 2016 presidential debate between Hillary Clinton and Donald Trump, one debate segment about Social Security entitled “Entitlement or Debt.”

A FOX News anchor moderated the debate, so this segment started incorrectly since the title itself is prejudiced. The issue of entitlement reform is a catchphrase used by Republicans for reducing, eliminating, or privatizing any form of state or federal subsidy to the poor, disabled, infirm, the blind, widows, veterans, or those unable to work for any number of reasons. Entitlements are a Republican slur that also includes “welfare queens,” “moochers,” and that Social Security is a “Ponzi scheme,” according to oligarch Elon Musk.

But that is a lie from the reported richest man in the world.

Social Security payments are primarily funded by payroll taxes (FICA) collected from workers and their employers monthly. Employers and employees each contribute 6.2% of wages up to a certain amount.

According to AARP, “About 80 cents of each dollar you pay in Social Security taxes goes to the old-age insurance fund, the rest to disability. In 2023, those taxes — called FICA for people with wage-earning jobs and SECA for the self-employed — brought in more than $1.2 trillion, accounting for 91.3 percent of Social Security’s revenue, according to the most recent annual report from Social Security’s board of trustees.”

If this is a Ponzi Scheme, Elon Musk has some burnt-out Teslas to sell you.

Republicans Declared War on Social Security in 1933

The Republicans hated everything that Democratic President Franklin Roosevelt passed in the New Deal. At the top of the Republican’s hit list is the Social Security Act, which was signed into law by President Franklin D. Roosevelt on August 14, 1935.

In that 2016 debate, Trump failed to answer the question of how to strengthen or reduce Social Security. He sidestepped the complex question by saying he would repeal the Affordable Care Act (aka Obamacare) and cut taxes. Hillary Clinton said she would put more money into the Social Security trust fund and raise the dollar cap on Social Security contributions so more high-wage earners would contribute more. She also said she would not cut benefits.

Flash forward to March 2025, and Democrats are sounding the alarm that Musks DOGE punks are dismantling Social Security to the degree that monthly payments to 73 million recipients will be delayed for weeks or months in an attempt to dismantle the system,

What the radical Republicans want is their old stated goal of privatizing Social Security.

But most Americans don’t understand what that means. In short, it means:

- You could receive a variable monthly check amount since your funds could be invested in the stock market or an annuity. Annuities have high expenses and commissions that recipients must pay.

- Potentially lower monthly payouts since individuals will pay fees, expenses, and commissions to the major investment firms that manage retirement accounts.

- Social Security today is an annuity structure. This means recipients get a monthly payout based on how much they have contributed to their accounts over their working life.

- Retirees will take more risk in their retirement if the payments are privatized. Their risk level will increase because of stock market fluctuations and the risk that an investment firm could have a significant business failure.

The bet is that Republicans hope the public will buy into their false claim that Social Security is a “Ponzi Scheme.” This is from the old Republican playbook, which seeks to stigmatize the “entitlement system” (a code word for welfare and all that it implies) that promises large payouts and contributes to the national debt. This is an old, false claim. As noted by the website Social Security Works, this is not true. Even President Ronald Reagan famously said Social Security does not add anything to the national debt.

As it stands today, the maximum monthly Social Security benefit in 2025, for someone retiring at full retirement age, is $4,018. However, higher benefits are possible for those who work or delay benefit receipt after retirement. The maximum benefit for those who wait until age 70 is $5,108.

But for the Republicans, these benefits are too high. Trump’s vice presidential running mate in 2016, Mike Pence, who could have been hung in the Jan. 6, 2020 insurrection, said that existing Social Security benefits are too high. Other Republicans have repeated this.

On Oct. 16, 2018, Republican Senate Majority Leader Mitch McConnell announced that due to an increased federal budget deficit, Republicans would have to reduce and alter some critical Social Security and Medicare provisions. In his announcement, McConnell said the only way to minimize the record-high federal deficit would be to cut entitlement programs like Medicare, Medicaid, and Social Security.

What Do Wall Street Firms Say About Cutting Social Security?

The beneficiaries of privatizing Social Security are the nation’s largest investment firms, which will receive the proceeds from the $2.89 trillion in the Social Security trust fund.

Naturally, these investment firms are salivating at the opportunity of privatization even if they know that their profits will come from the accounts of working people who rely heavily on those monthly payments. Social Security benefits represent about 33% of the income of the elderly. If these payments are cut, it’s not their problem.

This is why these huge investment firms that spend millions on advertising never address retirement income security.

The investment industry wants all of these future revenue streams included in its portfolio of assets under management. It can then sell overpriced investment products to the uneducated masses.

Why Are Large Investment Firms Silent on Social Security Changes?

The reason is simple: these firms will be the primary beneficiaries if a Republican-dominated Congress enacts the master plans to privatize Social Security or reduce its enrollment numbers.

And even better, the long-fought battle by the financial services and insurance industries to dilute the U.S Department of Labor’s fiduciary standard (the rule that a financial advisor has to act in the best interests of their clients makes more sense when it is paired with changes in the way Social Security coverage is decreased and those contributions are diverted to private investment firms.

That is the one-two punch for average investors. The scenario makes more sense when the two moves are combined—changing how financial firms collect and invest in workers’ retirement contributions and then selling them in an environment that allows conflicts of interest and overpriced products to be sold to unsophisticated investors.

Let’s face it: few investor markets in the world left to conquer have this much money in one place. China is vast but poor. Europe is a mature market with few avenues left for market penetration. That leaves the average U.S investor as the last main flock of sheep to shear. If Social Security is not privatized, the incessant push to control more assets under management will hit a wall. The Wall Street snake will have to start eating its own tail.

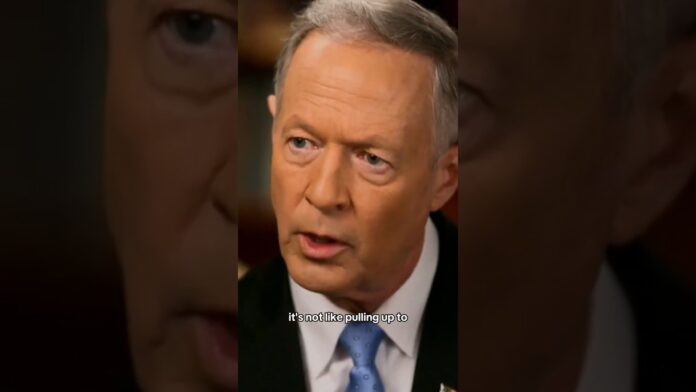

Martin O’Malley, the former Governor of Maryland and the former head of Social Security, is raising the alarm now. He says Musk’s DOGE punks are dismantling the Social Security Administration to the degree that monthly payments will be delayed.

That is why the investment industry avoids any response to this historic announcement that privatizing Social Security is in high gear. They insist they are not political, but they are. They spend millions on lobbyists to elect Trump, defeat the fiduciary standard, and push for changes in Social Security. This is why they avoid discussing these issues. It is a plan best kept secret.

It’s also a great example of an industry riddled with conflicts of interest and an industry that does not believe in the public good.

This unfolding Republican scheme is another play to destroy public services and representative government and concentrate wealth in the hands of the top 1%. It’s more Dark Days ahead for average Americans.