GameStop. Robinhood. TruthSocial. rivian. Virgin Galactic. The gamification of investing. Unethical financial and crypto exchanges and websites. And now, a suicide.

These are all being fueled primarily by inexperienced novice investors, many of whom will soon be in the red.

Americans have one of the world’s lowest levels of financial and political literacy. Now, they are all coming into the market to get rich quickly.

Worse, some unethical online brokerage firms and financial websites target less experienced investors to invest in upcoming IPOs without telling them that IPOs have poor long-term return records. This is made worse because novice investors are not told they should have a diversified portfolio before gambling on IPOs.

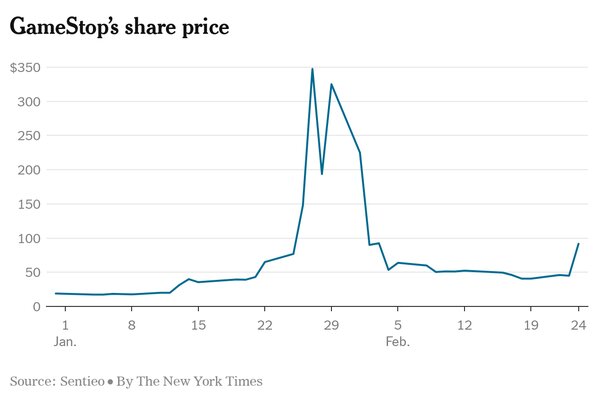

The most recent tragic example happened when a 20-year-old trader thought he lost over $700,000 in his options account held at Robinhood. When he looked at his screen, and maybe he was somewhere in this abnormal Gamestop price chart, it showed that Robinhood restricted his account as it posted a negative balance of $730,000.

According to CBS News, the firm sent him an email at 3:26 a.m. demanding that the trader take “immediate action,” demanding payment of over $170,000 in a few days.

The trader asked Robinhood for clarification but got a canned email response from the firm saying they would look into it. As per its business model, Robinhood had no humans answering its complaints, nor does it list a customer service phone number. Despondent, the trader thought he had lost more money than he could ever pay back. And if any experienced trader saw this chart, he would know it was a horror show in the making.

Within 24 hours, the trader had committed suicide. His family has filed suit against Robinhood, charging ” accusing Robinhood of wrongful death, negligent infliction of emotional distress and unfair business practices,” CBS News said.

This is a classic case of violating the “know your customer” rule. Before the likes of Robinhood and other no-commission brokerage firms, there were higher standards. These included asking customers how familiar they were with trading options and futures (the most leveraged forms of investments), their net worth, and whether they understood that certain forms of trading should only be used with non-essential money, i.e., money that if it was lost would not mean they would lose their house or be without food.

Robinhood also doesn’t think paying experts who can explain how more complex options strategies work or even how to read a statement is essential. If they did, this suicide could have been prevented.

Unethical Financial Web Sites and Trading Firms

Just like Robinhood sells its trading data to its unsophisticated options trading customers, some financial websites are disproportionately pumping out stories on new, highly speculative IPOs. These stories about upcoming IPOs cite big numbers and the implied promise that there will be a big payoff for small retail investors who jump into the IPO frenzy.

Unfortunately, this is not true.

These websites get paid big ad money from brokers who are the intended destination of an IPO story. Even for second-tier financial websites, this avalanche of IPO hype stories can generate $25,000 per month in revenues.

The problem is not the IPOs themselves, but the journalistically unethical way these stories are promoted, which excludes prudent long-term proven investment strategies and advice.

Novice investors with small portfolios (say under $100,000) have no business investing in IPOs unless they already have a diversified stock and bond portfolio, six months of savings, participate in their employer 401(k) to the maximum, and, hopefully, own a house. That’s a very conservative model not often presented on sites catering to Millennials (age 25-34) that disproportionately tout IPOs.

That may be unrealistic and asking a lot, but IPO investing should be made with throw-away money.

Studies have shown that in 2019, new US listings as a whole generated investor profits of 4.8% (January to October 2019) when weighted for size, according to Dealogic data. Out of the 133 companies to list in the US through this same period, 42 lost money for investors in trading, which means that 68% of deals in the US generated a positive return. Another study in Germany found that less sophisticated investors are more prone to making investment decisions based on emotions and sentiment than financial factors.

Worse, many novice investors enticed into buying IPOs are buying on hype, brand-name recognition, and emotion, not financial fundamentals (earnings estimates, financial ratios, sales, or market values) of the company going public.

Unethical Financial Journalism?

The same websites promoting upcoming IPOs also don’t bother to explain the whole IPO process. It’s boring and doesn’t generate clicks and ad dollars. However, companies that go public already have the inside price allocated to their institutional, banking, and money management investors.

The crowd of small retail investors lured by the unethical websites is not getting “the insider price” or “getting in on the ground level.” They only get the market price on the first day of trading. Nothing more. Worse, the early days of IPO pricing are volatile and emotionally driven.

These early prices don’t indicate the company’s future direction. That’s why mutual funds managed by experienced professionals do not buy IPOs until at least six months after listing.

IPO Hype is Robin Hood’s Problem

Many unethical websites promoting IPOs and SPACS generate revenues from spending excessive time deciphering Google keywords and keyword combinations.

This journalism problem is similar to why Robinhood recently made the news. Robinhood makes money by grouping orders and then selling the order flow to hedge funds. These profits offset the losses from the “free commissions.” Those hedge funds then trade in front of RobinHood customers. This is why the hedge funds pay dearly for the data.

In the lawsuit, Massachusetts Secretary of the Commonwealth William Galvin referred to RobinHood and said, “The worst aspect of what they do is the way they are gamifying the idea of investing.” He later said the firm “is a very reckless company when it comes to these investors. They’re interested in expanding their market base; they’re not interested in serving their investors.”

Robinhood is a broker-dealer and is subject to state and SEC regulations. This is why they were charged with violating the famous “know your customer rule,” which allowed their unsophisticated investors to enter shark-infested waters.

Google Ad Words Distort Financial Journalism

Financial websites have a similar obligation. Although unregulated, sites that disproportionately promote IPOs can be considered journalistically unethical when they push unsuspecting investors into risky trades without explaining the risks. This violates another fundamental concept in journalism: giving preference to advertisers over their readers.

Giving large advertisers extra-favorable coverage and special considerations began with mass advertising in print journalism after the Civil War. In the Google world, preferential treatment to advertisers is done by discovering keywords that direct unsuspecting viewers to advertisers.

If you are a novice investor and have indicated an interest in the latest hot topic, such as IPOs, look at your emails and the list of news stories flowing out of financial websites. You’ll see most of the latest IPO candidates waiting for your investment. There is a good reason for this.

Significant financial sites have large budgets and produce various business and investing stories. They have great content, and much of it is original and educational. The second-tier sites are more driven by Google ad revenue tricks involving keywords that follow the latest fads.

The problem is many of these financial sites are doing some of the same things as RobinHood. The difference is that it’s happening in the journalism world.

Consider these statements from Massachusetts Secretary of the Commonwealth William Galvin:

In his CNBC interview, he said Robinhood “market[ed] itself to them [inexperienced customers] as a device by which they can become wealthy without having the expertise or the skill.”

He then said RobinHood took “unsophisticated investors, most of whom have no experience, and basically [made] this into a game, causing them to suffer losses. They’re bringing them aboard on something these people have no idea about.”

This is precisely what many sites promoting IPOs are doing today.

Be A Real Investor: Build a Boring Stock and Bond Portfolio

The financial websites promoting IPOs without regard for their customers will not change. Their business model relies on Google ad clicks. It’s a sad example of how many online journalistic sites have had to bend their ethical obligations to generate revenues. Online and print journalism will only become more focused on Google ad words in the future. This will skew their coverage, directing unsuspecting investors to risky, new products and offerings.

New investors should realize that any licensed investment professional would never suggest IPO investments unless they own a basic stock and bond portfolio. The adage—“Investing is a marathon, not a sprint.” “Trees don’t grow to the sky for a reason.” “Beware of bulls, bears, and pigs.” And “Never meet a margin call.”—are all valid today because they are correct.

Avoid the IPO hype. Stick with getting your information from top-tier, brand-name financial and investment advice websites. If you are a young, inexperienced investor, build a dull stock and bond portfolio. And most of all, protect your money. No one cares about it as much as you do.

[…] So far, this is nothing new. […]