Who says money cannot buy happiness, or even better, keep you out of jail?

Those are the benefits Georgia Senator Kelly Ann Loeffler (R-Ga.) received when she was exonerated by the Securities and Exchange Commission (SEC) in an insider trading scandal this summer. Based on the charges, she used her position to sell stocks after she received a secret briefing on the extent of the emerging COVID virus.

After the meeting, Loeffler and her husband, Jeff Sprecher, chairman of the company that owns the New York Stock Exchange, “sold millions of dollars worth of stock from late January through mid-February, including transactions in shares later affected by the global pandemic,” according to Reuters. The couple is worth an estimated $500 million.

And to show that it is hard to keep profit-making information secret, U.S. Sen. Richard Burr (Republican-North Carolina) resigned from his post as chairman of the Senate Intelligence Committee as part of a separate COVID insider trading scheme.

Quid Pro Quo For Sprecher, Loeffler and the SEC?

What makes the SEC’s decision to dismiss the charges against Loeffler interesting is that it may have been propelled by a string of big donations from her husband, Sprecher, to the Republican Party, according to the Atlanta Journal-Constitution.

In this article, the newspaper found “Loeffler and her husband, Jeff Sprecher, have done that and much more, plowing more than $31 million in loans and contributions into GOP races for the U.S. Senate, U.S. House, and White House, including $23 million to Loeffler’s campaign so far, all allowed by federal law.”

The insider trading charges against Loeffler were dropped by the Republican-controlled  Senate Ethics Committee and the SEC, which is headed by Jay Clayton, a Trump appointee. Clayton said he will leave the SEC in December 2020.

Senate Ethics Committee and the SEC, which is headed by Jay Clayton, a Trump appointee. Clayton said he will leave the SEC in December 2020.

During his tenure, NPR reported that the S.E.C. brought just 32 insider-trading enforcement actions last year, the fewest since 1996. Loeffler was one who escaped the enforcement net.

Sprecher’s Involvement in Insider Trading is an NYSE Problem

One of the great benefits of the Trump administration is that its corruption was always in full view. Anything goes in the Trump administration and all million-dollar donations are rewarded, so you may as well get something for your money.

While this is a sticky situation for Georgia Republicans, especially in the heated upcoming Senate race with Democratic candidate John Ossoff, this situation also poses a PR problem for the NYSE.

When the chairman of the NYSE’s parent company, the Intercontinental Exchange, Jeff Sprecher, and his wife are involved with messy insider trading violations, it understandably raises questions about what is happening inside the NYSE’s Compliance Department.

It also brings back memories of the SEC’s insider trading case involving Martha Stewart, then Chairman and Chief Executive Officer of Martha Stewart Living Omnimedia, Inc. In that case, the SEC found that Stewart committed illegal insider trading when she sold stock in a biopharmaceutical company, ImClone Systems, Inc., on Dec. 27, 2001, after receiving an unlawful tip from her stockbroker. Both were indicted and convicted.

At that time, Stephen M. Cutler, the SEC’s Director of Enforcement, said: “It is fundamentally unfair for someone to have an edge on the market just because she has a stockbroker who is willing to break the rules and give her an illegal tip. It’s worse still when the individual engaging in insider trading is the Chairman and CEO of a public company.”

So to reiterate, Sprecher is chairman of a public company that owns the NYSE, the world’s pre-eminent stock exchange, where “a man’s word is his bond.” People have been fired there for even the appearance of impropriety, so why does Sprecher still have his job?

Worse, what’s the connection between his million-dollar contributions to the Republican Party in the Trump era, and what did he expect in return for making those contributions?

What Is the SEC Doing?

The SEC has limited or no effective jurisdiction inside the NYSE since the exchange is considered a Self-Regulatory Organization (SRO). This essentially means the exchange regulates itself. But this does not eliminate the question: Are well-connected traders receiving different treatment than less-connected traders? And, are large Republican donors getting better treatment than others, especially during the Trump administration?

Charges of insider trading and other trading irregularities are rare at the NYSE, but they have happened before and in very public ways.

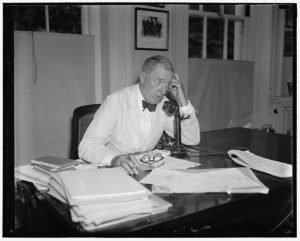

In 1933, President Franklin Delano Roosevelt met with Richard Whitney, chairman of the  NYSE. At that meeting, Roosevelt told of the need for “moral reform of Wall Street,” including the need for the NYSE to adopt a code of ethics that could be adopted by the nation’s other stock exchanges. Whitney was a Harvard graduate, had a blue-blood ancestry, and was a senior member of JP Morgan.

NYSE. At that meeting, Roosevelt told of the need for “moral reform of Wall Street,” including the need for the NYSE to adopt a code of ethics that could be adopted by the nation’s other stock exchanges. Whitney was a Harvard graduate, had a blue-blood ancestry, and was a senior member of JP Morgan.

Unfortunately, after that meeting, Whitney showed he was not at all concerned about the “moral reform of Wall Street.” In 1938, Whitney was “exposed as the embezzler, of funds entrusted to him by the stock exchange and the New York Yacht Club, of which he was treasurer, as well as for misappropriating funds from his father‐in‐law’s estate, the one‐time hero of Wall Street was sent to Sing Sing Prison,” according to this article in the New York Times.

Those are the type of problems Loeffler’s and Sprecher’s insider trading problems raise. It also raises the conflict-of-interest problem that is embedded in the entire Trump  administration. Rich corporate and individual donors who deal with the Trump administration by making multi-million dollar contributions expect something in exchange. There is nothing altruistic in Trump’s world. All the quid pro quo donations are being done in the open.

administration. Rich corporate and individual donors who deal with the Trump administration by making multi-million dollar contributions expect something in exchange. There is nothing altruistic in Trump’s world. All the quid pro quo donations are being done in the open.

This entire topic, including the treatment of the chairman of the NYSE’s parent company, should be used in the upcoming Georgia Senatorial runoff. This is a great example of how self-regulation works in a Republican environment. When rich people make tough decisions regarding the fate of other rich people, the blinders come out and the deals are made. This is the same Georgia ol’ boy network that has been around for over a century. Georgia voters should decide if they want this ol’ network to continue.

Then, Sprecher’s involvement in the messy insider trading scandal should be brought before the corporate board. If the NYSE’s parent company wants to be transparent about this, it should be broadcast on the internet. We are sure it will make an interesting discussion at the next few board meetings.