Fool’s mate happens in chess when a player, often a novice, is boxed into a position where any action leads to defeat.

That’s the case for individual investors today as evidenced by news stories involving two of the nation’s largest financial institutions.

Taken together, these events involving JP Morgan, with $1.7 trillion in assets under management, and LPL, the nation’s largest firm representing independent financial advisors, show that average Americans, both rich and poor who are interested in getting the best investment advice possible and the greatest possible return, are routinely being victimized by the very people who are supposed to be helping them, their well-informed financial advisors.

In the first case, JP Morgan received subpoenas from the Securities and Exchange Commission and requests for information from other regulators about selling practices regarding its own proprietary mutual funds and other proprietary products, according to a May 6, 2015 Investment News report. JP Morgan had the highest percentage growth in asset inflows of any large manager in the five years through 2014, ending the period with $1.7 trillion in assets under management, according to a February presentation to investors.

Now, federal and state regulators are asking for information about the bank’s sales of proprietary products in its wealth-management business. News reports said JP Morgan is cooperating, but, of course, they don’t have any other choice.

Now, federal and state regulators are asking for information about the bank’s sales of proprietary products in its wealth-management business. News reports said JP Morgan is cooperating, but, of course, they don’t have any other choice.

The bank is also on record as saying the banking industry is under too much regulatory scrutiny.Reports said the SEC “has been looking into whether the bank and its brokerage affiliate adopted a strategy that uses bonuses and other incentives to encourage their financial advisers to steer clients improperly into in-house funds, structured notes and other investments that generate fees for the bank.”

This is a standard industry practice and is propelled by revenue sharing, 12b-1 fees, the need for bank advisors to earn excessive sales commissions and other in-house incentives to push in-house products over other outside managed funds. In most cases, outside funds generate better returns and have lower expenses. But it looks like JP Morgan’s sales force didn’t consider what was best for their well-heeled clients, proving that even the much-sought after high-net worth client is fair game to be victimized.

Not surprisingly, JP Morgan had the largest influx of new money of any large investment manager in the five years through 2014, according to Bloomberg News, so one has to wonder whether misleading andante-fiduciary standard sales practices were involved in generating this huge influx of new money.My bet is that it did. As a result, sophisticated investors were duped or just failed to do their own due diligence. My bet is that both happened.

So Much for Quality Independent Advisory Firm Management

In the second case, the Financial Industry Regulatory Authority (FINRA) ordered LPL Financial to pay about $12 million in fines and restitution for what it deemed “widespread supervisory failures” related to sales of complex products, according to a news report in Investment News, May 6, 2015.LPL is “the nation’s largest independent broker-dealer, a top RIA custodian, and a leading independent consultant to retirement plans.” according to the company’s web site.

It also supervises over 14,000 financial advisors and approximately 700 financial institutions.From 2007 to April 2015, the Investment News article said LPL “failed to properly supervise sales of certain investments, including certain exchange-traded funds, variable annuities and non-traded real estate investment trusts, and also failed to properly deliver more than 14 million trade confirmations to customers, according to FINRA.

LPL did not have a system in place to monitor the length of time customers held securities in their accounts or to enforce limits on concentrations of those complex products in customer accounts, Fire said. This means clients were over- or under-exposed to equity or bond sectors that could reduce their returns or increase their risks. All this happened at the same the LPL boasts on its own web site that it has state-of-the-art technology to enhance the investing process. Don’t believe everything you read.

The systems that LPL had in place to review trading activity in customer accounts were plagued by “multiple deficiencies,” FINRA said. The firm failed to generate proper anti-money laundering alerts, for instance, and did not deliver trade confirmations in 67,000 customer accounts, according to the settlement letter.All this earned a penalty including a $10 million fine and restitution of $1.7 million to customers who were sold certain ETFs. FINRA said LPL could pay more to ETF purchasers.

Fool’s Mate for Average Investors

So what do these two seemingly isolated news stories mean to average investors?My take is that both rich and poor are being victimized by the largest financial institutions in their respective categories: global giants like JP Morgan with $1.7 trillion in assets under management, down the nation’s largest independent advisory firm, LPL, that boasts of exceptional technology and acting in the best interests of their customers.

Both of those claims are now pretty worthless. As expected. Jamie Dimon, the CEO of JP Morgan, is on

record as saying Morgan and other global too-big-to-fail banks, are under too much regulatory scrutiny. In this CNN interview, Dimon said the bank was “under assault” by regulators. When asked for more details on that, he responded by saying, “You’ve got to be kidding me.” Dimon said things were so bad due to excessive regulation that the bank reported a $4.9 billion profit in the fourth quarter 2014. Things are tough.

Too much regulation is the Republican mantra. The GOP seeks to roll back all regulation in everything from the environment and banking to food safety and working conditions, as they push for cuts in Social Security, Medicare and raising the retirement age as they simultaneously seek to roll back the new health legislation and push for a new trade agreement that exports more jobs to the world’s poorest nations.

All this is happening at a time when hedge fund managers at the big SALT conference in Las Vegas are predicting slower economic growth, continued low interest rates, which cuts into the growth in retirement accounts and continued economic inequality.

The good news, for social ethicists anyway, is that misleading investors in America is an equal opportunity

practice. It is done regardless of race, creed, income, geography and age.

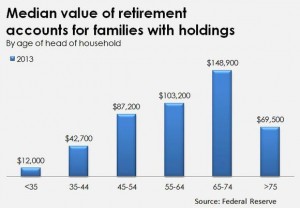

Put it all together and you have a future scenario where the average American will work until they drop or get laid-off due to age discrimination. Add to that a median retirement savings account of less than $60,000 held by Americans, according to the Federal Reserve.

Those savings differ by different age groups, so in the real world, the average person retiring at age 65 with $103,000 in retirement savings would withdraw just $4,120 in their first year of retirement, or $343 per month. “That’s hardly enough to live on,” according to the Motley Fool.This is a dire vision of the new America. We’ll have to see whether the upcoming posse of presidential candidates who will spend billions convincing people they really care about their best interests, will even acknowledge America’s sad new future.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

Hi. I would be interested in any of the sites you mentioned in your note.

Chuck Epstein