First, there was significant student debt, then jobs that didn’t pay a living wage, job insecurity, and the rise of the gig economy.

The net effect of all these factors is that millennials now say they will be renters for years, some say forever. Even worse, this will definitely impact building retirement wealth and whether some Millennials will be able to retire at all.

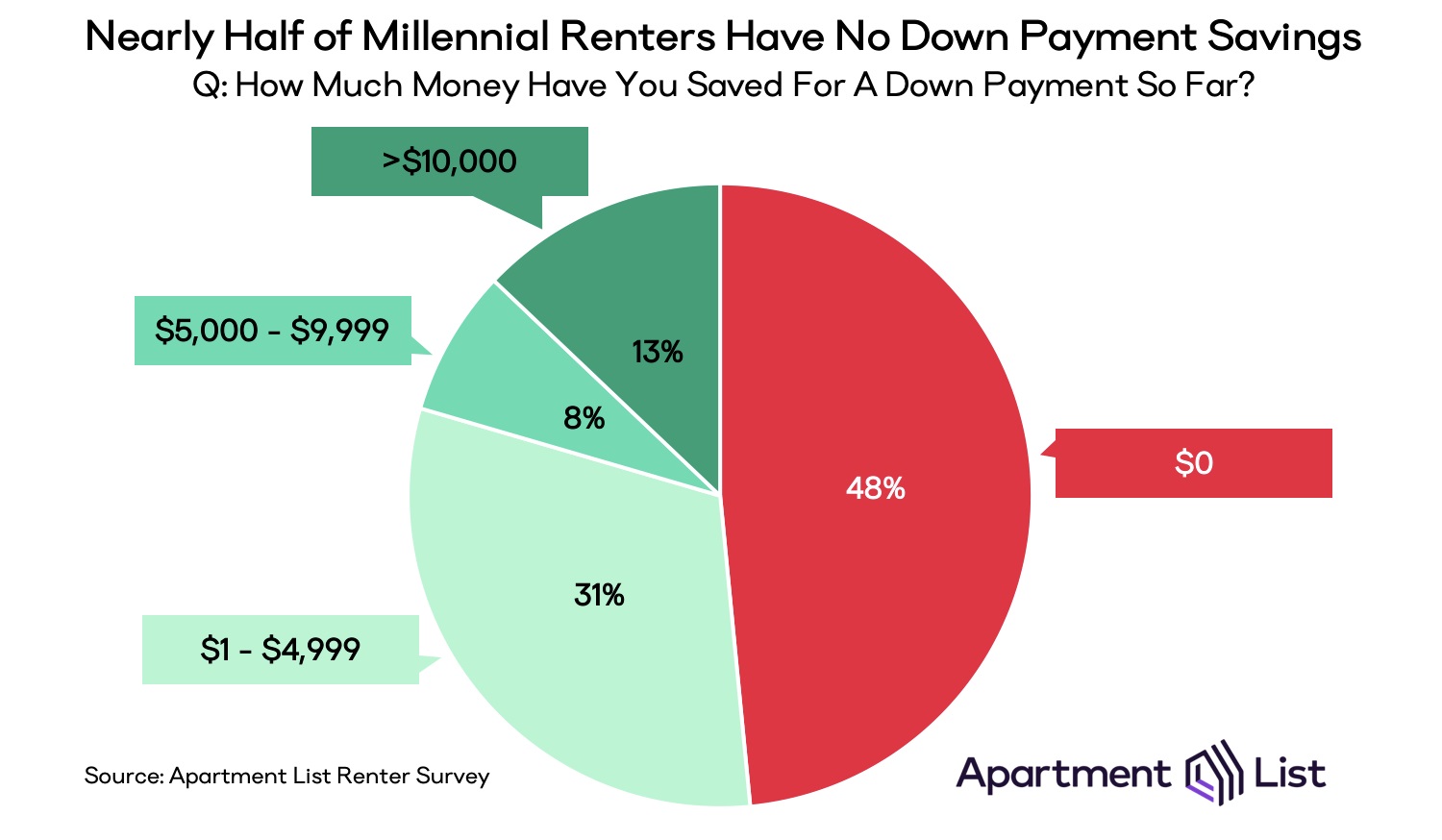

The latest bad news comes from a survey by Apartment List’s 2019 Millennials & Homeownership Report that analyzed the attitudes, expectations, and actions of over 10,000 millennial renters in the U.S.

The new report found the following:

- One in eight millennial renters expects to rent forever (up from one in nine just a year ago). However, of those who wish to purchase a home, 48% have not yet started saving towards a down payment.

- At current savings rates, just 25% of millennial renters will be ready to put down 10% on a median-priced starter home in the next five years.

- Forgiving student loan debt would be a significant boon to millennial homeownership. If debt payments were instead put towards savings, we estimate the percentage of millennial renters ready to buy a home would rise from 25% to 39%.

- To cope with high costs, 17% of millennial renters expect down payment support from family, down from 19% in 2019. Plus, those who wish assistance now expect less: $9,000 on average in 2019, down from $10,000 last year.

Not surprisingly, the report said 70% percent of renters say affordability is why they have not yet (or will never) purchased a home.

“Furthermore, student debt continues to be a barrier, and millennials expect lower financial assistance from their parents than in prior years. These statistics indicate that millennials are unlikely to catch up to previous generations in homeownership in the coming years, especially if the United States experiences another recession.”

Connections Between Housing Wealth and Retirement Security

While homeownership has significant benefits and expenses, owning a home has traditionally been part of the American Dream. But that has changed.

Homeownership provides the opportunity for asset appreciation, tax deductions of interest payments, and access to a reverse mortgage later in life.

While this study addresses rental patterns among millennials, other studies have tracked baby boomers and found that when they plan to retire, housing wealth accounts for most of their net worth, outsizing portfolio wealth.

Numerous academic and government studies show that home equity is paramount in determining overall household wealth, especially among people over age 55 with the highest homeownership percentage.

A 2002 study found that 82% of those in the study who were aged 60 to 64 owned their residence, with a typical home equity of $120,000. A 2004 survey of consumer finances found that Social Security accounted for 42% of total wealth for a typical family approaching retirement (sample household headed by a person aged 55 to 64), followed by the principal residence (21% of total wealth), as cited in the paper, “The Impact of Diminishing Wealth on Future Consumption: How Housing Wealth Affects Retirement Planning.”

Then, there is also the benefit of accessing a reverse mortgage if a person owns a home. Reverse mortgages allow the owner to access the equity in their home without paying money out of their budget. These are asset-based loans secured entirely by the home. They are attractive because there are no monthly mortgage payments. This is one reason why reverse mortgages are appealing to people with low incomes. Another is that homeownership can also be used to pay Medicaid expenses via a reverse mortgage.

The net message here is that another generation will have to find a new way to fund their retirement as they also rethink their current job opportunities, how to cope with wage stagnation and future ways to pay bills in retirement.

All this also shapes election preferences and how cities operate with more rental housing and affordability issues. So far, few politicians have even offered any potential solutions.