Too many financial professionals ignore the daily news and instead focus on their businesses.

This is acceptable, except when the news directly impacts their industry and customers. When financial and investment news erodes customer confidence, it should be a major concern for anyone in the industry.

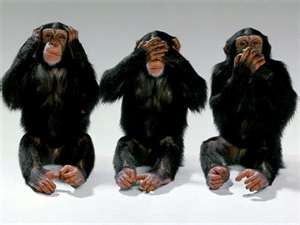

Yet when this happens in the investment business, too many financial professionals (advisors, brokers, planners) intentionally ignore the bad news in the hope that a client will never ask tough questions about their own industry.

For too long, too many financial pros have been whistling past the graveyard when it comes to their own industry. In some case, market manipulations of the world’s largest markets have been going on for over a decade, as regulators failed to detect it and investors (individual and institutional) suffered the monetary consequences.

News reports since 2013 have found that the world’s largest banks have profited by distorting key financial world markets in interest rates, currencies and commodities. Yet despite this dire news, financial professionals ignore very serious legal and ethical breeches that involve some of the biggest financial institutions on the planet, which in a global investment world, affect their own customers, their investments, public markets, and erode investor confidence.

Consider the following:

Currency Market Manipulation

In March 2015, the U.S. Justice Department said it is seeking about $1 billion each from global banks being investigated for manipulation of currency markets, according to Bloomberg News. “The figure is a starting point in settlement discussions, with some banks being asked for more and some less than $1 billion. One bank that has cooperated from the beginning is expected to pay far less, one of the people said. Penalties of about $4 billion are on the table,” the report said. Not only are the banks involved among the largest in the world (Barclays Plc, Citigroup Inc., JPMorgan Chase & Co., Royal Bank of Scotland Group Plc and UBS Group). But the currency market itself is considered the most liquid market in the world. Attempts to manipulate parts of this market are unthinkable, yet the banks succeeded.

Swaptions Manipulation

In August 2013, Bloomberg reported that U.S. investigators found evidence that banks “reaped millions of dollars in trading profits at the expense of companies and pension funds by manipulating a benchmark for interest-rate derivatives.”

In this swaptions manipulation, banks sought to change the value of the swaps because the ISDAfix (International Swaps Dealers Association) rate sets prices for the other derivatives. IN this scheme, traders worked to manipulate prices on the close when trading was thin. They did this by telling their rate-swap colleagues the level at which they needed ISDAfix to be set that day in order to bolster the value of their derivatives positions before these were settled the next day, according to a Bloomberg News report.

Then, the rate-swap trader would tell a broker at a firm which arranged contracts between banks to execute as many trades in interest-rate swaps as necessary to move ISDAfix to the new, artificial level. This would be done just before 11 a.m. in New York, the time when current trades are used to create reference points that help determine the final ISDAfix rates, Bloomberg said.

LIBOR Interest Rate Manipulation

In June 2013, news broke that the Libor (London Inter-Bank Offer Rate), a benchmark for $300 trillion of securities, was underway. This probe led to fines of about $2.5 billion against Barclays Plc (BARC), UBS AG (UBSN) and Royal Bank of Scotland Group Plc. (RBS)

In a report, Bloomberg said “While the indexes under scrutiny are little known to the public, their influence extends to trillions of dollars in securities and derivatives. Britain’s markets regulator is looking into the currency market, where $4.7 trillion is exchanged each day, after Bloomberg News reported in June that traders have manipulated key rates for more than a decade. “Yet despite the news, some

commentators, such as CNBC’s Larry Kudlow, sought to minimize the damage caused by the LIBOR price fixing by insisting there were no victims of the manipulations.

Housing Market Manipulation

The 2007 housing recession was the culmination of a top-down, bottom-up manipulation of the residential housing market by everyone from real estate agents, appraisers and mortgage companies to the derivatives traders at the nation’s largest banks who packaged fraudulent loan tranches in corrupt market securities. This was an open secret in the industry and one which eluded sleepy regulators for years.

At least seven years after the recession, and the destruction of trillions in housing equity and wealth, average investors and simple homeowners alike are still climbing out of the hole created by banks that were too-big-to fail. Not surprisingly, today, average Americans say they have limited faith in the financial system.

Financial Professionals Asleep?

So as these global price and market manipulations engulf international market regulators, where does this leave financial professionals on Main Street? Not surprisingly, too many ignore the news as if it was a messy disaster in a far way place, one which would never affect them in their own homes.

But for average investors, these manipulations are serious business. They show that markets are rigged. Esoteric markets, such as swaptions and LIBOR, but maybe even the U.S. equity markets where they invest for retirement and college education. What’s more, maybe the financial institutions which handle their own money are guilty of market manipulations. Who can tell?

So what should a concerned financial professional do?

My bet is that the worst thing to do is to ignore the news reports. The investigations are serious and not as Kudlow says, a non-event. If they were, why would these targeted banks agree to pay millions in fines?

Maybe it’s time for financial professionals to get more involved in their own industry by becoming more vocal about policing the markets where their own clients invest their money. Banks that have become too big to fail do not deserve the confidence of individual investors and financial professionals when they become parties to market manipulation.

Maybe it’s time for social investing to become more aggressive. Don’t invest in investment products offered by banks names in global market manipulation probes. These withdrawals and transfers should be initiated by financial professionals who are vigilant about their client’s assets.

Similarly, individual investors should close accounts at banks named in global manipulation probes. Investment companies are paid by their assets under management. When those assets decrease, bank profits suffer. This is a deserving end for criminal enterprises. It’s also a great way to protect hard-earned investment assets.