Social investing has always been about race.

In its original application, which has somehow gotten lost in all the new variations of social investing, now known as Environmental, Social, and Governance (ESG) investing, racial equality was always the underlying engine for change.

In its earliest form, which started in the mid-1970s, social investing was an attempt to inject ethical and social factors into the basic investment guidelines. This attempted to combat the rigid and myopic legacy of imposing the economic model on investing.

In traditional economics, the focus was on the quantifiable components that drive economic growth. This included wages, interest rates, employment rates, investment levels, supply-demand, fiscal policy, and geopolitical factors.

But what was missing was the impact of those economic policies. As a result, economists and the entire economic establishment would never consider how economic policies affected living standards, disparities between rich and poor, environmental disasters, or pollution. When these outcomes were addressed, the economists considered them “externalities,” jargon for the derivative impact of policies, but never ones that could be quantified or considered as priorities when formulating economic policy.

As a reporter with the trade magazine Pensions & Investments in the mid-1970s, I covered the first plan to adopt social criteria in its investment policy statement.

As early as 1969, the Council on Economic Priorities provided institutional and individual investors with information about environmental and energy use, equal employment practices, defense contracting, consumer health and safety practices, political influence, and foreign investments in publicly traded companies.

In 1972, universities and philanthropies founded the Investor Responsibility Research Center to monitor social and environmental issues raised in shareholder resolutions. In 1971, the Interfaith Center on Corporate Social Responsibility focused on ending apartheid in South Africa. It soon had 15 Protestant and 150 Roman Catholic bodies monitoring the corporate and social responsibility activities of the companies they invested in.

The Start of Social Investing

The first fund to adopt a socially responsible investment policy was the Jane Addams Hull House in Chicago in the early 1980s. Hull House had a history of local community organizing and activism when it began helping new immigrants to the city’s south and west sides become acclimated to their new lives.

This non-traditional or alternative investment philosophy gained traction during the anti-apartheid movement in the late-1970s. At about that time, a set of guidelines was created in 1977 by Leon Sullivan, a Baptist minister, civil rights activist, and board member of

General Motors, who became a leading proponent against the apartheid policies in PW Botha’s South Africa. Sullivan reasoned that GM’s pension money, then at the time ranked as one of the nation’s most significant pension funds, would have political and economic clout if it took a social stand on racial policies, which were then attracting worldwide attention.

The ESG movement gained more traction in 1978 when the book The North Will Rise Again: Pensions, Politics, and Power in the 1980s, by Jeremy Rifkin and Randy Barber, advocated a social-political investment movement.

The Employee Benefit Research Institute 1979 also conducted a policy forum of the nation’s most significant funds, benefits lawyers, Washinton pension policy experts, and academics to discuss the implications of social investing as it concerned investment returns, ethics, fiduciary obligations, ERISA, pension asset ownership and corporate social responsibility. At this time, most institutional assets were in pension funds, not 401(k)s, so the emphasis was on different laws, investment practices, and fiduciary concerns.

In 1999, his Sullivan Principles were formalized to include racial non-segregation on the factory floor and in company eating and washing facilities; fair employment practices; equal pay for equal work; training for blacks and other nonwhites so they could advance to better jobs; promotion of more blacks and different nonwhites to supervisory positions, and improved housing, schooling, recreation, and health facilities for workers, according to the New York Times.

To Sullivan’s credit, his timing was excellent. He capitalized on the combination of assigning a new form of public political activism with investing, which became an explosive combination. This set the stage for a much broader social investing movement that, over the past approximately 33 years, has embraced such social issues as equal wages for women, environmentalism, anti-slave working environments, workplace safety, anti-child labor policies, anti-smoking, anti-defense weapons and the humane treatment of animals.

Investment companies, unions, and corporations in Europe also took notice of this change in investment policy criteria.

Soon, the investment criteria began to evaluate and rate companies that were polluters, had poor employment and race discrimination policies, violated laws, were engaged in sex discrimination, were not transparent, or engaged in anti-union practices.

Flash Forward to 2022

Flash forward to 2022, and ESG investing has become mainstream, thanks to a generational change in investors, the rise of Exchange Traded Funds (ETFs), the increase of 401(k)s, and the visible climate crisis.

While ESG in the U.S. has come under attack from far-right Republicans for the following reasons:

- ESG policies detract corporations from their primary goal of making the most significant profits possible;

- ESG gives shareholders too much influence over guiding corporate policies outside of direct business operations;

- ESG is a threat to traditional corporate and political power.

- ESG is incompatible with free-market capitalism and conventional economic theory.

In almost every area of ESG policies, these goals are challenged by cultural and economic

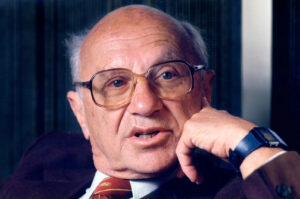

conservatives. For instance, on the financial side, economist Milton Friedman, in a famous New York Times op-ed on Sept. 13, 1970, “The Social Responsibility of Business Is To Increase Its Profits,” argued that asking corporations to pursue social responsibilities beyond profit was akin to preaching socialism. This meant that corporations had to include expenses, such as protecting the environment or advocating for affordable housing, as activities that would interfere with market processes.

So far, most attacks on ESG have been at the state level, such as in Florida, where Republican-dominated legislatures have passed laws that forced state pension funds to divest from firms that made ESG investments or could be used to issue state bonds.

Europe Moves Ahead in ESG Investing

But the story in Europe is different. In Europe, the number of ESG funds grew dramatically between 2020 and 2021, and assets under management reached about $107 billion by year-end 2020. Recent research found that returns from these investments met or exceeded those from traditional assets. As a result, investor interest in ESG investing is increasing, according to Agnes Sipiczki in a 2022 article, “A Critical Look at the ESG Market.”

For U.S. investors, there are more ESG investing opportunities now than ever. And despite the chicken-little, reactionary message from MAGA Republicans, the statistics for U.S. corporations adopting ESG standards are increasing.

According to the data research firm Perillon, As of 2020,

- 88% of publicly traded companies, 79% of venture and private equity-backed companies, and 67% of privately owned companies had ESG initiatives. [NAVEX Global]

- More than three out of four (77%) small and mid-caps have a formal purpose statement related to ESG. [Quoted Companies Alliance]

- Nearly one out of five (18.5%) small and mid-caps use ESG standards, such as the UN SDG, GRI, or SASB. [Quoted Companies Alliance]

- More than one in four S&P 500 companies that conducted earnings calls for Q4 2020 cited “ESG.” This represents a 63% increase in ESG mentions from the previous quarter and the highest number of ESG says in the last ten years. [FactSet]

- More than 200 companies have signed The Climate Pledge, a pact to reach the Paris Agreement goal of net zero carbon ten years early.

This corporate activity has also attracted more investors. As of November 2022, allocated assets reached $403 billion, according to Statistica.

Since the late 1970s, social investing has evolved as younger, more socially conscious investors have entered the investment market as new ETFs have developed to fulfill investor priorities.

While ESG critics have always focused on the unchallenged priority of getting the best returns possible, regardless of their impact on society and the environment, a new generation seems to say, “That’s important, but returns are not everything.” And that represents a paradigm shift in the investment world.