There is a great scene in the movie “Titanic” when the chairman of the White Star Steamship Company, J. Bruce Ismay, the heir to the family that owned the Titanic, sneaks into a lifeboat that was reserved for women and children. In the movie, Ismay pushes past one of the ship’s officers to enter the lifeboat. When he is recognized, the company executive looks sheepishly down but enters the lifeboat with the women and children. He was one of 325 men to survive the sinking ship.

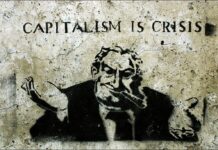

That is a great analogy for the hedge fund and the private equity industries in April 2020. Some executives of these firms (the number is now not clear) are not ashamed of reclassifying themselves as “small businesses” in order to qualify for the small business loans in the $349 billion Paycheck Protection Program administered by the Small Business Administration.

As this Bloomberg article found, some hedge funds have filed out the paperwork claiming “they have fewer than 500 employees and certifying the ‘current economic uncertainty makes this loan request necessary to support the ongoing operations.’”

Of course, this is a lie. Hedge funds, as noted in this article on the hedge fund scam posted on this site, will not pass up the chance to get free federal money. They are structured as general partnerships, not small businesses and they also do not employ large staffs since they rely on technology, not people. They also are not essential to the economy since they are investment firms that cater to wealthy individuals and corporations who need access to alternative strategies and markets. Hedge funds are also unregulated, so that attracts a whole different class of clients.

The Bloomberg article says some executives in the hedge fund industry are warning that taking the federal small business money is unethical. They cautioned that it could create a public backlash. Hedge funds that take the federal money can be named in a Freedom of Information request. If that happens, it will be like the top executive of the Titanic sneaking into a lifeboat with the women and children and then suffering the indignity of being recognized for all posterity as a coward.

But let’s not overstate the ethical and moral qualities of top executives in hedge and private equity funds. Both are opportunistic traders. They are unregulated, so some of these firms will push the boundaries of any opportunity to the line that separates legal from illegal.

Still, some hedge funds are applying for this money because they claim they will use it to pay receptionists and office managers. If this were true, it would make these staffers very rich. But I doubt that will happen. As noted in this article, Anthony Scaramucci, who served in the Trump administration for a total of 11 days and has a net worth of $200 million, says hedge funds should be eligible for small business loans. Scaramucci’s hedge fund, Skybridge Capital, has seen redemptions in the last year, so maybe he could use the loan himself or for his receptionists.

As for Ismay, we know his name today, 108 years after the Titanic sank, because he broke an ethical and moral rule. “But by the time the Titanic’s survivors reached New York, Ismay was one of the most reviled men on Earth,” according to this report on NPR.

Like Ismay, I am sure there are a few hedge and private equity fund executives who will take Scaramucci’s advice and gladly line up for the federal bailout money designated for small businesses. And like Ismay, when their names become public, they should suffer the same reputational death as Ismay.

[…] hedge fund industry has manipulated financial regulation for decades. In its latest iteration, it has even applied for COVID federal […]