Ken Griffin (net worth: $46 billion), the CEO of the powerful Citadel hedge fund investment company, knows about money, power, and how federal policies affect business and profit flows. That is his job.

So, it is surprising that Griffin said that President-elect Donald Trump’s economic policies, including the implementation of his controversial tariff policy, will lead to massive corruption in the form of “crony capitalism.”

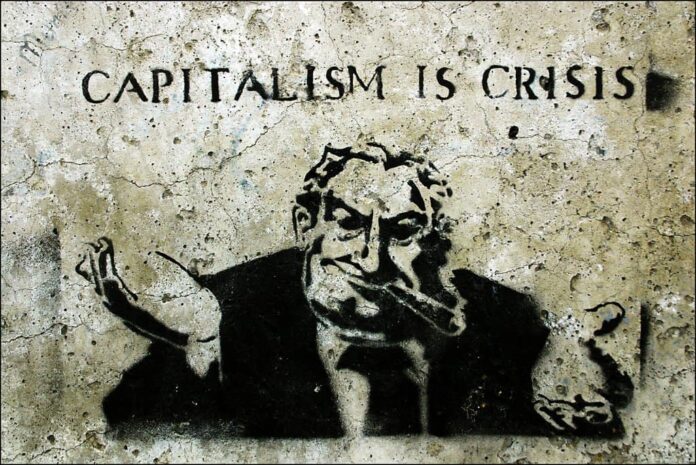

According to a report on CNBC, crony capitalism is an economic system marked by close, mutually advantageous relationships between business leaders and government officials.

“Those same companies that enjoy that momentary sugar rush of having their competitors removed from the battlefield soon become complacent, soon take for granted their

newfound economic superiority, and frankly, they become less competitive on both the world stage and less competitive at meeting the needs of the American consumer,” Griffin said.

Griffin refers to the preferential treatment the tariff policies will give Trump’s most prominent supporters and contributions. This list is long, especially among the investment class.

As noted in other articles on this site, Trump has attracted an army of capitalist jackals who made significant contributions and now want their payback. That payback will come in the form of political appointments, cabinet posts, or even better, a say in how tariffs will favor their companies at the expense of domestic and foreign competitors and the average American consumer.

Griffin’s surprising reference to “crony capitalism” shows he is concerned about how better-run corporations with good management could fall prey to lesser competitors whose management is connected to Trump.

Speaking at the Economic Club of New York, Griffin said, “Now you’re going to find the halls of Washington filled with the special interest groups and the lobbyists as people look for continued higher and higher tariffs to keep away foreign competition and to protect inefficient American businesses that have failed to meet the needs of the American consumer. “

Griffin’s comments are newsworthy because he is a dedicated Republican and Trump supporter. He contributed $100 million to Trump in the 2024 election. His remarks also show that free market capitalism is being jeopardized by “Trump’s rejection of the traditional Republican free-market orthodoxy in favor of industrial policy,” as Peter Turchin wrote on Bloomberg.

This is anathema for Republican economic purists. Griffin also predicts the rise of American oligarchs who will benefit from Trump’s selective tariff policies.

The Plutocrats Who Are Ready to Pounce

On the domestic side, this article lists Trump’s most significant contributors who have positioned themselves to benefit from the tariff negotiations. Trump has already floated the tariff proposal, which includes a 20% levy on all imports from all countries and a very high 60% price increase for Chinese goods.

Trump is poised to create the first generation of American plutocrats. His entire approach to business is a quid pro quo. As president, he can add billions to his net worth by selling off this access to federal assets and preferential treatment in the marketplace.

This was all predictable, but the American people knew this would happen. Now, they will suffer for at least four years by paying higher taxes to offset his upcoming tax cuts to the rich and a corrupted economy that favors his contributors.