The Basics of Investing:

Managing Portfolio Risk Through Diversification

Diversifying your investment portfolio is as much common sense as it is investment science.

Diversification can be achieved in two ways: by investing within an asset class, such as stocks, bonds, real assets, and alternatives, or by investing across asset classes, such as stocks, bonds, real assets, and alternative investment strategies.

Diversification is essential because we know the price of individual securities(such as stocks and bonds) and asset classes behave differently from one another, going up and down in separate cycles and to varying degrees.

For example, the price of each stock is affected by a combination of different elements, including the overall stock market, the health of the industry the company does business in, and the company’s performance.

Stock prices generally vary more than fixed-income investments, but fixed-income prices can be affected by changes in interest rates, macroeconomic events, and the health of the overall fixed-income market.

As an example of how diversification can be achieved with an individual asset class, take the example of individual equities. In this case, equities can be broken down into large-, medium- and small capitalization stocks. In addition, stocks can be categorized as to whether they are value or growth stocks, which reflect their long-term price appreciation potential.

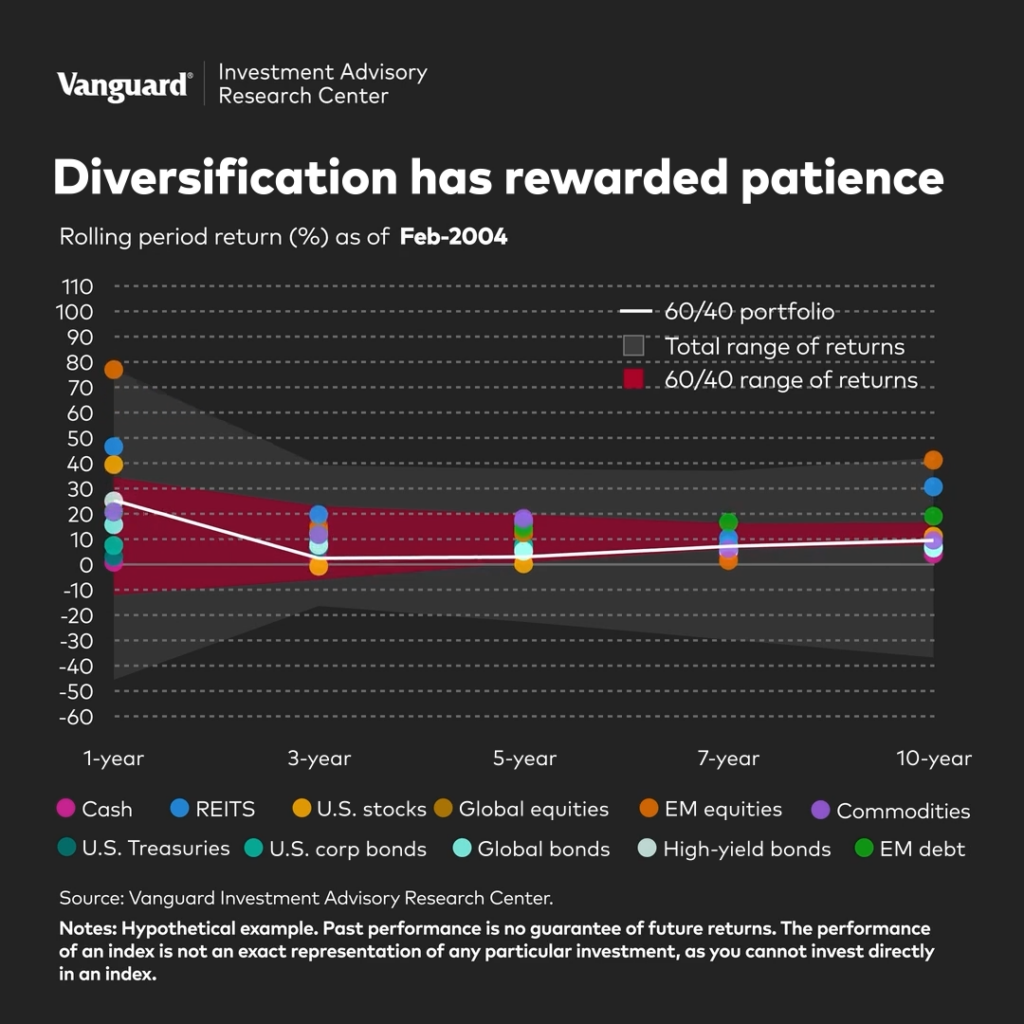

As this chart from Vanguard shows, diversification using a traditional medium-conservative portfolio that is 60% in equities and 40% in bonds, has a narrower range of returns over time, and also lower risk, than holding the portfolio for a shorter time frame.

Source: Vanguard Investment Advisory Research Center

Note that the portfolio has a mix of 11 asset classes, and this is the basis for the diversified portfolio. Also, note that there are no cryptocurrencies in this portfolio since crypto is not considered an asset class since it has no underlying fundamental factors that drive prices.

The Importance of Fixed Income

Bonds can be categorized in several different ways: domestic vs. international; duration; ratings; and yields.

In addition, portfolio research has also shown that adding real assets, such as real estate, commodities, and precious metals, for example, can provide additional diversification to withstand more volatile macroeconomic events. Another important diversification opportunity exists in alternative investments, such as funds that employ non-traditional or alternative investment strategies.

Alternative Asset Classes

Alternative asset classes include the best of both worlds of investing: access to new strategies and diversification across the entire spectrum of assets, either on a domestic or global basis. This can include access to all sectors of the stock market (such as, energy, technology, manufacturing, and consumer durables), as well as equity styles (large, medium, and small-cap).

The added kicker is that investors also gain access to another dimension of diversification through different investment strategies, such as long-short. This strategy is very different from the most common long-only investment strategy in which investors only make money when the market appreciates sending equity prices higher.

Alternately, in the case of long-short strategies, investors have the opportunity to make money in both declining and appreciating markets. Since the vast majority of investors only make money when they buy a stock and it appreciates in price and via dividend payments over time, making money in a declining market presents a new world of opportunities. This opens the door to a completely other world of profit potential for investors (largely professional), who make money when markets decline. These are short-sellers who profit from selling short over-valued equities and then selling them back when the price declines further.

Don’t Forget About Risk

Combining investments improves diversification and takes a middle road through the highs and lows of market performance, allowing your investments the opportunity to grow regularly with fewer fluctuations along the way. This can make you feel more comfortable with your investments over time.

Risk, or the variability of returns, can be reduced by investing in different markets. This can buffer a portfolio against volatility caused by adverse national and international developments; and economic factors, such as production; employment; monetary policy; and levels of investment. These factors all influence markets for equities and fixed-income securities in different ways. By diversifying across asset classes and strategies, you can reduce that risk or variability of returns. Investors who diversify, but limit themselves to a single market, such as large-cap stocks, assume more risk than those who invest in multiple markets.

Diversification isn’t a free ride, however. When some of your investments are gaining, others are holding or losing value. Consequently, you are not likely to make a killing with a highly diversified portfolio. However, you may be reducing your short-term losses and allowing your investments to grow significantly over time.