Millennials are being squeezed out of homeownership and that will reduce their ability to become wealthy over the next decades, increase health risks, reduce neighborhood cohesion, and impair educational advances for the kids of renters.

All of these are important side-effects when people become prolonged members of the rental class. While homeownership is recognized as the main engine to build wealth, its societal impact is overlooked at the expense of building a more cohesive nation.

But the initial impediment is the ill effects of wage stagnation and a changing job market on people who are looking to become first-time homebuyers but are now renting. Unfortunately, the prospects for this rental class to buy a home looks bleak.

A new report from Apartment List in their 2022 Millennial Homeownership Report found that 66% of Millennials who want to purchase a home don’t have any savings ($0) for a down payment. The impact of this is both immediate and long-term since homeownership is the main engine behind wealth creation.

After years of wage stagnation, and now the reality of rising interest rates, a lack of housing stock that is pushing home prices higher, Millennials (individuals born between 1981 and 1996, or people who spanned the ages 25-40 in 2021) may be the first generation to re-think the American Dream.

“The Millennials that we surveyed overwhelmingly cite affordability as the primary obstacle holding them back from homeownership,” according to Chris Salviati, housing economist, the List.

“Of those who say that they expect to always be renters, 77% tell us that it is due to affordability rather than a preference for a more flexible renter lifestyle. Similarly, among those who would like to purchase a home but have yet to do so, 71% say that affordability is what’s holding them back.

“We’ve been running our survey since 2018, and while affordability has always been the dominant concern, it has only worsened in recent years.”

How bad is the homeownership problem?

The survey found that 66% of Millennials have no down payment savings at all, while 18% have saved less than $10,000, and just 16% have saved more than $10,000. Only 2% of the Millennial renters surveyed have saved enough to make a 20% down payment on the national median condo price (specifically, a $60,000 down payment on a median price of $299,900).

Younger People Are Opting Out of the American Dream

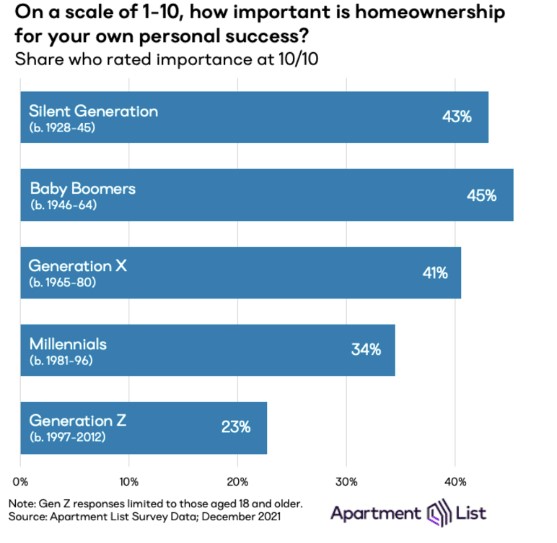

Owning a home was a stronger belief for Baby Boomers than for younger generations. In a March 2022 report, Generational Attitudes on Homeownership, Baby Boomers said they were nearly twice as likely as members of Gen Z to rate the importance of homeownership at 10 out of 10.

As this chart shows, younger people are abandoning the idea of owning a home since it is financially unattainable, or does not fit into their future lifestyle plans. Policymakers have yet to determine how this will affect the future of American society.

Homeownership Problems Are Endangering the Financial Security of a Generation

Economists, policymakers, and investment experts share the belief that the main contributor to building wealth over time is an investment in a home. While there are pros and cons of renting versus homeownership, it’s generally agreed that owning a home provides more financial security, the ability to build home equity, and is better for society and neighborhood cohesion than being a member of the renter class for long periods of time.

“Homeownership has been the primary vehicle for wealth creation in the U.S. for decades. If the Millennial homeownership rate continues to lag that of prior generations, it could have significant implications for the long-term financial security of this generation,” Salviati said.

The Societal Impact of Homeownership Problems

Impact on Health

“Where people live—and especially where children grow up—is critical to long-term well-being, including life expectancy, health, and income,” according to Jenny Schuetz, Senior Fellow – Brookings Metro, Future of the Middle-Class Initiative

“Housing has long been recognized as a major social determinant of health. Other determinants include socioeconomic status, race/ethnicity, and geography among others. These determinants, including housing, are arguably the most significant identifiers of health between different social groups disparities in the United States,” according to the Prosperity Now website.

“Existing research has broadly identified four main pathways that housing affects health: stability, quality, and safety, affordability and neighborhood characteristics.” The article also said that “the negative health impact of housing unaffordability appears to be greater for renters than homeowners.”

Homeownership Builds Neighborhoods

“Homeowners move far less frequently than renters, and hence are embedded into the same neighborhood and community for a longer period,” according to an April 2012 study, “Social Benefits of Homeownership and Stable Housing” by the National Association of Realtors (NAR). The report also found that 4.7% of owner-occupied residents moved from 2010 to 2011, and 26% of renters changed residential locations. The key reason for the higher “mover rate” among renters is the fact that renters are younger – that is, changing and searching for ideal jobs, not yet married, and hence, literally, less committed.”

Homeownership Enhances Education and Reduces Child Pregnancy

The same NAR study found that homeownership “does make a significant positive impact on educational achievement.” This is because the children of people who own homes stay in school longer.

Homeownership also reduces teen pregnancy. “Furthermore, daughters of homeowners have a much lower incidence of teenage pregnancy.”

Passing Along Financial Responsibility to Children

The NAR study noted that owning a home creates “certain behavioral characteristics” that “get passed onto their children.” These derive from the fact that buying a house is a major financial commitment, so “homeowners, therefore, tend to minimize bad behavior by their children and those of their neighbors that can negatively impact the value of homes in their neighborhood. Second, homeowners are required to take on a greater responsibility such as home maintenance and acquiring the financial skills to handle mortgage payments.” This means that doing chores around the house is not just make-work, but a means of instilling pride in ownership and responsibility.

Long-Term Education Benefits of Being an Owner

The study also cited research from a sociologist and an economist that concluded that there is “a higher overall quality of life among homeowners, which contributes “to the well-being of both homeowners and their children in a number of ways. For example, young children of homeowners tend to have higher levels of achievement in math and reading and fewer behavioral problems (which often carry over into reduced deviant behavior in later years).”

The children of homeowners also move on to get a more advanced education. Owning a home “helps explain increased educational attainment and higher lifetime annual incomes of homeowners’ children. Research has also confirmed that access to economic and educational opportunities is more prevalent in neighborhoods with high rates of homeownership and community involvement.

One study found that the average child of homeowners is significantly more likely to achieve a higher level of education and, thereby, a higher level of earnings. The authors further find the housing tenure of parents plays a primary role in determining whether or not the child becomes a homeowner.”

So Why Don’t Conservatives Push for More Home Ownership Opportunities?

The results of these studies point out the societal benefits of owning a home, as well as the benefits of individual responsibilities in maintaining a home and strengthening the neighborhood’s social fabric.

So, if these benefits are well-known, why do conservatives oppose programs that could enable more people to buy homes, such as raising the minimum wage, and reforming expensive health care and child care costs that erode the middle class’s ability to save more for a down-payment?

The answer is that these long-term societal benefits are subordinated to the lobbying goals of financial institutions that oppose federal home purchase assistance or any other reforms that would raise real wages, and reduce predatory costs from student loan debt, childcare, and unaffordable health care. Eliminating tax loopholes and changing the tax code to force billionaires to pay more in taxes would help Millennials own homes, but the system opposes these reforms.