The scandals, Russian collusion investigation, self-dealing financial transactions, mismanagement, insults to women, attacks on abortion rights, and people of color are all trademarks of any possible Donald Trump administration as they continue to inflame the electorate.

But, the one thing that crosses all social-economic and political boundaries is an 89-year-old benefit that is now under attack by the Republicans and has never failed to deliver on its promise: Social Security.

This makes Social Security the common political thread that provides a financial benefit and, in many cases, an essential economic lifeline to millions of Americans regardless of party, race, age, income, or social status.

The indisputable thing about Social Security is that it is a paid-in benefit, meaning people pay into this economic shared pool and then, at retirement or if they become disabled, can withdraw a percentage of their contributions over time. The system works democratically because people take out what they contributed over time. Even better, and while it is rarely discussed, the administration of this retirement income benefit is done by federal workers at a cost that is well beneath anything in size and scope that the private sector can administer.

Still, that has not prevented the financial services industry from spending millions in lobbying money to dismantle and privatize the Social Security system to extract hefty fees and have more funds under management. The industry is working with Republicans to dismantle Social Security, although they have a hard time admitting that in public. However, their Project 2025 proposals from the Heritage Foundation spell out this dismantling plan, which calls for cutting funding for various social entitlement programs, including Social Security and Medicare.

This is why we do not see one financial services firm running ads that encourage elected officials to protect this essential retirement benefit, even though every financial professional knows that without Social Security millions would be pushed into poverty in their old age.

It has been his way since the Social Security benefit was introduced in 1935 by the progressive democratic administration of Franklin D. Roosevelt as part of the profoundly populist New Deal set of policies that helped lift the U.S. out of the Great Depression and its economic aftermath (1929 to 1941.) These policies made the country financially secure enough to allow it to reach unprecedented levels of industrial productivity to defeat the Axis in World War II.

So with all this, it is astounding that the Republicans in 2018 have again re-launched their attacks on Social Security benefits, calling them “entitlements” as a way of diverting attention from the grossly inequitable $1.5 trillion (yes, trillion) tax benefits disproportionately directed towards the top 1% of the wealthiest people in the nation.

The Old Smear Campaign Against Social Security

Republican Senate Leader Mitch McConnell said entitlement programs (which he expanded to include Social Security, Medicare, and Medicaid) must be reduced to balance a budget that went into the red to finance the tax cuts for the wealthy.

This is an old canard from the Republican playbook, one that wants to erase all programs that stem from the New Deal. However, given the partisan gains experienced by the Republicans in recent weeks, it is surprising why McConnell and his party want to publicly attack these popular medical and financial benefits programs weeks before a crucial mid-term election that will determine who controls Congress.

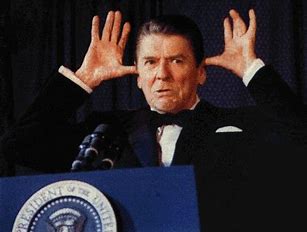

Even Ronald Reagan, the neo-conservative who was once a Roosevelt Democrat and saw the ravages of the Great Depression and who later wanted to privatize many federal programs, said in 1994: “Social Security, let’s lay it to rest once and for all, has nothing to do with the deficit. It’s funded by the payroll tax levied on employers and employees. If you reduce the outgo of Social Security, that money should not go into the general fund; that money should go into the general fund or reduce the deficit. It would go into the Social Security Trust Fund. So Social Security has nothing to balancing a budget or lowering the deficit.”

(Video of Ronald Reagan on Social Security)

Given the long history of post-Reagan Republican attempts to privatize or reduce Social Security, it’s boggling that Democrats have not leaped on this cross-political issue to build support for Social Security, Medicare, and Medicaid. Even the most rabid Tea Party members say they hate the government but don’t want their Social Security or Medicare benefits cut by one cent.

So where are the Dems and the Democratic National Committee (DNC) on this issue?

Are they going to miss any other huge political opportunity?

And what about Republicans who say they hate the government but still insist on getting federal benefits in the form of Medicare, public highways, subsidized drug development, air traffic control, and hurricane emergency relief? You cannot both hate the government and take what it delivers. Society has never worked that way.

Let us know if you can find the answers to these modern political problems.

If you are an RIA or financial services firm that wants to find like-minded clients, consider posting a notice on this site listing your pro-investor business case. The listing information is available on the front page of this site, which can be accessed by clicking the Business Listings and Submit Listing tabs.

There’s so many falsehoods here I guess we’ll start at the top and take em as they come in order.

1. You say that Social Security has never failed to deliver on its promise. False! Social Security has never kept it’s promise. It was sold to Americans by claiming that it would NEVER require contributions above 3% of their paychecks. It is now a bigger tax than Fed income tax. It was promised that the money would not be touched by the gvt. or ever be used as a general fund. FALSE!

2.Social Security is a paid in benefit and you collect what you pay in. FALSE!! Today, Joe Blow collects 8$ for every 1$ that Joe Blow paid in in 1963 . In other words Joe pays in one dollar and collects eight dollars. Social Security is a Ponze scheme, meaning it cannot pay the seniors etc. who are collecting Social Security benefits unless they get the money from today’s pay ins. Joe Blow isn’t collecting the money he paid in because that money is gone, Joe Blow is collecting the money that his son and grandson are paying into the system now. That is a dangerous and irresponsible system that would be highly illegal for anybody outside the gvt to run. Remember Bernie Madoff?

3. It’s administered by get employees blah blah blah….. Bullshit! It’s administered by gvt. Because it is highly illegal for any private firm or individual to run any kind of a fund that is structured that way….Bernie Madoff?

4. The New Deal policies helped lift US from the depression. FALSE!! After the crash , unemployment never hit double digits and was dropping until the New Deal, after which unemployment shot to over 10% and stayed in double digits for the next decade. The New Deal prolonged the depression for 10 yrs.

5. Social Security is absolutely an entitlement unless you think that somehow recipients aren’t entitled to their money after paying in for years. The tax cuts did not disproportionately direct trillions to 1% of Americans and that has nothing to do with Social Security.

6. Tax cuts do not require financing and we did not go into the red financing tax cuts for wealthy people. That is just an outright lie and an obvious red flag regarding the competence and integrity of those who would make such an outrageous FALSE claim.

Social Security needs to go!