Corporate tax evasion reaches a new pinnacle.

America’s largest corporations hold themselves out as the paragon of citizenship and patriotism, yet when it comes to doing their biggest civil duty–paying taxes–too many of the nation’s largest corporations are traitors and deserters.

Now, it looks like the U.S. Department of Homeland Security, the $1 trillion-plus agency that was created after Sept. 11, 2001 to protect the homeland from outside invaders who threatened the American way of life, have now caved in to the corporations that sell to the U.S. Defense Department and given them a huge present: They no longer have to pay U.S. taxes if they are registered outside the U.S., yet they can still get Pentagon contracts.

How bad is this damage? According to Bloomberg, about 50 companies have now “inverted” tax situations, which is jargon meaning the are registered outside the U.S. and don’t pay U.S. taxes. Many of these corporate tax evaders made the jump within the past five years. Bloomberg found that “a Congressional panel estimated last year that future inversions would cost the Treasury $19.5 billion in forgone revenue over the following decade.”

As this news reports says, “The Department of Homeland Security last year endorsed a legal memorandum that argued in part that a 2002 law banning such companies from federal contracts was invalid,” according to Bloomberg News. This means the corporations avid paying taxes, yet they will still get their contracts all of which are paid for by average citizens who do not have any lobbying clout.

This represents a huge shift in the tax burden from corporations to individuals and is another sign that average Americans will continue to work for corporations who have the goal of running the government. And the timing could not have been better: the news broke the day after July, the day for patriotism and remembering fallen soldiers and the American quality of life.

It Even Gets Worse

If avoiding taxes is is not bad enough, many of the nation’s largest corporations are pushing through the Trans-Pacific Partnership Trade Agreement that will give them even more tax breaks on taxes avoiding pollution standards and labor conditions.

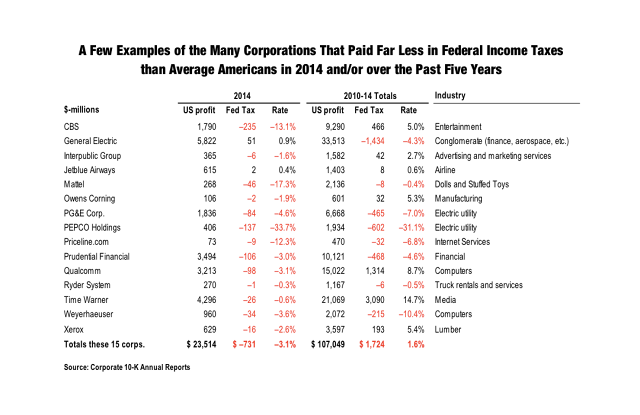

But it gets worse. As the chart below speaks for itself: the nation’s largest corporations are now pushing through another free-trade deal that is entirely secret to the American people.

As Senator Elizabeth Warren (D-Mass.) said in a recent MSNBC interview, Senators have been allowed to read the Trans Pacific Partnership trade deal, but they are forbidden to talk about it.

They cannot share it with their constituents or the American people, even though this is a deal which will affect all consumers and worker for another decade.

Why the secrecy?

Great question. Basically, it’s because if people knew how bad the trade deal was for U.S. workers, their wages and their long-term economic growth potential, they would rally against the deal. This was the same story for NAFTA and other deals that were all pushed by the Presidents who were in office at the time, from Bush to Clinton. It’s also a reason why unions oppose and every major U.S. corporation who has a horse in the trade deal race has put its lobbyists on overtime to push this through.

That’s why it’s especially good timing that during the week of April 15, this chart of the largest corporations who do not pay their fair share of federal taxes was published. People with more resources than I have can categorize these companies by industry and see which ones are pushing for the latest trade deal.

Since the names of the corporations who stand to benefit most from this deal is top secret, my bet is that GE is one of them. Interestingly, during the week of April 15, 2015, GE announced that it was spinning off it financial division.

This had long been a profitable operation and essentially put GE into the financing business. Yet while the financial press was all excited about this spin-off, it obviously and conveniently neglected to note that GE pays almost no taxes as this chart shows.

Instead, the financial press fell all over itself quoting “Neutron Jack Welch,” who laid off thousands of workers, as saying this spin off would be great for GE. The wimpy reporters conducting these interviews and reporting on the GE divestiture, never mentioned that GE pays little taxes, yet considers itself an all-American company.