When asked about the major issues facing Americans in the 1992 presidential election, James Carville, a strategist for then-presidential candidate Bill Clinton, said, “It’s the economy, stupid.”

Carville told campaign workers that the three issues facing Americans were health care, avoiding the same mistakes perpetuated by George Bush, and the economy.

About 32 years later, little has changed. Today, the economic issue facing Americans is not the economy or inflation but something more insidious: income inequality.

Again, this is nothing new.

Income inequality has fluctuated since 1915, when the government began to track income inequality, and it has fluctuated since due to changes in inflation, unionization declines, economic shocks, and tax policies. But since 2016, income inequality has been steadily increasing by almost any measure:

- The share of American adults living in middle-income households has decreased from 61% in 1971 to 51% in 2019. This downsizing has proceeded slowly since 1971, with each decade after that typically ending with a smaller share of adults living in middle-income households than at the beginning.

- CEO pay has skyrocketed by 1,460% since 1978. According to the Economic Policy Institute, CEOs were paid 399 times as much as a typical worker in 2021.

This constant and widening wealth gap affects every aspect of America’s economic and political life. It happens because of technological change, globalization, the decline of unions, and the eroding value of the minimum wage. Most professional political pundits miss the political economy of the wealth gap, and for good reason. The neoliberal political-economic problems are systemic; they question whether unregulated capitalism works. It does not.

The wealth gap affects people’s political outlook, their faith in the U.S. democratic system, their future plans, and where they live. A recent article in Bloomberg found that “the wealth gap between homeowners and renters has never been higher. In the past three decades, the average wealth of homeowners increased by almost $900,000. For renters, the increase is only by $56,000,” according to Saleah Mohsin.

Housing ownership only exaggerates the wealth gap between the haves and the have-nots. Owning a home remains the most significant wealth creation engine in the U.S. Without ownership; families are stuck as renters on a treadmill of payments.

In the same article, Shaun Donovan, the secretary of Housing and Urban Development during the fallout of the 2008 financial crisis, said, “There’s plenty of data that shows that our economic mobility has slowed down and that moving up the economic ladder is harder and harder in the US. I’ve never seen the affordability crisis this bad.”

More Problems With Anti-Trust Enforcement

Antitrust regulation helps everyone participating in the economy, from small businesses to individuals who can shop around for better prices, services, and amenities from more innovative and aggressive suppliers for the best deals that fit their budget.

Buying from a few providers benefits the bog providers, not the average consumer.

This is evident in housing, food, medical services, and industry sectors that have become a limited source of sellers due to distortions created by private equity firms. Institutional investors owned about 4% of the 15.1 million single-unit rental properties in the U.S. as of February 2024. Worse, CNBC claims that by 2030, institutional investors will own nearly 40% of the nation’s single-family rentals.

The income gap is possible through the lack of antitrust enforcement, monopoly tendencies in mature markets, and private equity firms that use speculative capital to target industries where private equity speculators see opportunities (private prisons, medical practices, technology, and healthcare.)

How Income Inequality Disrupt Everyday Life

In everyday life, American consumers now have to compete against organized business forces like private equity, whose primary purpose is to extract more profit from every business sector they consume. Profit maximization creates a spiral of high prices even as the quality and level of services decline.

In housing, people looking to buy their first home or buy a more prominent house face dealing with corporate sellers whose primary goal is to increase prices and reject more offers because they have the backing to keep the house off the market for as long as they want until they get an offer that meets their price and target profit margin. Private equity firms have become the country’s most prominent corporate landlords. In 2023, private equity accounted for 44% of all flipped homes nationwide.

Private equity home purchases disrupt the buy-sell market since corporate, private equity sellers have deeper pockets and are not enticed to sell because the private equity corporation does not have a new job or expanding family to deal with. That’s the problem when individuals are dealing with corporations versus another human family with more human considerations, such as let’s move before the new school year starts. Private equity corporations couldn’t care less about these factors.

So, when voters say they are concerned about “the economy,” what do they mean?

It’s not only inflation, which originates in monopoly capitalism and “sticky prices.” It’s the more powerful impact of income inequality, disproportionate income distribution, and all the economic and political distortions it creates.

Corruption in the U.S. Supreme Court, politicians owned by corporations, lobbyists who write legislation at the state and federal levels, buying politicians, and pay-to-play access to political discussions are all part of income inequality.

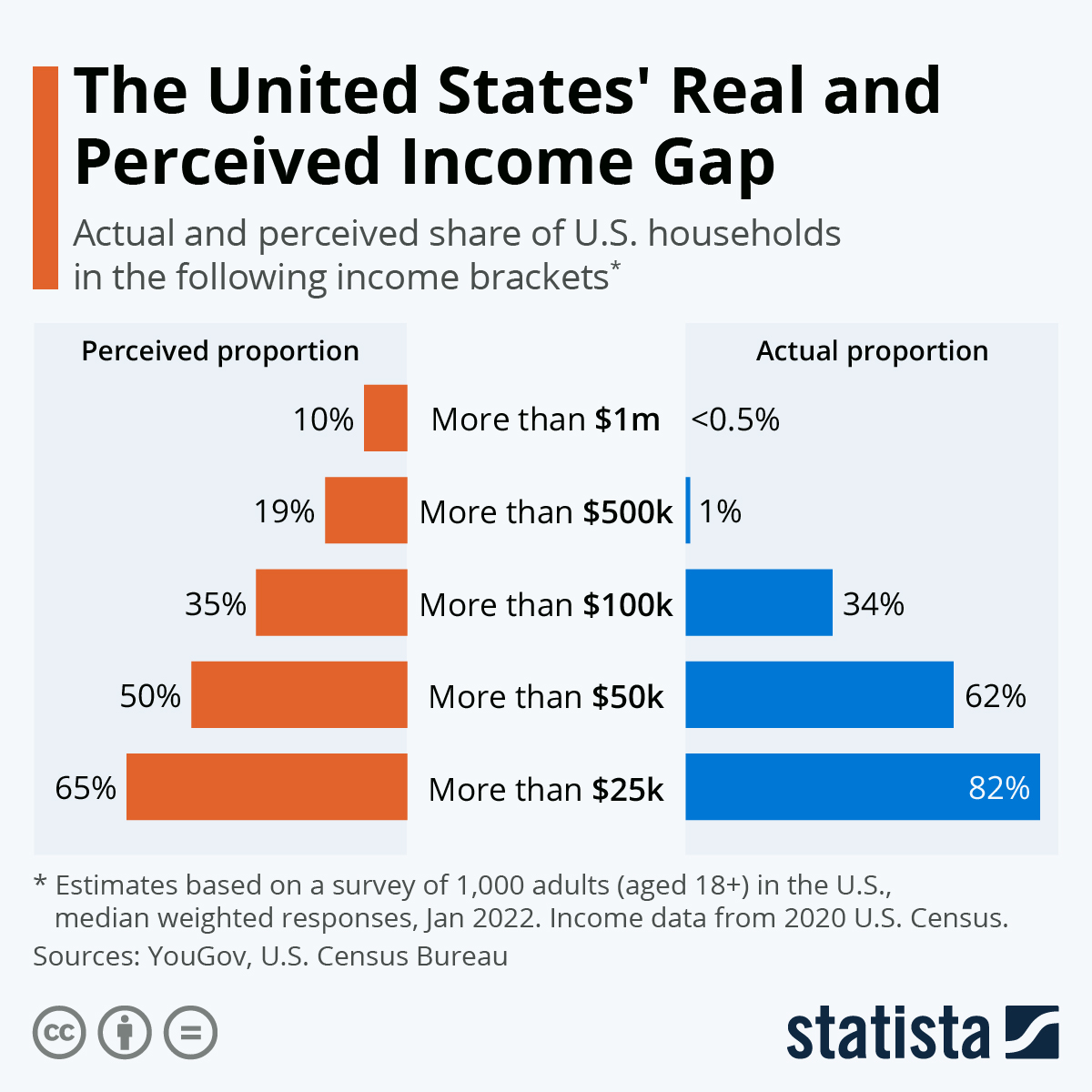

The media ignores this because they cannot criticize the capitalist system or even begin to explain unregulated capitalism to regulated capitalism. The American public is too ill-informed to understand the differences. As detailed in this article, this sad fact has been verified in years of surveys and studies.

So, as Americans go to the polls, only the progressive Democrats led by progressive Senators Bernie Sanders and Elizabeth Warren have addressed the dangerous impact of the wealth gap. Most mainstream politicians, including Democrats, avoid this discussion because they believe it is too contentious or would undermine confidence in the existing economic and political systems.

But that is precisely what is happening anyway.

The electorate is way ahead of the politicians. The negative impact of income inequality explains why government at all levels is held in low esteem and why voters think too many politicians are corrupt or bow to bid donors.

All this verifies the point: It’s the wealth gap, stupid.

Address it and see the results. Closing the gap will benefit 95% of all Americans.