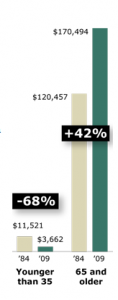

Call it the “Revenge of the Baby Boomers,” but the huge inequality in net worth between people aged 65 or older is now estimated to be 47 times greater than that of a family headed by someone who is under age 35.

That is a staggering, unsustainable gap, which casts a long dark shadow for today’s younger people. The problem is that it indicates that people are not building wealth as they get older. This is the foundation for retirement and wealth creation, and it will impact the ability of home prices and the quality of life for millions of young Americans for decades.

The analysis, conducted by the Pew Research Center, concluded that the impact of the economic downturn, has hit young adults particularly hard. The study found that the median net worth of households headed by someone 65 or older was $170,494. That is 42% more than in 1984, when the Census Bureau first began measuring such data broken down by age. The median net worth for the younger-age households was $3,662, down by 68% from a quarter-century ago.

The research findings of the 47-to-1 gap in net worth between old and young is believed by demographers to be the highest ever, even predating government records (see chart).

The data also found that the biggest asset held by younger people was their home, but the housing debacle only aggravates the fact that housing net worth dropped 31% from 1984, due to increased debt and falling home values. Older Americans (65 or older) commonly purchased their homes long before the housing boom. This helps explain why this group posted a 57% gain in housing net worth even after the bust.

More Problems for Housing

This disparity foreshadows more problems in the housing market. If the younger people cannot afford to buy an appreciated home from an older seller, due to no income gains, student loan debt and strict mortgage guidelines, home prices should fall further simply because no one can afford to buy them.

Add that fact to the huge foreclosure home inventory supply and the rigid forces of supply and demand should further depress housing prices for years to come. This should concern people who are buying more expensive homes now. This new reality should cause them to ask” Who can afford to buy my house in a decade?”

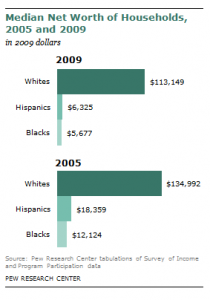

All this bad news follows another earlier study done by Pew which found that the wealth gap between blacks,

Hispanics and white had also widened to an exceptional historical level (See chart at right.).

Why the Inequality?

The Pew Center’s study summarizes the wealth gap which has been building for at least 30 years.

According to a book, “Winner-Take-All-Politics” by Jacob Hacker and Paul Pierson, the gap is the result of policy choices in Washington, designed to advance big business, provide preferential tax preferences and the interests of big business and their lobbyists. (The book was reviewed in Foreign Affairs, “Why the Rich Are Getting Richer,” by Robert Leiberman, January-February 2011.)

According to Hacker and Pierson:

“The dramatic growth of inequality, then, is the result not of the “natural” workings of the market but of four decades’ worth of deliberate political choices. Hacker and Pierson amass a great deal of evidence for this proposition, which leads them to the crux of their argument: that not just the U.S. economy but also the entire U.S. political system has devolved into a winner-take-all sport. They portray American politics not as a democratic game of majority rule but rather as a field of “organized combat” — a struggle to the death among competing organized groups seeking to influence the policymaking process. Moreover, they suggest, business and the wealthy have all but vanquished the middle class and have thus been able to dominate policymaking for the better part of 40 years with little opposition.”

The Bottom Line

Sustained income inequality erodes any society. It is especially egregious in a consumer society, propelled by consumer spending. When the spending and wealth engines fail to work, the consumer economic model breaks down. That may be a partial answer to what we are seeing today.

But in the absence of any solutions from Washington, investors should take action themselves to protect their savings and retirement assets. Money lost today, including money invested in something as simple as mutual funds with high fees and index-like performance, will be exceptionally difficult to replace in the future.