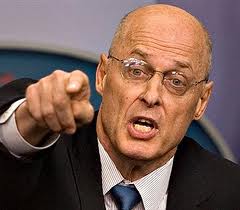

On July 28, 2008, then-Treasury Secretary Henry Paulson held a curious meeting in New York with about a dozen hedge fund managers.

At the time of the meeting, Bear Stearns had already been forced into a fire sale to JP Morgan Chase for $4 a share four months earlier, and the hybrid mortgage housing agencies, Fannie Mae and Freddie Mac, which together had more than $5 trillion in mortgage-backed securities and other outstanding debt, were showing signs they would need a capital infusion to meet their obligations.

The story of Paulson’s meeting with the hedge fund managers was reported in Bloomberg Markets Magazine by Richard Teitelbaum. The article reported that Paulson had earlier told the New York Times and others that the two housing agencies would be able to meet their obligations.

But in his meeting, Paulson told a different story. He now told about a dozen hedge fund managers that Treasury would be taking over the two agencies and placing them in government “conservatorship,” a drastic move that would eliminate many of their shareholders’ positions, including those who held preferred stock.

Even Iowa Senator Charles Grassley (R-Iowa), a defender of Paulson, said the Treasury Secretary “changed his story” with the hedge fund managers and it was not the same one he told Congress about his plans for the two housing agencies.

Since the report was made public, numerous Wall Street executives, and Senator Grassley, have questioned why Paulson would reveal the equivalent of insider information to a group of hedge fund managers, including at least five of whom were former employees of Goldman Sachs, where Paulson served as chief executive officer and chairman from 1999 to 2006.

While the consensus is that Paulson broke no laws, he certainly raised the issue about the levels of information available to different classes of investors at critical times in an economic crisis.

The Information Gap and the Income Gap

The issue of information disparity in investing is the barrier which separates profits from losses. Not only is the quality of the information critical, but the immediate access to act upon it is similarly important. Retail investors have no chance of hearing such sensitive details, not do they have access to the funds or strategies needed to capitalize on it.

But when Paulson presented this information to professional hedge fund managers, he certainly knew the information would be useless unless it was converted into an investment strategy by this select group. If not, why not just hold a press conference and make it available to everyone?

The Paulson meeting raises serious issues about the role and value of government policy information, who has access to it, and when.

Since information is power, it has now become an even greater engine for generating huge profits. This explains the new Washington D.C. industry of hiring ex-Congressional staffers and lobbyists to troll Congress for non-public information with the goal of converting it into an investment strategy.

Since open-market investing strategies, where people trade on publicly-available economic and financial data, has only produced average investment returns, this new search for non-public information is much more attractive. When leverage is added to the information advantage, it can be a recipe for huge short-term profits, and an ideal strategy for nimble hedge funds.

What the Meeting Means to Individual Investors

So what issues does Paulson’s seemingly straightforward meeting raise for average retail investors?

- It now means that a federal official can pre-release news about a single public policy change, or even a hint of change, without regard for violating any laws. It then falls on the already-stretched and limited enforcement staffs at the SEC or Justice Department to untangle the trades to prove insider trading. Given the many-layered strategies and access to global partners, this can become an insurmountable case to prove.

- It highlights the information gaps between the haves and the have-nots, the professional investors and everyone else. This gap probably mirrors the gap between the top 1% and everyone else.

- It raises questions about why Paulson would reveal this sensitive information to this specific group. What makes them more special than a group of corporate institutional investors or mutual fund portfolio managers? Why were these market participants favored over others?

- It raises questions about the “free market” and the efficient market hypothesis that says that all information is known in the marketplace and already incorporated into equity prices.

- It raises the question why unneeded market risks and volatilities are injected into the market by government officials whose job is to calm the markets during turbulent periods.

These are just questions. Does anyone want to provide any answers?