The best way for the average American to build wealth is through home ownership, which creates home equity accompanied by appreciation, which is difficult to achieve in the stock market.

The best way for the average American to build wealth is through home ownership, which creates home equity accompanied by appreciation, which is difficult to achieve in the stock market.

That’s why any weakening of the long-touted dream of people owning their own homes is critical to the long-term abilities of working people to become part of American society and share in its financial potential. Homeownership is also the primary way to secure retirement assets.

Yet, the 2007 recession, which severely reduced home equity for millions of Americans, seriously damaged a primary engine of wealth management. And that damage is still not repaired. This is compounded by new home buyers burdened by student debt that hurts their ability to get a home loan.

Consider the results of a new survey of 30,000 renters by Apartment List, which examined the connection between student debt and home ownership.

The study found that 51% of millennial college graduates in Los Angeles have student debt. 47% pay at least $300 each month. It also found that college graduates without student debt save $330 a month for a down payment, compared to $230 for graduates with student debt. Millennials without a degree save $170 a month.

The negative impact of student debt on Millennials without a college degree found they needed 29 years to save for a 20% down payment on a home in Los Angeles. Waiting 29 years for anything is a dream, so this is terrible news for the building industry, which must constantly be aware of the risks of recessions, interest rate hikes, changes in local demographics, and building booms. Now, they can add student debt loads to their list of serious risks.

Student Debt and Lower Pay Affects Black and Latino Women The Most

According to an April 2022 study by The Education Trust, “a year out from graduation, Black women have 36% more undergraduate debt and 69% more graduate debt than White women.” The same study found that “student loans have been the barrier to economic mobility for Black women” because this group pursues college degrees at higher rates than Black men. As a result, Black women owe more in student loans than any group of college loan borrowers. Black women owe an average of $38,800 for an undergraduate degree and $58,252 on average for a graduate degree alone.

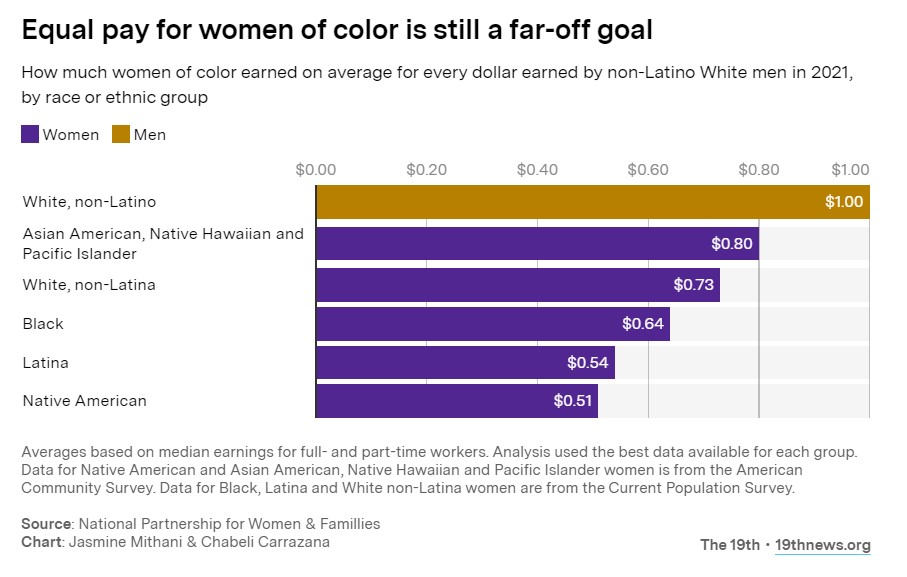

The second problem is that Black and Latina women make less than white men in the job market. Black women, on average, make 64 cents for every dollar a white man makes, while Latina women make 54 cents on the dollar, according to the National Partnership for Women & Families.

A Black or Latino woman with student debt and a low-paying job takes longer to pay off the student debt, and that decreases her wealth-building capacity. Higher student debt and lower-paying jobs make qualifying for a home loan harder. If the possibility of purchasing a house is delayed, it reduces the wealth-building capacity of home ownership.

Since these groups cannot buy a home, they become renters, and their monthly rent outlay goes to the landlord. This cycle can negatively affect generations of minorities and other Americans caught in this exact situation. This is why any political effort that the Democrats are leading to reduce or eliminate student loan debts for all borrowers is a long-term program to increase the wealth of Americans, many of them minorities.

Student Debt Hurts Investment Contribution Levels

Of course, student debt obligation has become a national political issue, so investment advisors should understand its scope and impact.

According to StudentLoanHero, Americans owe nearly $1.3 trillion in student loan debt among about 43 million borrowers. The average Class of 2016 graduate has $37,172 in student loan debt, up 6% from last year. However, the numbers also include default loans, forbearance, default, and repayment.

The loans cannot be dismissed via bankruptcy, and the loan rates are high. According to US News & World Report, the 2015 rate for a direct unsubsidized loan to undergraduates is 4.66%, and 6.21% for an unsubsidized loan to graduate students. However, this does not cover loans from private lenders, who have been criticized for excessively profiting from the loans.

Worse, for students pursuing advanced degrees, their loans also pose a significant risk to their ability to buy a house after graduation. Consider these loan amounts for advanced degrees courtesy of StudentLoanHero:

About 40% of the $1 trillion student loan debt was used to finance graduate and professional degrees.

Combined undergraduate and graduate debt by degree:

MBA = $42,000 (11% of graduate degrees)

Master of Education = $50,879 (16%)

Master of Science = $50,400 (18%)

Master of Arts = $58,539 (8%)

Law = $140,616 (4%)

Medicine and health sciences = $161,772 (5%)

Student Debt Relief is a Major Step Towards Wealth Creation

The bottom line is that student loan debt impacts the ability to buy a house and build an investment portfolio. These two substantial personal burdens are contributing to the U.S. retirement crisis.

While many politicians and top executives in the financial services industry want to deny or downplay the retirement crisis, attentive financial advisors will see this daily in their practices. Worse, there is very little they can do to correct the situation.

The solution will come from Washington, where Democrats are pushing plans to cut student debt. This is the first step towards building long-term wealth creation. It’s also a profoundly progressive decision with positive long-term effects.

Nice post!

Nice post!