Recent news that housing prices are beginning to rise after a six-year slump in certain cities, such as San Francisco and Seattle to Miami, makes for good headlines, but it does not mean this is a national event. Nor does it mean that home prices will appreciate any time soon to their pre-crash levels. It is this later event which should be of concern to any new home buyer.

The reasons:

–Housing has become the largest single financial asset among American families, especially among homeowners headed by the age group approaching retirement (usually age 55-64). However, the dramatic and historic decrease in housing values of approximately $400 billion between 2007 to mid-2008 has significantly altered the retirement plans of many Americans.

–Housing price increases cannot remain stable without a commensurate increase in real wage growth. If house prices increase without higher wages, it just means a new bubble has started. That is what happened from 2000 to 2006 when house prices rose by 100%, while incomes rose by only 2%, according to data cited in the book Aftershock, by David Wiedemer, Robert Wiedemer and Cindy Spitzer. And just as the authors state, home price increases in trendy cities like San Francisco or Miami are more of a danger signal when they happen in a flat economy, which is certainly what we have today.

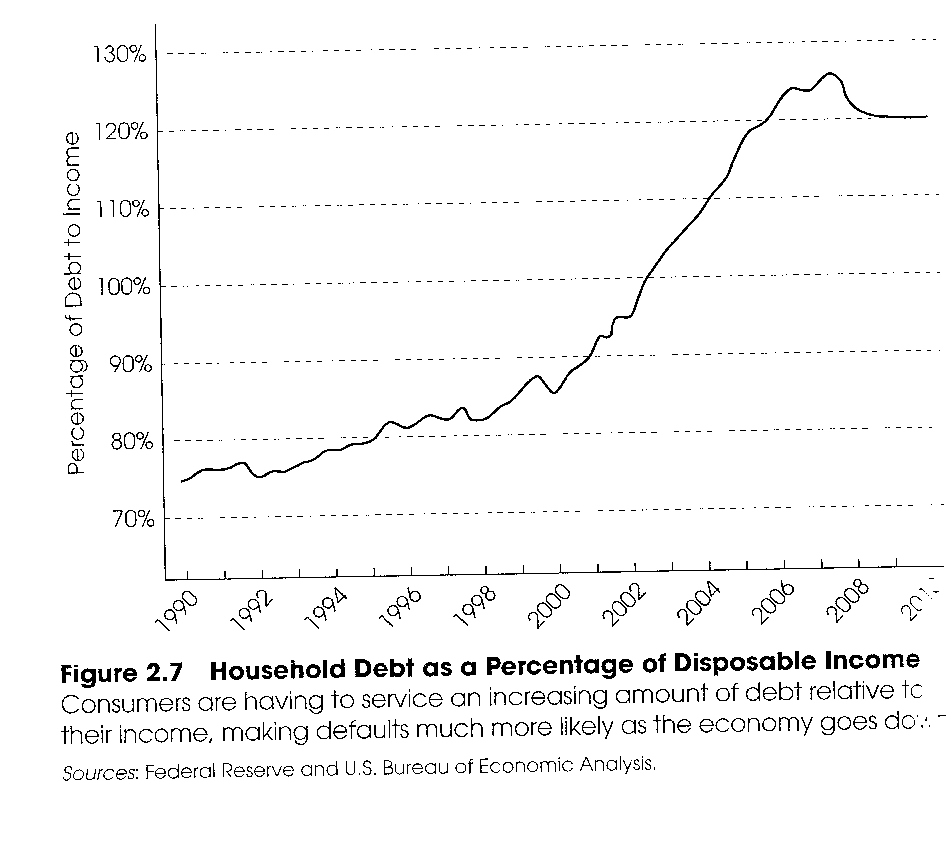

Nor can house prices increase until the household debt to income level decreases significantly, as this chart shows.

So rather than rejoice that home prices are rising, more astute people should wonder why they are rising if people are not making more money.

Negative Housing Prices, Negative Wealth Creation

This decrease in home prices has a compounding effect on diminishing individual wealth and is especially acute among people approaching retirement age who will now have to consider working longer.

The decrease in housing values is especially important since home ownership increases with age. As a result, older people rely more on their home equity as a source of wealth and as insurance against unforeseen negative life events, such as a serious illness or the death of a spouse.

The house price decline is more important since this loss cannot be quickly recovered through stock market gains, primarily because stock ownership is significantly less prevalent than home ownership. The decline is more important since home value appreciation typically occurs over decades, so recovering the equity that vanished will not be an overnight event.

To make matters worse, the time-to-recovery in home price declines is measured in a matter of years, not months. Without wage gain, and if he Republican plan to shift more health expenses to workers gets enacted, workers can forget about significant home price increase. This will happen simply because no one will have the extra money to put into a new home down payment and purchase.

Who Will You Sell the House to at a Profit?

This leads us to the other critical discussion that is not mentioned by advocates of the real estate recovery: Who will you sell your house to at a profit in five of 10 years?

That’s the key question which transforms a house from being a mere shelter to an investment. Now, there is nothing wrong with a houses being just a place to raise your family, but if Americans want to regain traction as a wealth-building nation, the house has to become an appreciating financial asset again. That means it has to appreciate in price to an extent that a new buyer can pay the new, higher price. For that to happen, their savings have to grow above the inflation rate.

But that simple assumption is threatened because real wages are not growing. Since 2007, wages have not grown. From 1973 until 2006, the average hourly wage as U.S. workers went from $18.90 to $21.34., according to the Economic Policy Institute. That translates into a meager 13% increase in 33 years, or abound 0.4% per year. If you factor in wages and benefits, the median worker’s pay package rose just 0.2% per year from 1983 to 1989. Even worse, if that is possible, from 2002 to 2007, worker compensation did not increase at all.

What this means is that the average worker’s pay has been stagnant since the 1970s, or about the time Ronald reign took office. (He was president from 1981to 1989, which is about the time when workers’ real wages began to stagnate.)

So when the media reports that housing “is on the rebound” and “moving higher,” take it with a grain of salt. Yes, the price of a house is more attractive because of the record-low interest rates, but that has nothing to do with the potential for home price appreciation, which is the primary engine behind rebuilding the huge amount of wealth that has been lost since the start of the great recession in mind-2007. For that to happen, real wages for most Americans has to increase.

But if the Republicans advance their plans to privatize Social Security into a fee-laden, limited investment offering that will become subject to increasing market volatility, your newly-privatized Social Security accounts will become the liquidity pool for the growing financial class. If that happens, your house will become just a shelter and never an investment. That’s one vision of the new America if real wages stagnate and Social Security is privatized.